- United States

- /

- Luxury

- /

- NYSE:FIGS

FIGS (FIGS) Is Up 11.2% After Q3 Beat and Conference Update Is International Expansion Gaining Momentum?

Reviewed by Sasha Jovanovic

- FIGS, Inc. recently presented at the Morgan Stanley Global Consumer & Retail Conference 2025 in New York, following the release of third-quarter financial results that surpassed analyst expectations with revenue of US$151.7 million and earnings per share of US$0.05.

- These results supported market optimism about FIGS' operational performance, especially as analysts highlighted international expansion and innovation as key contributors to future growth prospects.

- With quarterly results exceeding forecasts, we'll explore how this reinforces FIGS' investment narrative and its international expansion focus.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FIGS Investment Narrative Recap

To believe in FIGS as a shareholder, you need conviction in the long-term demand for premium healthcare apparel and the company's ability to expand its reach beyond the US market. While FIGS’ recent upbeat financials and stock performance underline progress on growth catalysts like international expansion and product innovation, the fundamental near-term risk, rising costs from tariffs on imported goods, remains unchanged and could still affect future profitability if not managed effectively.

Among recent announcements, FIGS' upgraded 2025 revenue guidance, following its third-quarter beat, is most relevant. This guidance revision ties directly to short-term market sentiment, reflecting improved confidence in the company's execution on both operational efficiency and its international growth strategy, which is seen as a crucial lever for future gains.

However, investors should also be aware that, despite these advances, sustained tariff headwinds on imports could impact margins into 2026 if the global trade environment shifts...

Read the full narrative on FIGS (it's free!)

FIGS' narrative projects $656.8 million revenue and $37.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $29.8 million earnings increase from $7.2 million today.

Uncover how FIGS' forecasts yield a $8.78 fair value, a 19% downside to its current price.

Exploring Other Perspectives

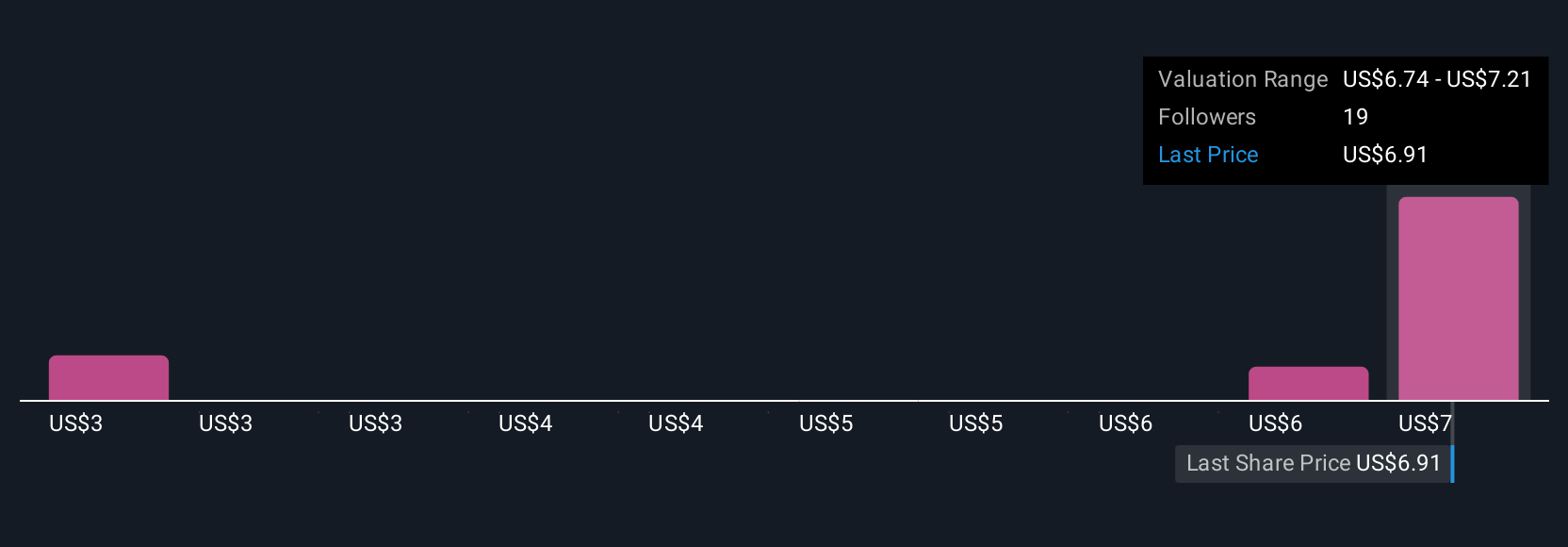

Four private investors in the Simply Wall St Community valued FIGS between US$2.36 and US$8.78 per share before the latest results. While international growth is fueling optimism, the broad spread in these estimates makes it clear that opinions on FIGS' future potential and risks can vary widely.

Explore 4 other fair value estimates on FIGS - why the stock might be worth as much as $8.78!

Build Your Own FIGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIGS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free FIGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIGS' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIGS

FIGS

Together with its subsidiary, FIGS Canada, Inc., operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026