- United States

- /

- Luxury

- /

- NYSE:AS

Assessing Amer Sports After New Brand Partnerships and a 51% Yearly Share Price Surge

Reviewed by Bailey Pemberton

- Curious whether Amer Sports is actually worth its current price tag? Let’s dig into what’s driving all the chatter about its value right now.

- After a rapid rise, Amer Sports stock has returned 4.6% year-to-date and an impressive 51.1% over the past year, though the last month saw a slight dip of 2.5%.

- Recent headlines have focused on Amer Sports’ latest brand partnerships and expansions into new markets, which investors seem to view as a signal of growth potential. At the same time, some analysts are watching to see if these moves will shake up the competitive landscape or impact margins.

- Based on our checks, Amer Sports notches a 3/6 valuation score, highlighting some key areas where it may be undervalued. Up next, we’ll lay out how standard valuation approaches stack up for this stock. You might want an even bigger-picture perspective before you make your next move.

Approach 1: Amer Sports Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value using today’s dollars. This approach accounts for both near-term analyst estimates and long-term extrapolations to reflect expected performance.

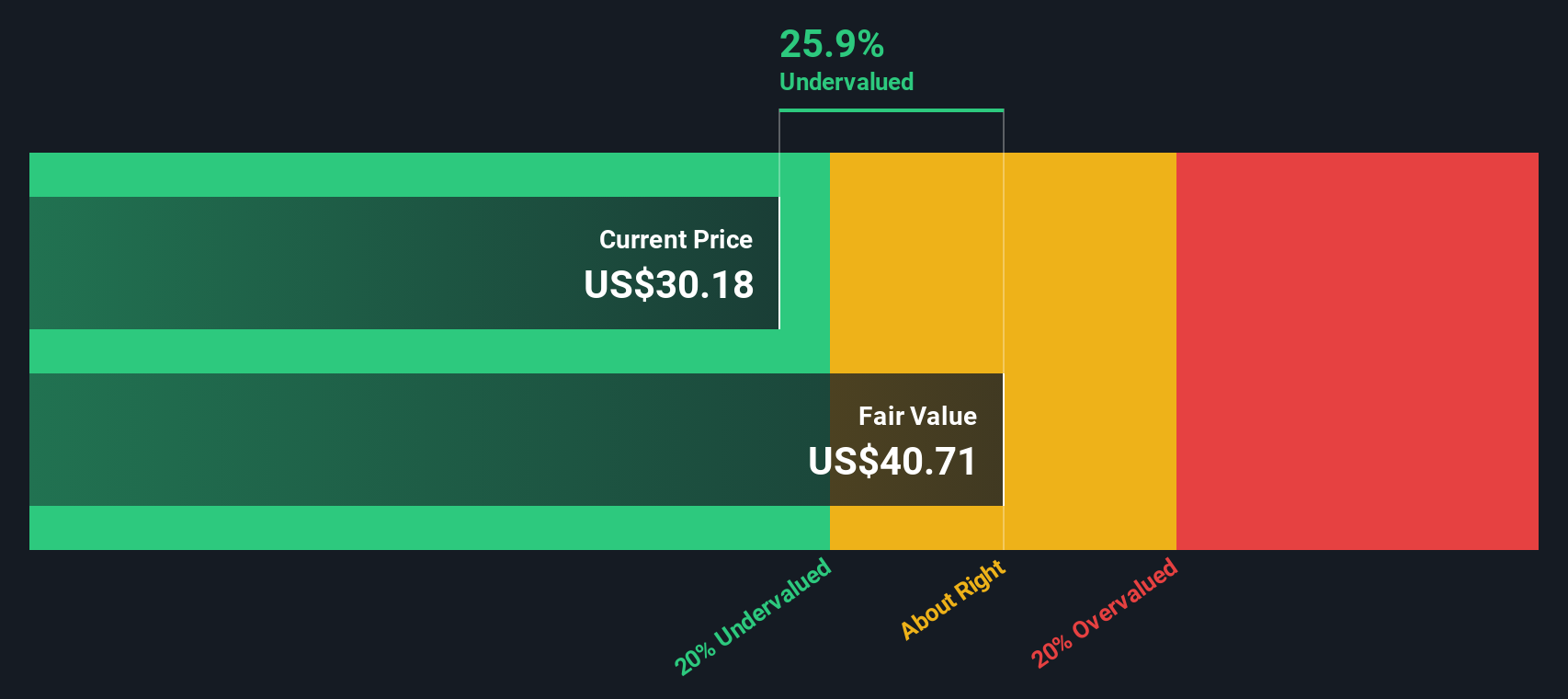

For Amer Sports, the model uses a 2 Stage Free Cash Flow to Equity method. The latest reported Free Cash Flow stands at $225.1 million. Analyst projections extend five years out, showing expected growth to $983.5 million in 2029. Beyond that, cash flows are extrapolated based on assumptions of sustained growth over a longer time frame, although with increased uncertainty as the horizon extends. All projections are calculated in US dollars.

The model arrives at an intrinsic fair value of $40.71 per share. Given this, and the current share price, Amer Sports appears roughly 25.9% undervalued according to this DCF analysis. This sizeable discount implies the market might not be fully pricing in Amer Sports’ future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amer Sports is undervalued by 25.9%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Amer Sports Price vs Earnings

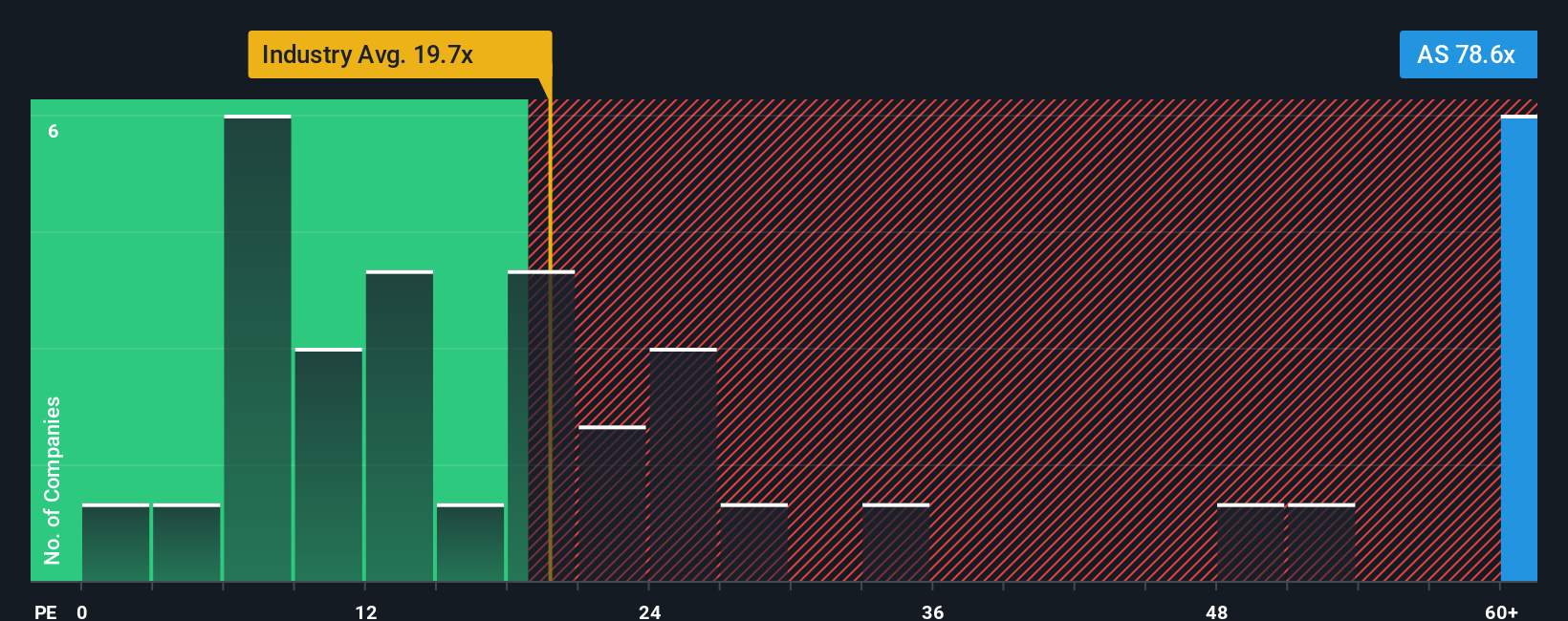

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies, as it provides a snapshot of how much investors are willing to pay for each dollar of current earnings. This makes it especially useful for companies like Amer Sports that are generating positive net income.

What qualifies as a “normal” or “fair” PE ratio can depend a lot on factors such as how quickly a company is expected to grow and how much risk it carries. Strong earnings growth and a robust business model typically justify higher PE ratios, while slower-growing or riskier companies trade at lower multiples.

Amer Sports currently trades at a PE ratio of 74.7x. For comparison, the average PE for its Luxury industry peers is 18.4x, and the direct peer group sits at 32.7x. This means Amer is trading at a significant premium to both the sector and its peers, reflecting either high market expectations or a higher growth outlook.

Simply Wall St’s Fair Ratio for Amer Sports stands at 26.8x. This proprietary measure incorporates not just the company’s growth potential, but also its risks, profit margins, industry context, and size. As a result, it provides a more tailored benchmark than simple peer or industry averages. Because it combines all these factors, the Fair Ratio offers a more complete picture of what would be a reasonable multiple for Amer Sports at this time.

Given Amer Sports’ actual PE of 74.7x versus the Fair Ratio of 26.8x, the stock appears overvalued based on this measure, even after accounting for growth and company specifics.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amer Sports Narrative

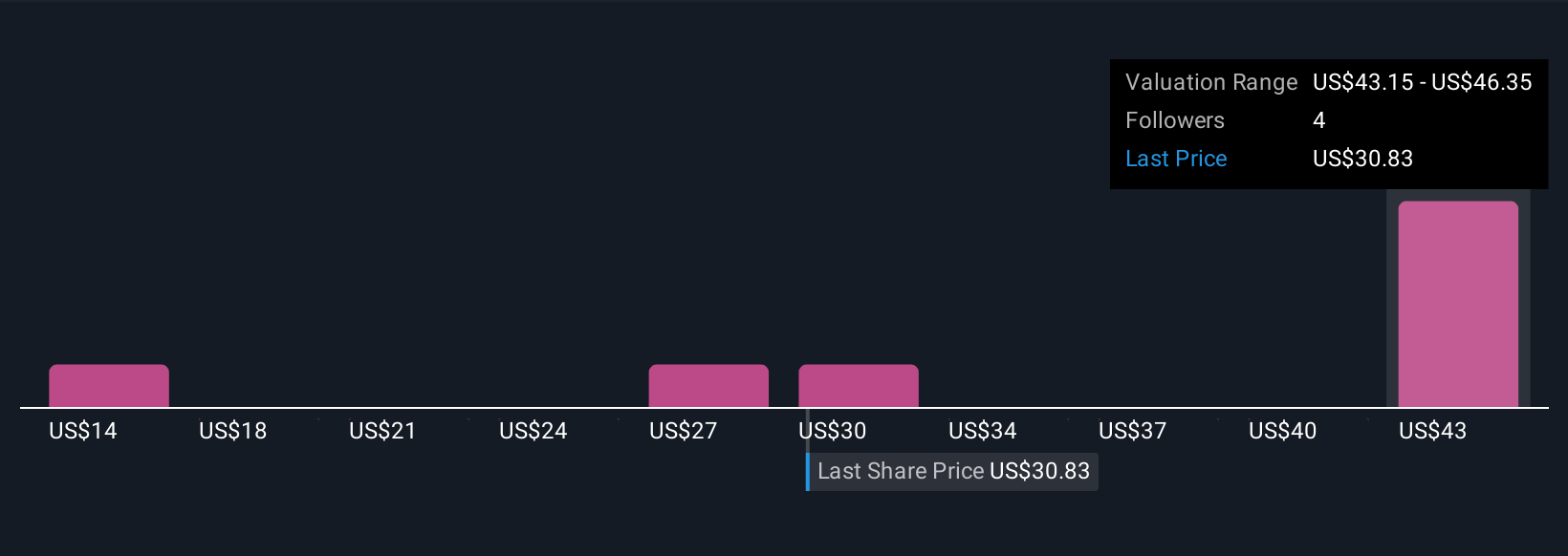

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a dynamic method that weaves the underlying story you believe about Amer Sports with your own financial forecasts to arrive at a personalized fair value.

Rather than just crunching numbers, a Narrative lets you build an investment thesis by combining your perspective on the company's future (like expected revenue growth, margins, or competitive edge) with concrete estimates of fair value. This approach links the “why” behind your view to a real, actionable financial outcome, helping you make decisions based not just on models but on your unique outlook.

Narratives are easy to create and update on Simply Wall St’s Community page, where millions of investors share insights and challenge each other's assumptions. By regularly comparing your Narrative's Fair Value with Amer Sports’ current price, you can get a clear signal for when it is time to buy, sell, or hold. Your Narrative automatically adapts as news and earnings roll in.

For instance, one investor’s Narrative for Amer Sports might forecast rapid expansion into Asia and healthy profit growth, supporting a bullish $52 fair value. Another could focus on margin risks or rising competition and set a more cautious $34 fair value instead.

Do you think there's more to the story for Amer Sports? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives