- United States

- /

- Luxury

- /

- NasdaqGM:SGC

Superior Group of Companies (SGC) Margin Decline Tests Bullish Earnings Growth Narrative

Reviewed by Simply Wall St

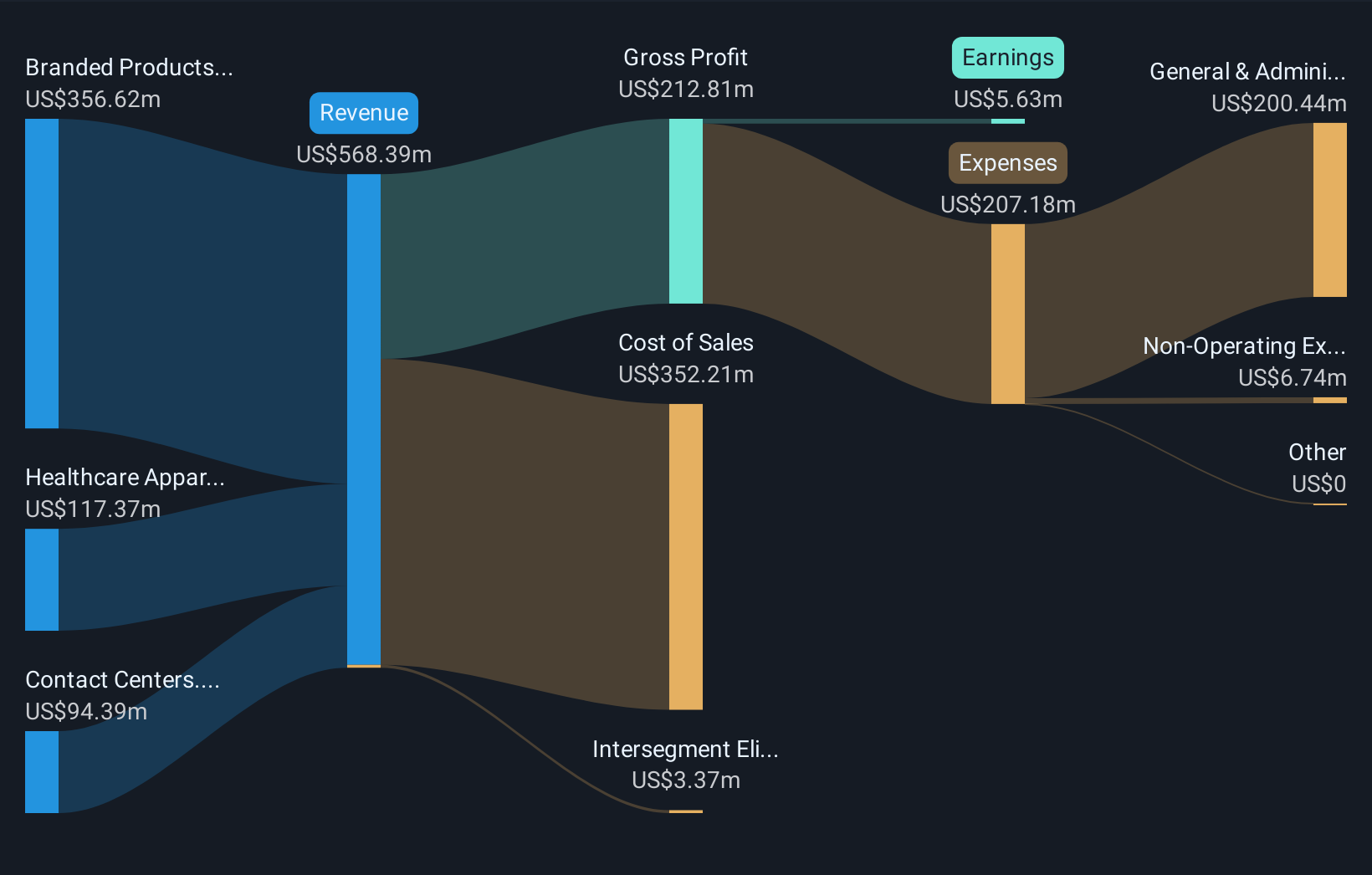

Superior Group of Companies (SGC) is forecasting earnings growth of 50% per year for the next three years, easily outpacing the expected 16% annual growth rate for the US market. Revenue is forecast to grow at 3.4% per year, which trails the US market’s 10.5% pace. The company’s net profit margin has slipped to 1% from last year’s 2.4%, after a five-year stretch of earnings declining by 29.1% per year. Despite the ongoing pressure on margins and a history of shrinking profits, investors are now looking closely at SGC’s projected rebound in profitability and the prospect of strong earnings growth ahead.

See our full analysis for Superior Group of Companies.The next section sets these results side by side with the main market narratives, highlighting where the numbers confirm or challenge widely held stories about SGC.

See what the community is saying about Superior Group of Companies

Profit Margins Projected to Recover by 2028

- Consensus expects profit margins to rise from 1.4% today to 2.6% over the next three years, signaling a reversal after several years of shrinking margins and aggressive cost pressures.

- According to the analysts' consensus view, ongoing investments in digital transformation and AI, coupled with diversification across branded products and healthcare, are expected to stabilize margins and drive expansion.

- This anticipated improvement comes after margins slid from 2.4% last year to 1% currently, highlighting the tension between recent setbacks and the optimism about future leverage.

- Consensus narrative notes that stable recurring demand in uniforms, healthcare, and branded apparel, along with enhanced efficiency from automation, heavily supports the outlook for steady profit margin gains even as the company navigates cost and industry headwinds.

To see how the analyst consensus stacks up against different perspectives and potential surprises, check the full company narrative for a deeper dive. 📊 Read the full Superior Group of Companies Consensus Narrative.

Valuation Discount Versus Peers, but Not the Industry

- SGC trades at a Price-To-Earnings ratio of 26x, below the peer average of 48.7x but still above the US luxury industry average of 19.3x.

- Consensus narrative underscores that while SGC screens as attractively valued relative to direct peers, the premium versus industry multiples means investors should keep watching for profit improvement to bridge that gap.

- With a current share price of $9.17 and DCF fair value at 16.05, the market appears cautious, discounting SGC’s outlook despite analyst targets implying roughly 82% upside from here.

- This discount creates upside potential according to consensus, but only if management delivers on the forecasted margin expansion and sustainable growth that sets SGC apart from broader industry peers.

Margin and Customer Concentration Risks Remain

- The company’s net profit margins have declined sharply year-over-year, and SGC faces notable risks including rising sourcing costs, exposure to large client accounts, and integration challenges from acquisitions.

- In the consensus narrative, critics highlight how unpredictable tariffs, reliance on select customers, and accelerated technological disruption in the branded apparel space could pressure both revenue and profitability if not carefully managed.

- Recent client bankruptcies already revealed revenue volatility, underlining why even with growth forecasted, shareholders should keep a close eye on the company’s ability to manage these structural risks.

- Bears argue that aggressive competition and changes in client industries could further compress pricing power, making the anticipated rebound in margins and earnings difficult to sustain if risk factors escalate.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Superior Group of Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a new angle? Use your unique perspective to craft a narrative of your own in just a few minutes. Do it your way

A great starting point for your Superior Group of Companies research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

SGC’s declining margins, customer concentration, and persistent profit volatility highlight risks for investors seeking more stable earnings and financial resilience.

If you’re searching for businesses with dependable results and healthy growth, check out stable growth stocks screener (2077 results) to discover companies consistently delivering steady performance across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SGC

Superior Group of Companies

Manufactures and sells apparel and accessories in the United States and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success