- United States

- /

- Commercial Services

- /

- NYSE:RSG

Will Analyst Upgrades After Earnings Miss Shift Republic Services' (RSG) Cash Flow Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, analysts upgraded Republic Services to Buy after the company missed earnings and faced macroeconomic headwinds, highlighting factors such as margin expansion, strong free cash flow, and higher dividends driven by pricing power and acquisitions.

- An interesting aspect is analysts’ view that potential lower interest rates and a recovering economy could boost Republic Services’ cash flow, even amid persistent market and economic uncertainties.

- To see how expectations for cash flow growth shape the broader outlook, let’s examine the possible effects on Republic Services’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Republic Services Investment Narrative Recap

To be a shareholder in Republic Services, you need to believe in its ability to deliver consistent free cash flow and margin expansion, even as growth slows amid macroeconomic pressures. The recent earnings miss and guidance cut brought more attention to the company’s short-term exposure to lower waste volumes in sensitive sectors, but the upgrade from analysts suggests that these setbacks don’t materially change the current outlook, as pricing power and cash returns remain the key catalysts. One recent announcement that stands out is Republic Services’ continued focus on shareholder returns, highlighted by its October dividend declaration and ongoing share buybacks. These actions reinforce the company’s commitment to rewarding investors, even as sector-specific risks like contract losses and cyclical volume softness linger as potential headwinds to future revenue growth. Yet, despite other strengths, the risk of ongoing softness in construction and manufacturing markets remains something investors should fully understand, because if such trends persist...

Read the full narrative on Republic Services (it's free!)

Republic Services is projected to reach $19.3 billion in revenue and $2.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.6% and a $0.6 billion increase in earnings from the current $2.1 billion.

Uncover how Republic Services' forecasts yield a $248.86 fair value, a 21% upside to its current price.

Exploring Other Perspectives

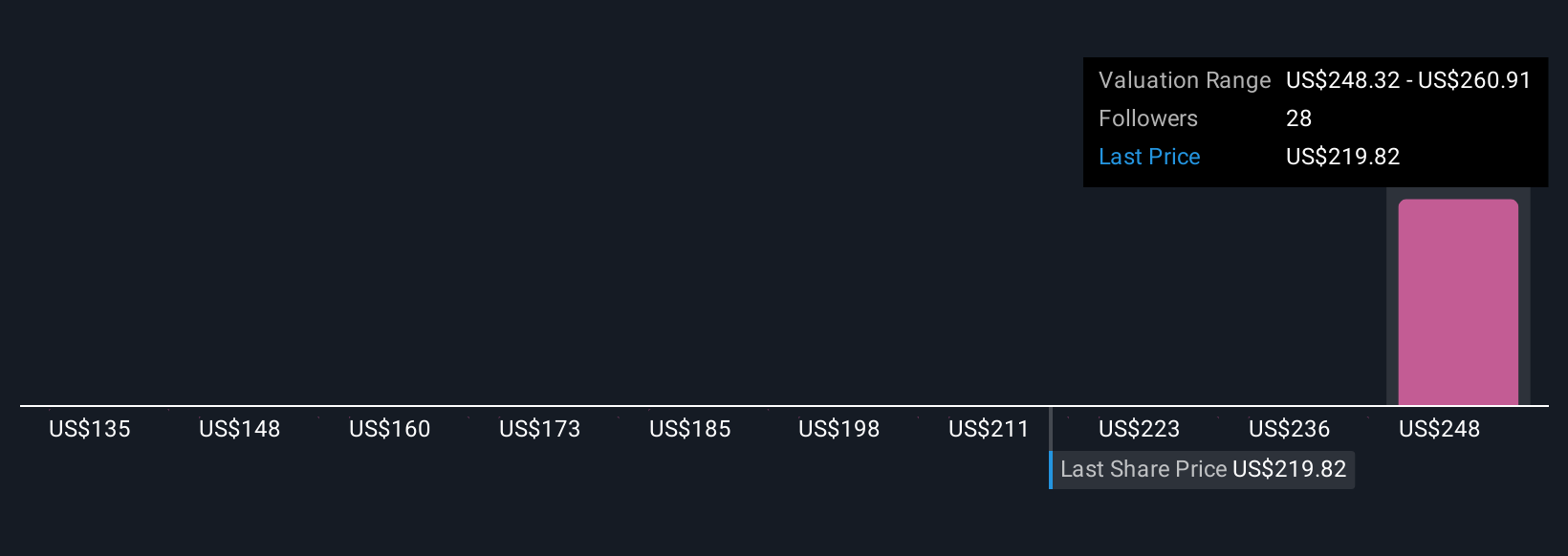

Four private investors from the Simply Wall St Community estimate Republic Services’ fair value between US$246.96 and US$264.79 per share. Their views reflect variation in outlooks, while continued volume softness in core segments remains a timely risk affecting short-term performance expectations.

Explore 4 other fair value estimates on Republic Services - why the stock might be worth just $246.96!

Build Your Own Republic Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Republic Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Republic Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Republic Services' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives