- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Mattel (MAT): Valuation Insights as UNO F1 Launch and Debt Strategy Signal Fresh Momentum

Reviewed by Simply Wall St

Mattel (MAT) is making waves this week with a two-pronged strategy. The company is rolling out the UNO Elite Formula 1 edition to tap into motorsport fandom, and issuing $600 million in senior notes to manage its debt load.

See our latest analysis for Mattel.

Mattel’s share price is showing strong momentum, notching a 14.9% gain over the past month and up 19.1% year-to-date. The one-year total shareholder return stands at 11%. These moves suggest investors are taking note of its product launches and proactive balance sheet management, which may indicate that sentiment is building as the company expands its reach and streamlines finances.

If you’re on the lookout for other consumer brands making bold moves, now’s a great time to broaden your scope and discover fast growing stocks with high insider ownership

But with shares already climbing nearly 15% in the past month and trading just under analyst targets, investors may wonder if Mattel is still undervalued or if the market has already priced in its next phase of growth.

Price-to-Earnings of 15.2x: Is it justified?

Mattel is currently trading at a price-to-earnings (P/E) ratio of 15.2x, placing it well below both its industry peers and the wider market. With a last close of $21.12, this figure suggests the market may be underpricing the company’s earning potential for the sector.

The price-to-earnings ratio shows how much investors are willing to pay today for a dollar of current earnings. For a consumer brands company like Mattel, this is especially relevant because it reflects expectations for continued profitability and brand strength.

At 15.2x, Mattel’s P/E ratio is significantly lower than the global leisure industry average of 22.2x, as well as the peer average of 64.9x. Notably, it also aligns closely with the fair P/E ratio estimate of 15.4x, a level the market could eventually recognize if growth continues on track. This indicates that Mattel is attractively valued relative to both its direct competitors and fair value benchmarks.

Explore the SWS fair ratio for Mattel

Result: Price-to-Earnings of 15.2x (UNDERVALUED)

However, slow revenue growth and pressure from industry competition could hinder Mattel’s ability to sustain its current momentum and valuation trajectory.

Find out about the key risks to this Mattel narrative.

Another View: What Does the SWS DCF Model Say?

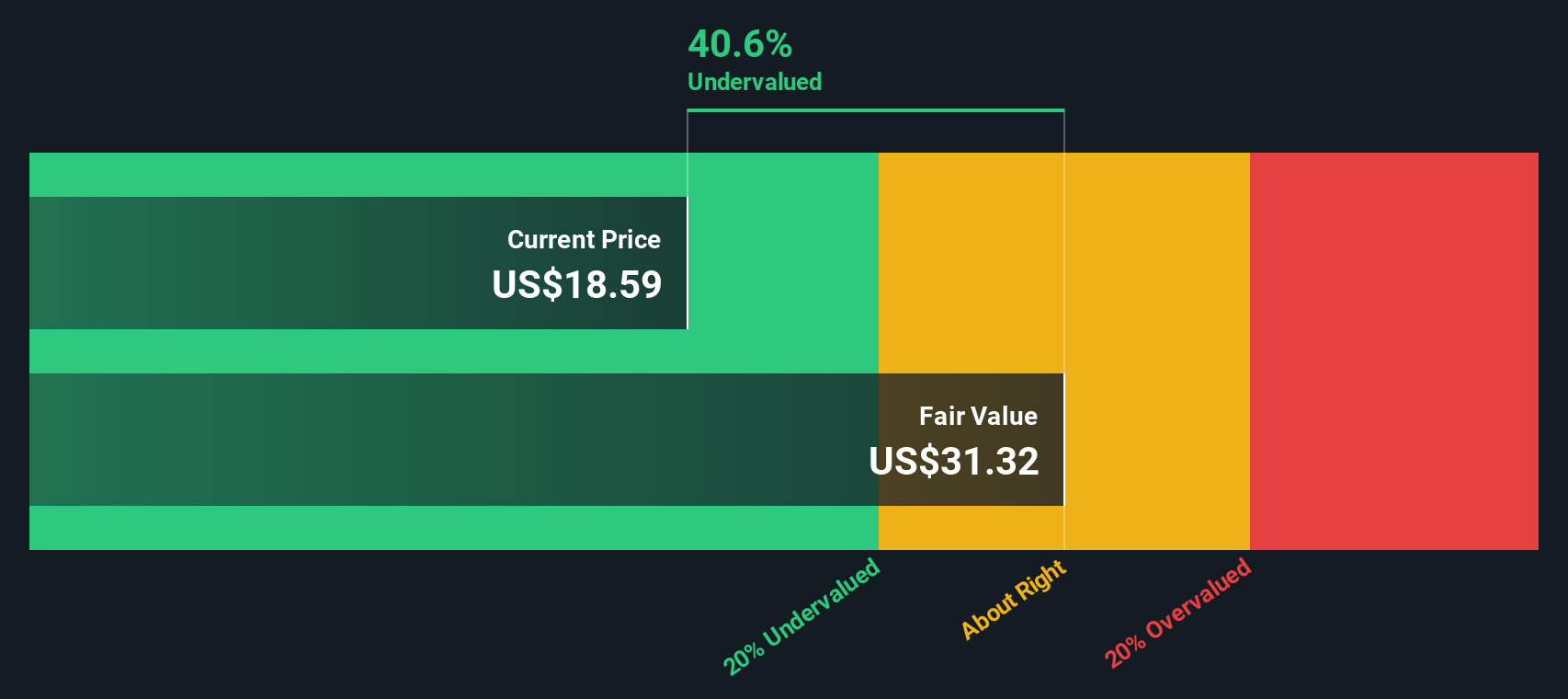

While Mattel appears attractively valued based on its price-to-earnings ratio, our SWS DCF model presents a different perspective. According to this approach, Mattel is trading at a 54.3% discount to its fair value estimate, which suggests more upside potential than the market currently reflects.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mattel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mattel Narrative

If you’d rather put the analysis to the test or dig deeper for yourself, creating your own narrative for Mattel is quick and easy. Do it your way

A great starting point for your Mattel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just settle for one stock when there are countless compelling opportunities at your fingertips. The right screener can put you ahead of the curve and help you act before the crowd catches on.

- Catch the momentum by searching for these 914 undervalued stocks based on cash flows, which are packed with untapped upside thanks to robust cash flow dynamics.

- Maximize your earning potential by targeting these 15 dividend stocks with yields > 3%, which consistently deliver yields above 3% for income-focused investors.

- Position yourself early in transformative tech by scanning these 28 quantum computing stocks, which are shaping tomorrow’s quantum breakthroughs today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026