- United States

- /

- Professional Services

- /

- NYSE:TNET

Can TriNet Group’s (TNET) New CFO and AI Focus Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- TriNet Group recently announced third-quarter 2025 earnings, reporting revenue of US$1.23 billion and net income of US$34 million, while also appointing Mala Murthy as its new Chief Financial Officer effective November 28, 2025.

- The company's reaffirmed full-year guidance, coupled with record customer satisfaction and new AI-driven HR capabilities, signals ongoing operational resilience and investment in innovation despite challenging conditions for small and medium businesses.

- We’ll explore how TriNet’s leadership transition and renewed focus on AI-powered HR solutions shape its current investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

TriNet Group Investment Narrative Recap

To be a shareholder in TriNet Group right now, you need to believe that heightened regulatory complexity and shifts toward remote work will keep driving demand for TriNet’s HR solutions, even as client hiring and worksite employee volumes remain soft. The recent Q3 results and CFO transition reinforce core operational stability, but do not materially alter the immediate focus on stabilizing revenue growth versus cost pressures from health plans and subdued SMB hiring.

Among the latest announcements, the launch of TriNet’s AI-powered HR suite stands out. These new tools, such as the TriNet Assistant and Dynamic Dashboard, are geared toward improving customer experience and operational efficiency, aligning squarely with ongoing efforts to offset workforce challenges and improve retention, which remain key short-term catalysts for the business.

But in contrast, investors should also keep a close eye on how ongoing health plan cost increases and customer attrition risk could still…

Read the full narrative on TriNet Group (it's free!)

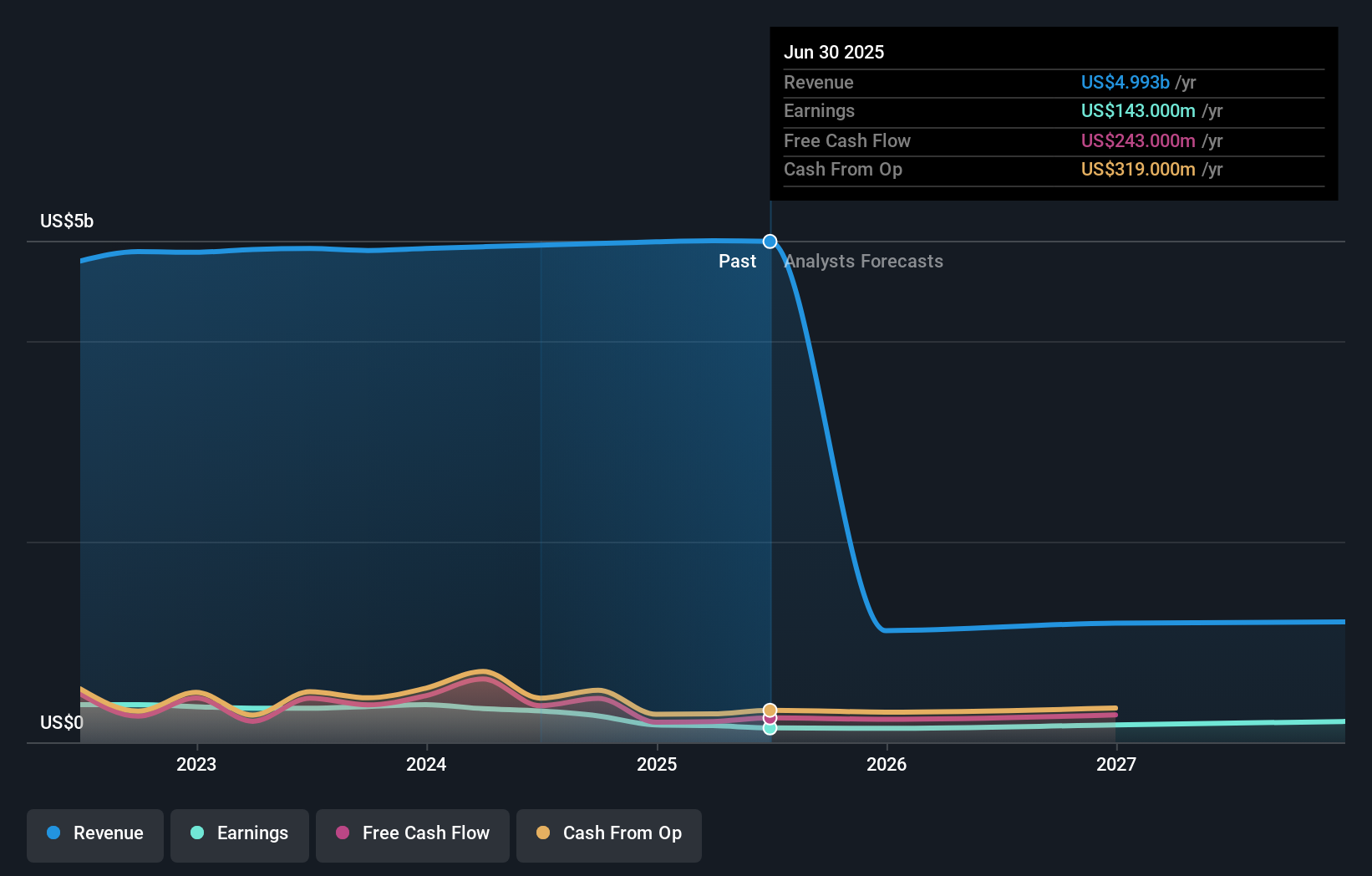

TriNet Group's outlook projects $408.0 million in revenue and $220.2 million in earnings by 2028. This assumes a 56.6% annual decline in revenue and a $77.2 million increase in earnings from the current $143.0 million level.

Uncover how TriNet Group's forecasts yield a $77.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published fair value targets ranging from US$77 to US$96.78 for TriNet Group, across two detailed analyses. While new AI-powered offerings aim to shore up customer retention, uncertainty around client hiring growth may shape both near-term momentum and broader outlooks. Explore these differing perspectives and see where you stand.

Explore 2 other fair value estimates on TriNet Group - why the stock might be worth just $77.00!

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives