- United States

- /

- Commercial Services

- /

- NYSE:UNF

Why UniFirst (UNF) Is in the Spotlight After Activist Push for Board Changes and Possible Sale

Reviewed by Sasha Jovanovic

- In the past week, UniFirst Corporation faced an escalating proxy contest, as activist investor Engine Capital urged shareholders to vote for its director nominees instead of the company’s board candidates at the upcoming December 15, 2025, annual meeting.

- This confrontation signals a broader dispute about UniFirst’s strategic direction, with Engine Capital publicly calling for board changes and the potential consideration of a sale to maximize stakeholder value.

- With Engine Capital urging the exploration of a company sale and board changes, we’ll examine the implications for UniFirst’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

UniFirst Investment Narrative Recap

To be a UniFirst shareholder right now is to believe in the company’s ability to deliver on operational improvements, margin expansion, and long-term value amid internal and industry pressures. The proxy contest with Engine Capital introduces more uncertainty around the board’s composition and strategic direction, making near-term governance developments the most important catalyst, while heightening the risk of potential management and operational disruption. For now, the impact of the proxy battle on customer demand or near-term earnings outlook appears limited, as operational momentum remains a key focus.

Among recent company updates, UniFirst’s November 28 proxy supplement recommending shareholders vote for its current board nominees is the most telling in light of the ongoing activism. This official corporate response reinforces management’s commitment to their strategic direction and signals to investors that governance, and the immediate outcome of December’s annual meeting, may shape the company’s priorities more than any near-term operational initiative.

On the other hand, investors should be aware of the risk that ongoing public proxy contests can...

Read the full narrative on UniFirst (it's free!)

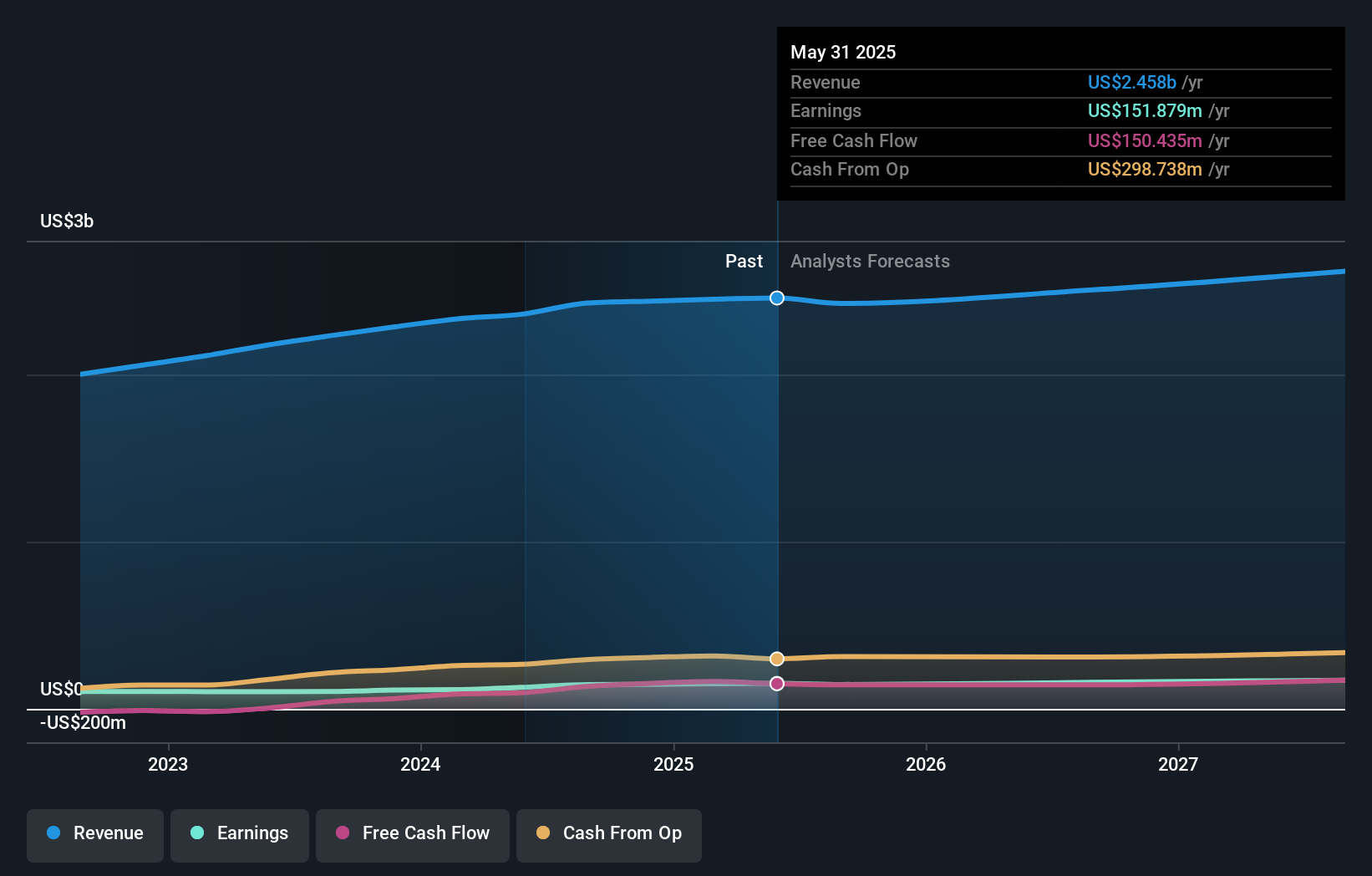

UniFirst's outlook anticipates $2.7 billion in revenue and $179.2 million in earnings by 2028. This is based on a 2.7% annual revenue growth rate and a $27.3 million increase in earnings from the current level of $151.9 million.

Uncover how UniFirst's forecasts yield a $165.50 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set UniFirst’s fair value between US$165.50 and US$171.37 based on two independent estimates. With board changes and potential shifts in governance now center stage, your outlook on UniFirst’s trajectory may differ significantly from these views, see what others are thinking and weigh the full range of possibilities.

Explore 2 other fair value estimates on UniFirst - why the stock might be worth as much as $171.37!

Build Your Own UniFirst Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UniFirst research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free UniFirst research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UniFirst's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNF

UniFirst

Provides workplace uniforms and protective work wear clothing in the United States, Europe, and Canada.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026