- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (WM): Assessing Valuation After Mixed Earnings and New Analyst Outlooks

Reviewed by Simply Wall St

Waste Management (WM) reported weaker-than-expected quarterly earnings and revenue, which led to lowered estimates from analysts and a cautious tone among some investors. The results have sparked fresh discussion around the company’s valuation and outlook.

See our latest analysis for Waste Management.

While Waste Management attracted attention with its margin gains and successful Stericycle integration, a string of mixed updates has kept the momentum in check. The share price climbed over 9% in the past month; however, one-year total shareholder returns are down slightly at -1.8%. That paints a picture of short-term optimism, with long-term gains still on pause as the market reassesses risk and value in light of recent results.

If WM’s mix of stability and recent swings has you curious about where else opportunity is building, consider expanding your view with fast growing stocks with high insider ownership

With mixed quarterly signals and recent analyst upgrades in play, the core question for investors now is clear: Is Waste Management trading below its true value, or is the market already factoring in all expected future growth?

Most Popular Narrative: 11.5% Undervalued

With the latest narrative estimating Waste Management’s fair value at $246.12, compared to the recent close of $217.87, analysts see room for upside based on forward-looking scenarios.

The company's strategic investments in sustainability, particularly in the areas of recycling and renewable energy, are showing strong, high-return growth. These initiatives could drive future revenue increases. The integration and optimization of WM Healthcare Solutions are on track to deliver significant synergies. These are anticipated to reach $250 million annually by 2027, positively impacting earnings.

Want to know what powers this bullish outlook? The secret is a set of ambitious expansion plans and synergy targets that, if met, could justify these premium expectations. Are you curious which future earnings upgrades and big sector shifts fuel this price target? Unpack the details and see what could truly tip the scale for Waste Management’s fair value.

Result: Fair Value of $246.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as lower recycled commodity prices or slower than expected gains from healthcare solutions could challenge this optimistic outlook for Waste Management.

Find out about the key risks to this Waste Management narrative.

Another View: What Do Earnings Ratios Say?

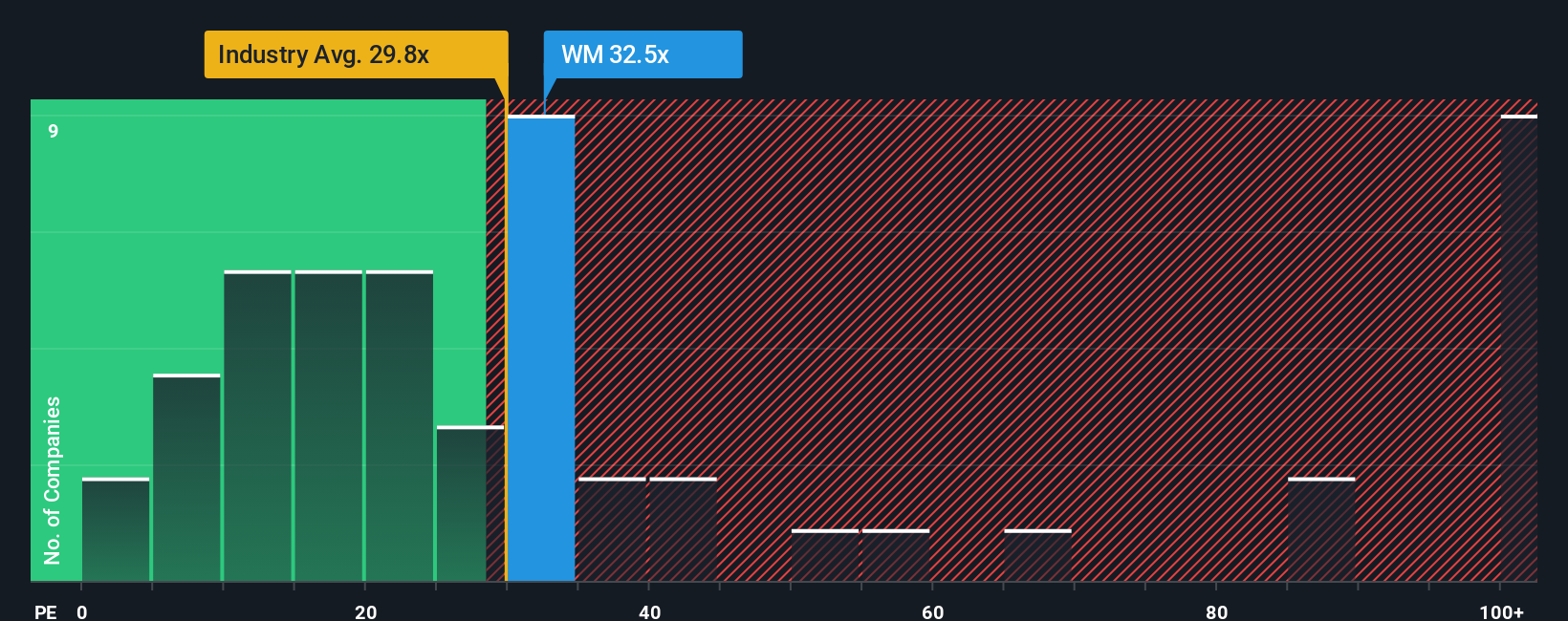

While fair value estimates hint that Waste Management may be undervalued, its price-to-earnings ratio tells a different story. At 34.2x, it sits well above both the industry average of 22.6x and peer average of 47.4x. However, it is just under its fair ratio of 35.4x. This suggests the market is pricing in optimism but leaving less margin for error. Are investors betting on consistent outperformance, or could future disappointment spark a correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Management Narrative

If you see the story differently or simply want to dive deeper on your own terms, you can shape your personal outlook in just a few minutes with Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop your search here. The best opportunities are often just a click away. Step up your strategy and explore the chance to add high-potential stocks to your radar now.

- Pursue future leaders with strong returns by checking out these 915 undervalued stocks based on cash flows, which stand out due to low market expectations and solid financials.

- Secure steady income with these 15 dividend stocks with yields > 3%, offering yields above 3% and showing reliability even during market swings.

- Explore the next wave in technology by reviewing these 28 quantum computing stocks, featuring companies focused on quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026