- United States

- /

- Consumer Durables

- /

- NasdaqGM:UHG

A Look at United Homes Group’s (UHG) Valuation Following High-Profile Board Resignations and Governance Turmoil

Reviewed by Simply Wall St

United Homes Group (UHG) shares slid sharply after most of its board, including former governor Nikki Haley and university leader James P. Clements, announced plans to resign, citing ongoing disputes with Executive Chairman Michael Nieri.

See our latest analysis for United Homes Group.

While the drama around United Homes Group’s board has taken center stage, the company’s share price reflects just how rattled investors are. Its 1-year total shareholder return is down nearly 67%, and momentum has clearly faded in the wake of recent turmoil. The past week alone saw a 56% decline in the share price, and even before this governance shakeup, longer-term losses signaled deep concern about UHG’s direction and risk profile.

If this kind of volatility has you thinking about different opportunities, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

Yet after such a dramatic plunge, does the stock now offer a rare bargain, or are investors simply bracing for ongoing instability with limited upside ahead? Is there truly a buying opportunity, or is the market already pricing in future risks and growth?

Price-to-Earnings of 20.7x: Is it justified?

United Homes Group trades at a price-to-earnings ratio of 20.7x, far above both its immediate peers and the broader US Consumer Durables industry. With the last close at $1.82, the stock looks expensive given its current profit picture.

The price-to-earnings (P/E) ratio tells investors how much they are paying for every dollar of company earnings. It is a popular tool for comparing valuation among similar firms. A higher-than-average P/E can imply the market expects significant future profit growth, but it may also suggest overpricing if those prospects seem uncertain.

In UHG’s case, the P/E of 20.7x is more than double the peer average (9.6x) and also well above the industry’s 10.5x mean. This suggests UHG’s share price is not only pricing in more growth than its competitors, but potentially more optimism than recent financial results support. Investors should weigh whether the current valuation can be justified by near-term performance or long-run recovery, especially given the company’s recent challenges and lack of robust growth data.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.7x (OVERVALUED)

However, persistent share price declines and weak net income growth remain significant risks that could undermine any case for a rebound in United Homes Group.

Find out about the key risks to this United Homes Group narrative.

Another View: What Does the SWS DCF Model Say?

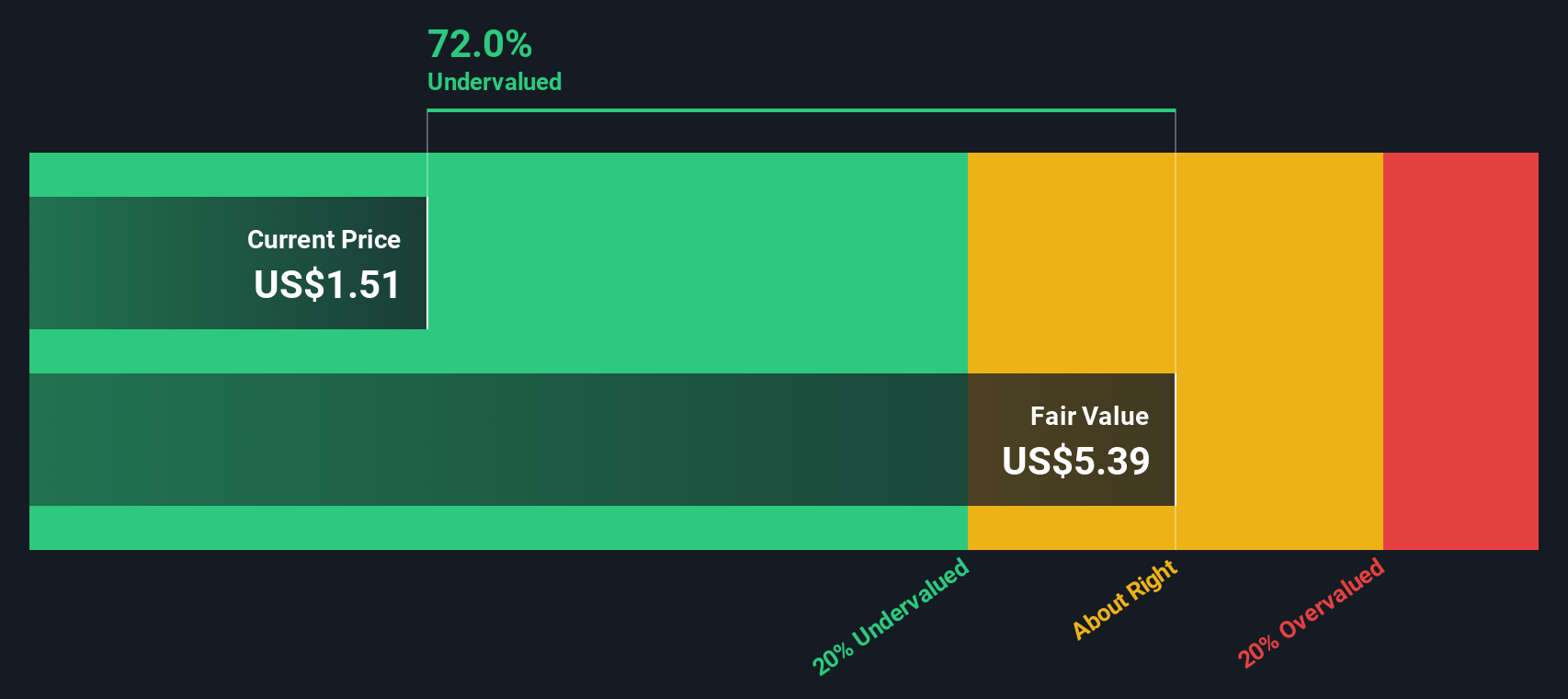

Taking a different angle, our DCF model estimates United Homes Group’s fair value at $5.67 per share, which is a big jump from its recent price of $1.82. This suggests the market may be overshooting its concerns about the company. Is this a sign of a deep value opportunity, or just a value trap in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United Homes Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United Homes Group Narrative

If you want to dig deeper or have your own view on United Homes Group, it only takes a few minutes to investigate and build your own perspective. Do it your way

A great starting point for your United Homes Group research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Power up your portfolio by targeting sectors where trends, growth, and income potential are creating buzz right now.

- Boost your income strategy and uncover strong yields when you tap into these 17 dividend stocks with yields > 3% with consistent 3%+ payouts.

- Ride the AI innovation wave and get ahead with these 26 AI penny stocks leading the artificial intelligence movement.

- Seize the best value among beaten-down gems by acting on these 874 undervalued stocks based on cash flows selected for future cash flow potential and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:UHG

United Homes Group

A homebuilding company, engages in the design, building, and sale of homes in South Carolina, North Carolina, and Georgia.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives