- United States

- /

- Commercial Services

- /

- NYSE:SCS

Steelcase (SCS): Evaluating Fair Value After Consistent Share Price Growth

Reviewed by Simply Wall St

Steelcase (SCS) shares have traded steadily over the past week, drawing fresh interest as investors assess the stock’s longer-term performance. With year-to-date returns up 35% and annual net income growth of 31%, the numbers suggest steady progress.

See our latest analysis for Steelcase.

The past year has seen Steelcase rack up a robust 35% year-to-date share price return. Longer-term momentum has been sustained by a three-year total shareholder return of 114%. After a strong run-up, recent price movement has softened slightly, yet underlying growth and profitability have kept the stock on many watchlists.

If you’re looking to widen your research beyond just the latest movers in commercial services, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With impressive returns already logged, investors now face a pivotal question: Is Steelcase still flying under the radar, or has the market already priced in its future growth potential, leaving limited room for a bargain?

Most Popular Narrative: 1% Overvalued

Steelcase’s fair value estimate in the most followed narrative lands almost exactly at the current price, indicating the market is closely tracking this valuation. At the last close of $15.76, shares trade just above the narrative fair value of $15.60, putting investors and the company’s prospects to the test.

This appears to be a value trap rather than value opportunity. The low multiple reflects justified skepticism about business quality. Confidence Level: Medium (Fair value achievable but business fundamentals concerning)

Curious why the narrative’s central thesis calls into question the strength behind Steelcase’s apparent discount? The calculation rests on sector-aligned multiples and the belief that current earnings are sustainable. However, one key financial projection could reveal where the cracks or strengths really lie. Want to see what makes or breaks this outlook?

Result: Fair Value of $15.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or renewed volatility in office real estate could challenge the fair value outlook and change Steelcase’s valuation narrative.

Find out about the key risks to this Steelcase narrative.

Another Perspective: What Does the DCF Say?

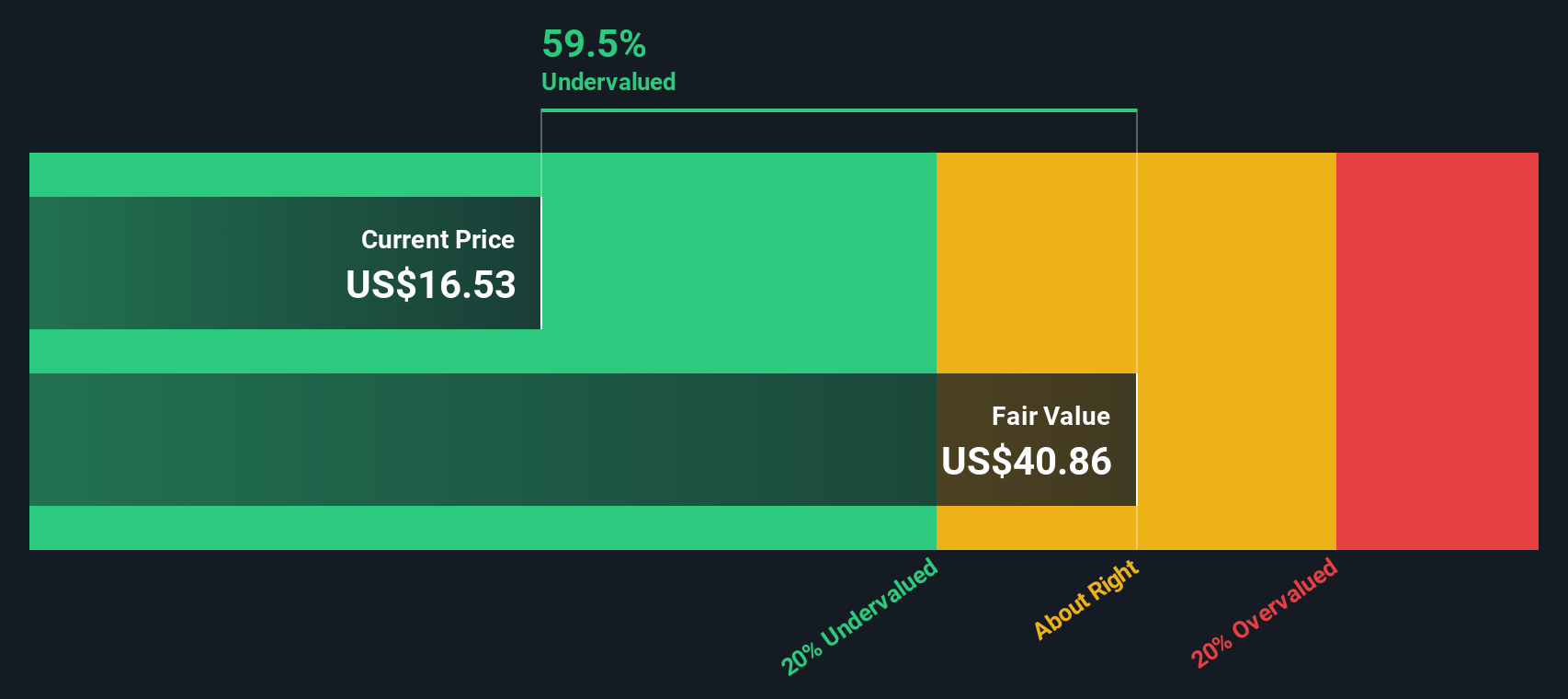

While sector comparisons point to Steelcase being fairly priced, our SWS DCF model takes a different view. It estimates Steelcase’s intrinsic value at $42 per share, which makes the current price look significantly undervalued. Does this model spot hidden upside or does it simply overstate expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Steelcase Narrative

If you see these conclusions differently or want to dive into the data yourself, you can build your own perspective in a matter of minutes. Do it your way

A great starting point for your Steelcase research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let other exciting opportunities slip by. Find your next standout stock by focusing on the trends and advantages shaping tomorrow’s leaders; your portfolio will thank you.

- Supercharge your income potential with these 16 dividend stocks with yields > 3% that offer attractive yields above 3% for reliable cash flow.

- Boost your growth strategy by targeting these 25 AI penny stocks as AI transforms entire industries and changes the competitive landscape.

- Target untapped market potential with these 28 quantum computing stocks leading breakthroughs in computing and secure new frontiers before they become mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCS

Steelcase

Provides a portfolio of furniture and architectural products and services in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives