- United States

- /

- Luxury

- /

- NYSE:DECK

Deckers Outdoor (NYSE:DECK) Launches New UGG®? Clog Collection In Mustard Seed Colorway

Reviewed by Simply Wall St

Deckers Outdoor (NYSE:DECK) introduced its Goldenstar and Goldencoast UGGbraid Clog collection this past week, engaging its customer base with innovative products and a creative promotional event in partnership with Gray's Papaya. Despite these efforts, the company's stock price remained flat over the past week. This move parallels the broader market's modest gains as investors monitored tariff developments and Nvidia's market capitalization milestone. Deckers' marketing push with UGG® added weight to maintaining interest amidst market uncertainties, contributing to the overall steady performance, aligning with general investor sentiment amidst fluctuating economic conditions.

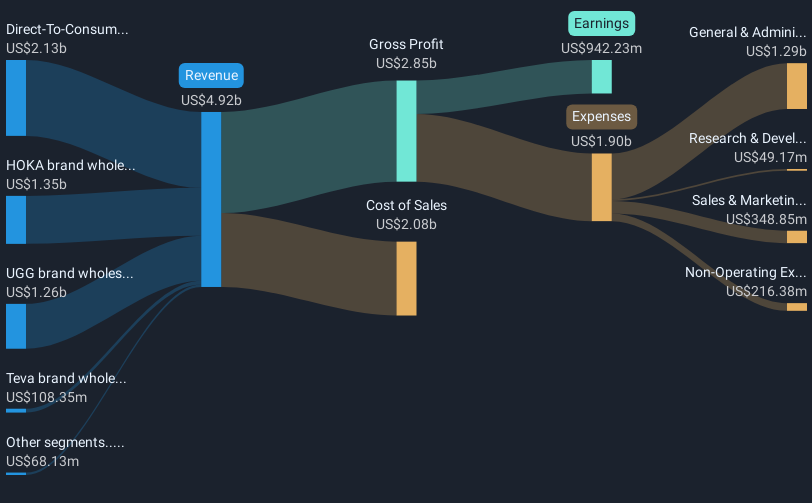

Deckers Outdoor's recent launch of the UGGbraid Clog collection showcases its effort to captivate consumers, but the share price remained flat this past week. Over a longer five-year period, however, the company's total return, which includes both share price and dividends, reached 218.37%, indicating substantial growth. This longer-term performance contrasts with a more recent underperformance relative to the US Luxury industry’s annual return of 5.1% and the broader US market's 12.6% over the past year.

The global expansion plans for UGG and HOKA, mentioned in the narrative, combined with innovative product launches, could further drive Deckers' revenue and earnings growth. Analysts forecast a revenue increase to $6.5 billion and earnings reaching $1.1 billion by 2028, despite expected profit margin declines. However, given the current share price of $117.07 and the consensus price target of $168.56, which is 30.5% higher, the potential for upside remains if the company achieves expected metrics. Investors should assess whether the new products and strategies will materially impact these forecasts given market conditions and potential risks like currency fluctuations.

Take a closer look at Deckers Outdoor's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DECK

Deckers Outdoor

Designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities in the United States and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives