- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Assessing Peloton's (PTON) Valuation After Launching New Wellness Partnership With HSS

Reviewed by Simply Wall St

Peloton Interactive (PTON) is teaming up with the Hospital for Special Surgery to launch science-backed classes for injury prevention and recovery. The partnership will also offer members exclusive access to new orthopedic care resources and recovery services.

See our latest analysis for Peloton Interactive.

Peloton’s high-profile collaboration with HSS arrives after a turbulent year for the share price, which currently sits at $7.54. While the 1-year total shareholder return is up 11.2%, the year-to-date share price return has dropped 14.6%, suggesting fading short-term momentum even as the long-term turnaround story remains in play.

If Peloton’s focus on member well-being has you curious about other innovative growth stories, it might be the perfect time to discover fast growing stocks with high insider ownership

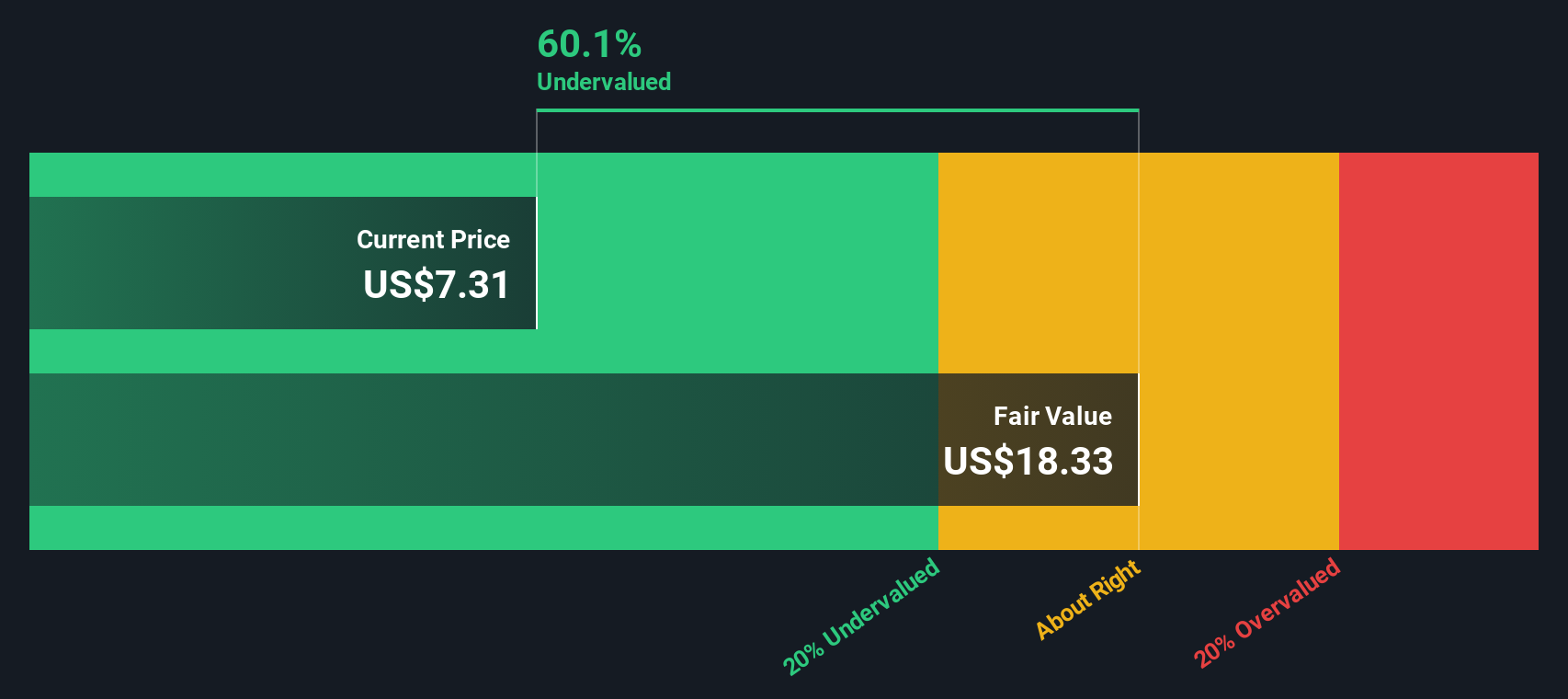

With shares still trading well below analyst price targets despite recent strategic moves, investors face a key question: Is Peloton undervalued at these levels, or has the market already priced in its rebound potential?

Most Popular Narrative: 26% Undervalued

Peloton’s widely followed narrative pegs its fair value at $10.18, well above the recent close of $7.54, sparking a valuation debate as the company pivots into digital and holistic wellness.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness (strength, sleep, stress, nutrition). This aligns with growing global health consciousness and should support future subscription revenue growth and higher engagement alongside churn reduction.

Want to know why Peloton’s future rests on digital reinvention and bold margin expansion? The real shocker is a staggering profit rebound and an ambitious earnings target; see how these numbers shape the sky-high fair value.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in hardware sales and increased competition could threaten Peloton’s growth story if new initiatives fail to reignite user demand.

Find out about the key risks to this Peloton Interactive narrative.

Another View: Our DCF Model Says Even Deeper Discount

While the popular narrative values Peloton at $10.18 using traditional metrics, our DCF model suggests an even greater disconnect. With fair value at $19.25, well above today's price, this approach weighs long-term cash flow potential rather than just recent peer comparisons. Does the market truly see things so differently?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peloton Interactive Narrative

If these perspectives do not align with your own, why not dive into the numbers and craft your own Peloton story in just minutes? Do it your way

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover fresh opportunities and get ahead of the market by finding stocks most investors overlook. Sharpen your strategy with ideas matched to your goals so you do not let the next big winner escape you.

- Tap into future-defining breakthroughs by checking out these 28 quantum computing stocks, where quantum technology is changing what is possible in computing and beyond.

- Lock in reliable income streams by exploring these 21 dividend stocks with yields > 3% that consistently deliver yields above 3% and support portfolio stability.

- Seize the potential for rapid growth with these 3576 penny stocks with strong financials, featuring under-the-radar picks that combine strong financials with exciting upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives