- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Assessing Valuation Following the Launch of Harvest Glen Near Davis, California

Reviewed by Simply Wall St

Century Communities (CCS) just announced the launch of Harvest Glen, a new housing community near Davis, California. The project features 11 floor plan options and is positioned to attract buyers with its easy access to UC Davis and Sacramento.

See our latest analysis for Century Communities.

The Harvest Glen launch is a bright spot as Century Communities contends with a shifting housing landscape. The company’s 1-month share price return of 8% shows some short-term optimism, although the 1-year total shareholder return is still down nearly 28%, which underscores lingering challenges in the sector. Over a multi-year horizon, however, Century’s strong 3- and 5-year total returns suggest that its expansion strategy may be setting the stage for a longer-term recovery if demand stabilizes.

If you’re interested in what else the market has to offer, now's a great time to explore fast growing stocks with high insider ownership and find fast-moving companies with strong leadership stakes.

But with Century Communities trading just below analyst price targets and showing only modest annual growth figures, the real question for investors is whether today's share price reflects hidden value or if the market has already accounted for any future upside.

Most Popular Narrative: 2.6% Undervalued

With the narrative fair value set at $66 and Century Communities last closing at $64.31, the stock sits just under what the most widely followed narrative believes is fair. This close gap reflects investor caution balanced with optimism about future growth drivers. Here is a key catalyst the narrative spotlights:

Strong operational efficiency, a growing community footprint, and a flexible land strategy position Century Communities for long-term growth despite ongoing affordability challenges in the housing market.

Curious how disciplined cost control, expansion ambitions, and strategic flexibility could underpin this valuation? The full narrative reveals the bold growth and margin assumptions that may unlock future value. Ready to uncover what could make this company defy the tough housing cycle?

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability pressures or regional economic downturns could quickly undermine sales momentum and call future growth assumptions into question.

Find out about the key risks to this Century Communities narrative.

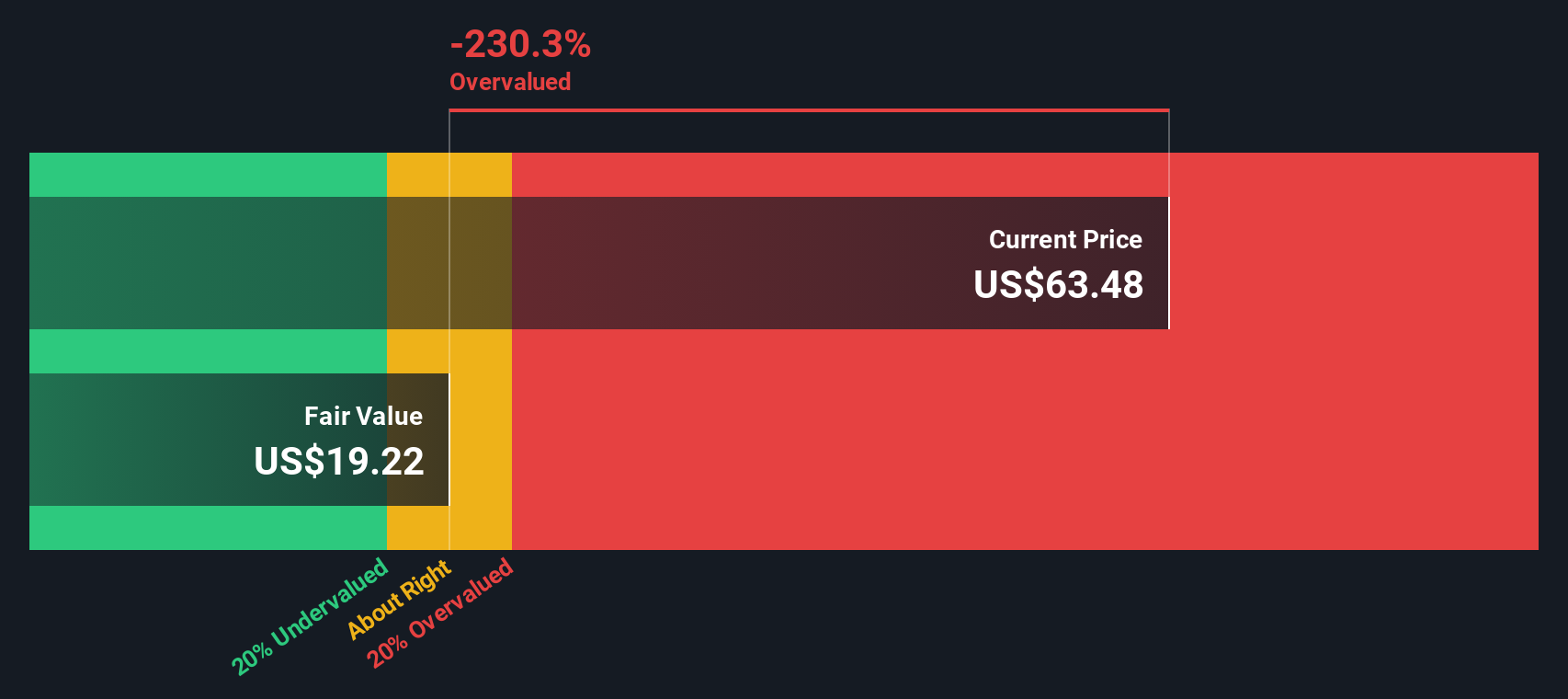

Another View: Our DCF Model Paints a Different Picture

Taking a look at the SWS DCF model, a starkly lower fair value estimate emerges. By projecting future cash flows, the DCF suggests Century Communities may actually be overvalued at current levels. This more cautious perspective could indicate hidden risks that multiples might overlook.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you see things differently or want to work through the numbers yourself, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your potential to just one company when huge opportunities could be right in front of you. Now is the perfect time to get ahead of the curve with targeted stock screens that give you the edge.

- Unlock tomorrow’s breakthroughs and start your search with these 25 AI penny stocks, which are positioned to benefit from artificial intelligence’s rapid development.

- Strengthen your portfolio’s defensive power by exploring these 14 dividend stocks with yields > 3%, which offer yields above 3%.

- Discover the next investment wave by identifying opportunities among these 929 undervalued stocks based on cash flows, which are trading below their intrinsic value based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026