- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

November 2025 Penny Stock Opportunities For Savvy Investors

Reviewed by Simply Wall St

Major stock indexes have recently rebounded as optimism grows over a potential resolution to the prolonged U.S. government shutdown, providing a positive backdrop for investors. In this context, penny stocks—often associated with smaller or emerging companies—continue to capture interest due to their potential for growth at accessible price points. Despite their name evoking a bygone era, these stocks can still offer significant opportunities when backed by robust financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.67 | $357.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.60 | $578.66M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.961 | $164.35M | ✅ 4 ⚠️ 3 View Analysis > |

| LexinFintech Holdings (LX) | $4.28 | $720.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.07 | $25.73M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.50 | $590.99M | ✅ 4 ⚠️ 0 View Analysis > |

| Cricut (CRCT) | $4.77 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.06 | $69.33M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 360 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Rapid Micro Biosystems (RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the production of pharmaceuticals, medical devices, and personal care products globally, with a market cap of $137.05 million.

Operations: There are no specific revenue segments reported for Rapid Micro Biosystems, Inc.

Market Cap: $137.05M

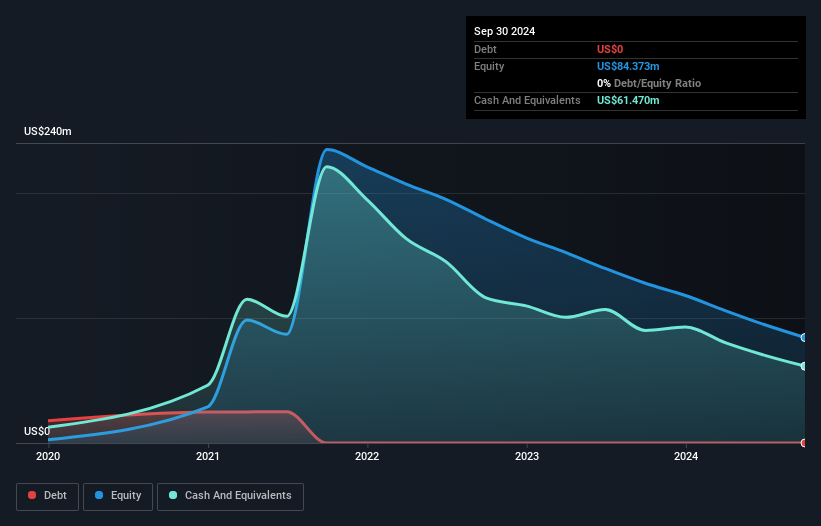

Rapid Micro Biosystems, Inc. has shown modest revenue growth, reporting US$22.31 million for the first nine months of 2025 compared to US$19.83 million in the previous year. Despite being unprofitable with a net loss of US$34.63 million over the same period, it has managed to reduce losses annually by 8.4% over five years and raised its full-year revenue guidance to at least US$33 million for 2025. The company maintains a strong cash position with short-term assets exceeding liabilities and has secured a $45 million term loan facility to support further expansion and operational improvements, indicating potential resilience despite high volatility in share price movements.

- Jump into the full analysis health report here for a deeper understanding of Rapid Micro Biosystems.

- Gain insights into Rapid Micro Biosystems' future direction by reviewing our growth report.

Clarus (CLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clarus Corporation designs, develops, manufactures, and distributes outdoor equipment and lifestyle products globally, with a market cap of approximately $140.93 million.

Operations: The company generates revenue through two main segments: Outdoor, contributing $180.74 million, and Adventure, accounting for $75.69 million.

Market Cap: $140.93M

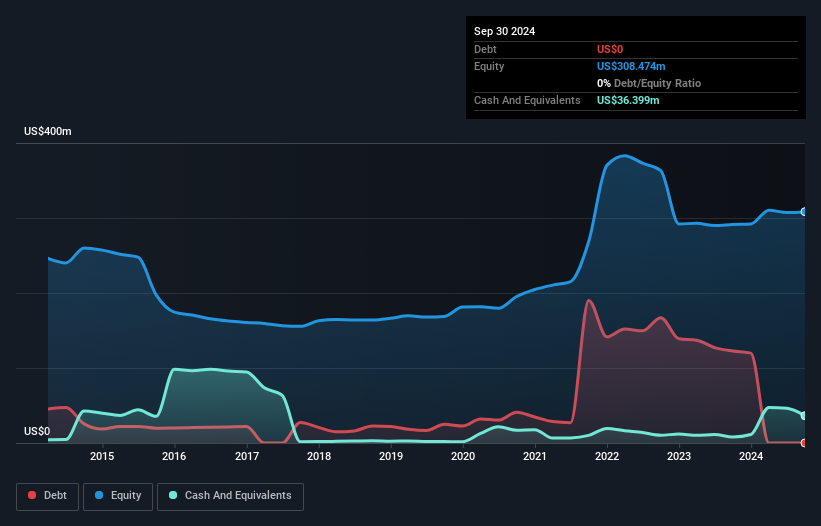

Clarus Corporation, with a market cap of US$140.93 million, remains unprofitable but has improved its quarterly net loss to US$1.62 million from US$3.16 million a year ago. Despite trading significantly below fair value estimates and maintaining more cash than debt, the company faces challenges in achieving profitability within the next three years. Its short-term assets comfortably cover both short- and long-term liabilities, providing some financial stability amidst ongoing losses that have increased annually by 47.8% over five years. The board is experienced; however, management is relatively new with an average tenure of 1.3 years.

- Get an in-depth perspective on Clarus' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Clarus' future.

BioLargo (BLGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLargo, Inc. invents, develops, and commercializes various platform technologies with a market cap of $56.84 million.

Operations: The company generates revenue through its BLEST segment, which accounts for $3.21 million, and ONM Environmental segment, contributing $11.82 million.

Market Cap: $56.84M

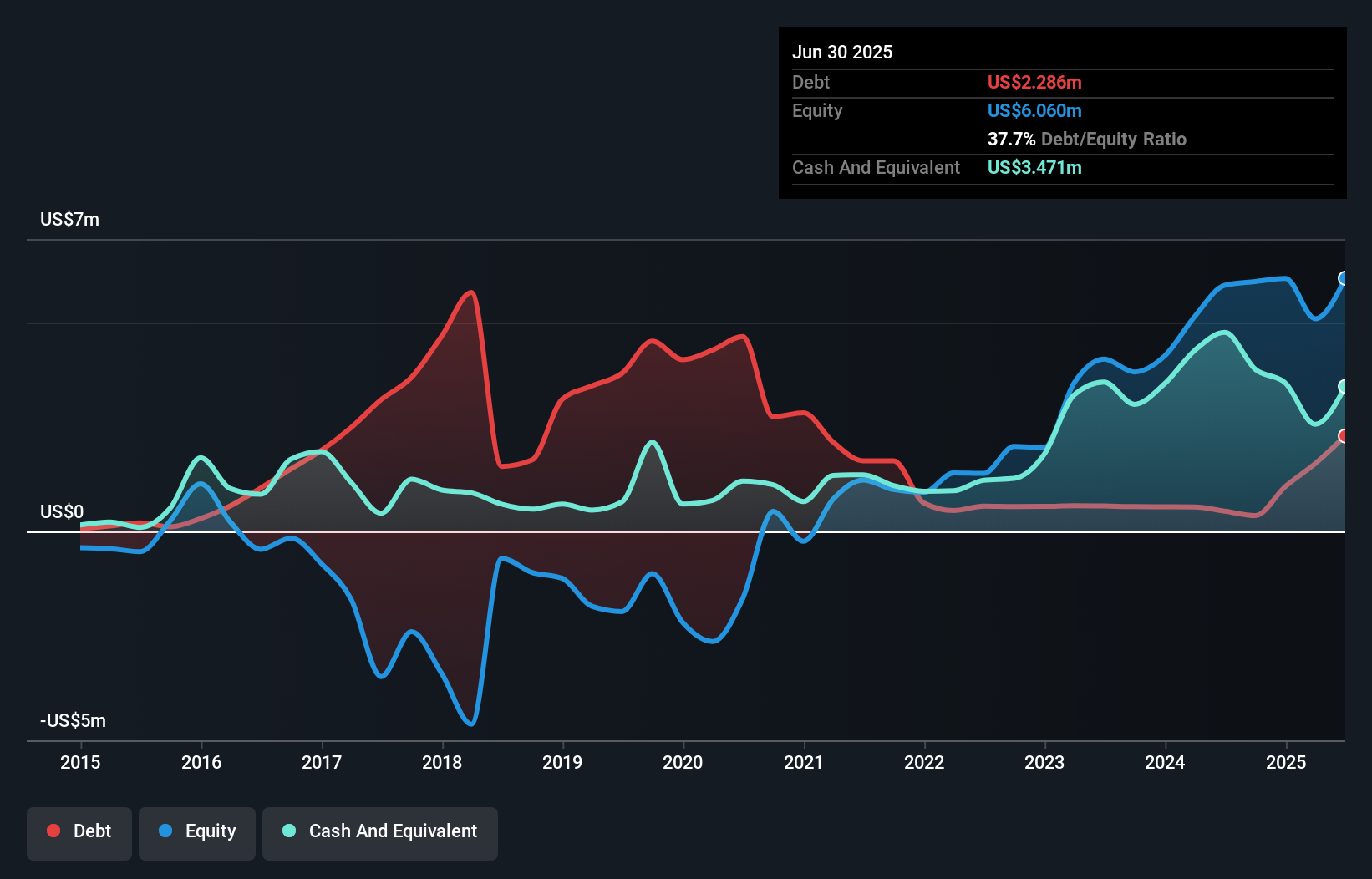

BioLargo, Inc., with a market cap of US$56.84 million, struggles with profitability, reporting a net loss of US$2.35 million for the first half of 2025. Despite reducing losses over five years and having more cash than debt, its cash runway is less than a year if current trends continue. The company recently terminated its licensing agreement with Pooph Inc., citing unpaid royalties and contractual breaches, which may impact future revenue streams. BioLargo's seasoned management team and board provide stability amid financial challenges, while short-term assets exceed liabilities offering some buffer against immediate financial pressures.

- Navigate through the intricacies of BioLargo with our comprehensive balance sheet health report here.

- Examine BioLargo's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Gain an insight into the universe of 360 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives