- United States

- /

- Commercial Services

- /

- NYSE:VSTS

3 Undervalued Small Caps With Insider Buying To Consider For Your Portfolio

Reviewed by Simply Wall St

As U.S. markets react positively to recent inflation data, hopes for a Federal Reserve rate cut have buoyed investor sentiment, particularly benefiting small-cap stocks as indicated by the S&P 600's performance. In this environment, identifying promising small-cap opportunities can be pivotal for investors seeking growth potential; companies with strong fundamentals and insider buying may present intriguing possibilities in this fluctuating market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Blue Bird | 12.7x | 1.1x | 45.74% | ★★★★★★ |

| Wolverine World Wide | 16.4x | 0.8x | 39.68% | ★★★★★☆ |

| First United | 10.1x | 3.0x | 44.62% | ★★★★★☆ |

| Merchants Bancorp | 7.9x | 2.6x | 48.65% | ★★★★★☆ |

| S&T Bancorp | 11.5x | 3.9x | 36.95% | ★★★★☆☆ |

| Farmland Partners | 6.5x | 8.0x | -92.49% | ★★★★☆☆ |

| CNB Financial | 18.1x | 3.4x | 45.79% | ★★★☆☆☆ |

| New Peoples Bankshares | 9.2x | 2.1x | 42.88% | ★★★☆☆☆ |

| Omega Flex | 17.4x | 2.8x | 5.99% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -12.60% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Ichor Holdings (ICHR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ichor Holdings specializes in the design, engineering, and manufacturing of critical fluid delivery subsystems and components for semiconductor capital equipment, with a market capitalization of approximately $1.2 billion.

Operations: The company's primary revenue stream is derived from semiconductor equipment and services, with a recent gross profit margin of 11.90%. Operating expenses are significant, including research and development costs, which impact net income margins.

PE: -14.9x

Ichor Holdings, a small company in the U.S., has caught attention due to its potential for growth despite recent challenges. With earnings projected to increase by 75% annually, there's optimism around its future. However, the company faces high-risk funding due to reliance on external borrowing and has experienced share price volatility over the past three months. Insider confidence is evident as Iain MacKenzie purchased 25,000 shares in October 2025 for US$415,750. Recent leadership changes saw Philip Barros step up as CEO following Jeffrey Andreson's resignation in November 2025. Despite reporting a net loss of US$22.85 million in Q3 2025 compared to US$2.78 million last year, sales rose from US$211 million to US$239 million year-over-year, indicating operational resilience amidst financial headwinds.

Nicolet Bankshares (NIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nicolet Bankshares operates as a financial holding company providing consumer and commercial banking services, with a market capitalization of approximately $1.02 billion.

Operations: The company's revenue primarily stems from Consumer and Commercial Banking Services, reaching $375.96 million in the latest period. Operating expenses are significant, with General & Administrative Expenses accounting for a large portion at $167.15 million. The net income margin has shown variability, recently recorded at 38.53%.

PE: 13.3x

Nicolet Bankshares, a smaller player in the banking sector, has shown promising financial performance. In Q3 2025, net interest income increased to US$79.26 million from US$68.37 million the previous year, while net income rose to US$41.74 million from US$32.52 million. Insider confidence is evident as Robert Weyers purchased 3,000 shares for approximately US$347,200 recently. The company also repurchased over 155,000 shares between July and September 2025 for about US$20.67 million and declared a quarterly dividend of $0.32 per share payable on December 15th, reflecting its commitment to shareholder returns amidst ongoing growth initiatives like the merger with MidWestOne Bank.

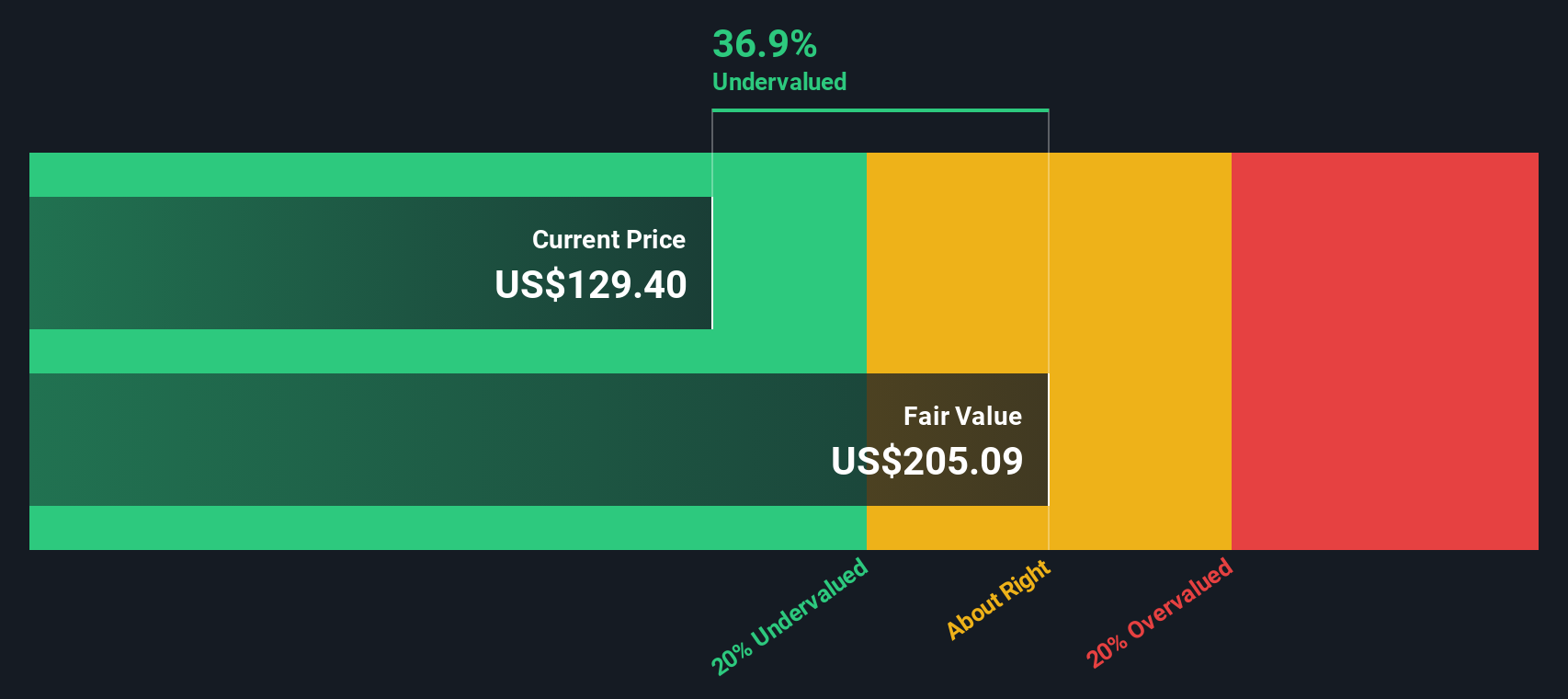

Vestis (VSTS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vestis operates in the apparel and accessories sector, focusing on markets in Canada and the United States, with a market capitalization of $2.73 billion.

Operations: The company generates revenue primarily from the United States and Canada, with a recent total of $2.83 billion. Its gross profit margin has shown fluctuations, reaching 30.47% in late 2023 before declining to 26.50% by late 2025. Operating expenses are significant, with general and administrative costs being a major component consistently exceeding $450 million per period analyzed.

PE: -22.9x

Vestis, a small company in the U.S., recently reported a challenging financial year with sales of US$2.73 billion but a net loss of US$40.22 million, contrasting with the previous year's profit. Despite this setback, insider confidence is evident as executives have been purchasing shares over recent months, suggesting belief in potential growth. The company forecasts flat to slightly declining revenue for 2026 but has bolstered its leadership team with experienced executives to drive digital transformation and HR strategy improvements.

- Click here and access our complete valuation analysis report to understand the dynamics of Vestis.

Gain insights into Vestis' historical performance by reviewing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 72 Undervalued US Small Caps With Insider Buying now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSTS

Vestis

Provides uniform rentals and workplace supplies in the United States and Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026