- United States

- /

- Consumer Durables

- /

- NasdaqGS:LGIH

LGI Homes, Inc.'s (NASDAQ:LGIH) Earnings Are Not Doing Enough For Some Investors

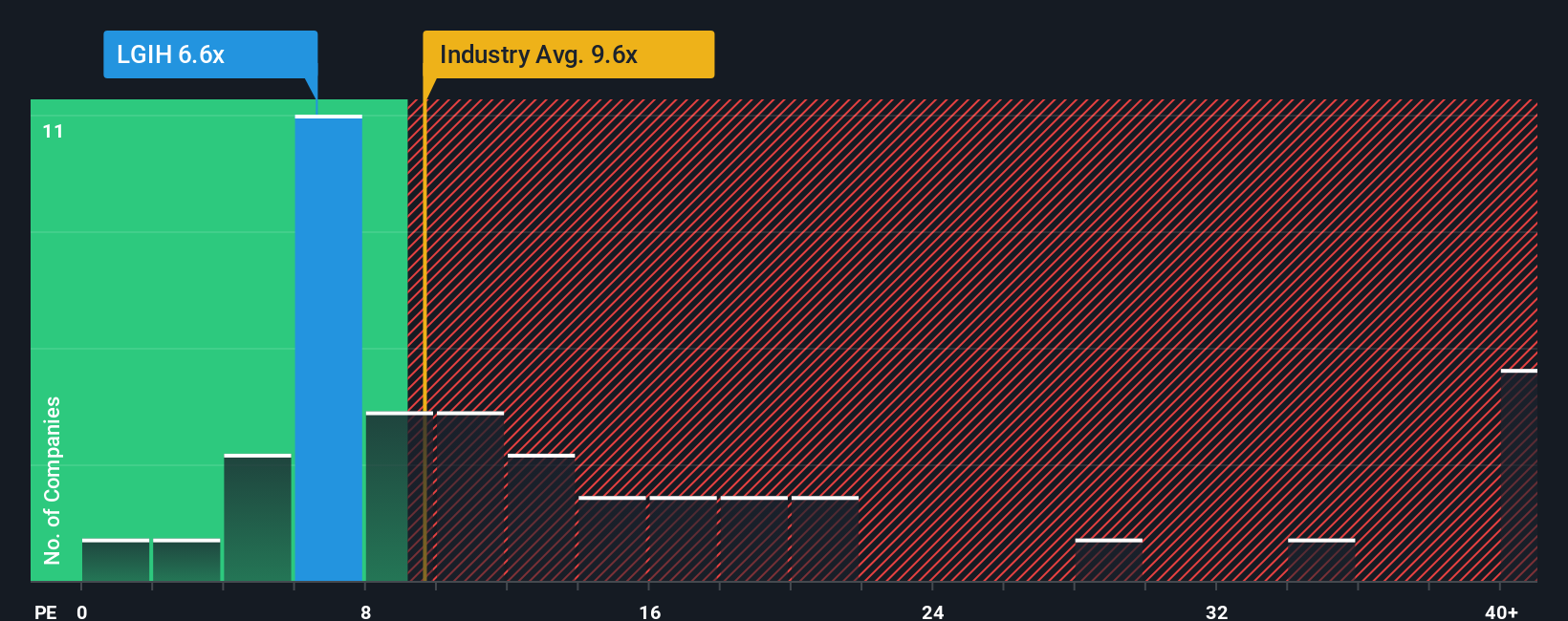

With a price-to-earnings (or "P/E") ratio of 6.6x LGI Homes, Inc. (NASDAQ:LGIH) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

LGI Homes hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for LGI Homes

How Is LGI Homes' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as LGI Homes' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 3.0% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 53% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 16% during the coming year according to the four analysts following the company. With the market predicted to deliver 13% growth , that's a disappointing outcome.

In light of this, it's understandable that LGI Homes' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On LGI Homes' P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that LGI Homes maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for LGI Homes you should know about.

Of course, you might also be able to find a better stock than LGI Homes. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LGIH

LGI Homes

Engages in the design, construction, and sale of homes in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026