- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins (ROL): Reassessing Valuation After Record Q3 Results and a Barclays Upgrade

Reviewed by Simply Wall St

Rollins (ROL) just delivered record third quarter revenue with better margins, and that strong print, combined with a fresh upgrade from Barclays, has pushed the stock sharply higher in recent weeks.

See our latest analysis for Rollins.

That backdrop has helped Rollins reach a share price of $61.4, with a 30 day share price return of 4.76% and a year to date share price return of 33.36%, while its five year total shareholder return of 78.28% shows that longer term momentum remains firmly intact.

If Rollins strong run has you thinking about what else might be compounding steadily, it is worth exploring fast growing stocks with high insider ownership as a way to uncover other under the radar growers.

With the share price hovering just below fresh analyst targets after a powerful multi year run, the key question now is whether Rollins is still trading below its fundamentals or if the market has already priced in its future growth.

Most Popular Narrative: 30% Undervalued

Compared with Rollins last close at $61.4, the most popular narrative sees fair value closer to $61.61, implying meaningful upside from fundamentals over time.

The acquisition of Saela Pest Control is expected to add between $45 million to $50 million in revenue in 2025 and is anticipated to be accretive to earnings, signaling potential revenue growth and earnings enhancement. Continued strategic investments in sales staffing and marketing are expected to drive organic growth, particularly as the pest control season ramps up, which could lead to increased revenue.

Want to see how steady double digit growth, rising margins, and a premium future earnings multiple all fit together into this valuation roadmap? The full narrative reveals the exact revenue, profit, and discount rate assumptions behind that fair value call.

Result: Fair Value of $61.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or integration challenges from ongoing acquisitions could easily erode margins and undermine the optimistic growth assumptions embedded in this narrative.

Find out about the key risks to this Rollins narrative.

Another View: Multiples Point to Rich Pricing

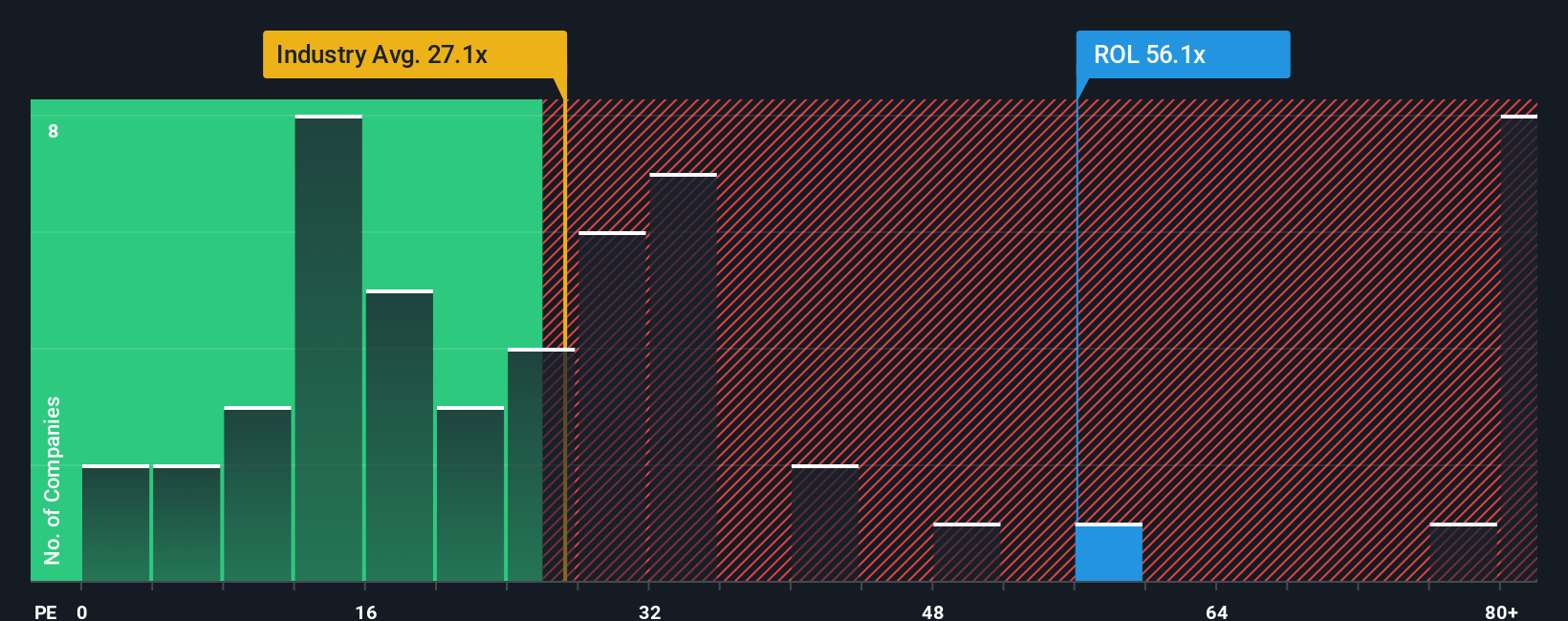

While the narrative assigns Rollins a fair value near its current price, our valuation using the price to earnings ratio paints a very different picture. The stock trades on 57.3 times earnings, versus 23.1 times for the US Commercial Services industry and 40.9 times for peers, with a fair ratio of just 29.3 times. That gap suggests investors are paying a hefty premium that could reverse quickly if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you are skeptical of these conclusions or would rather dig into the numbers yourself, you can quickly craft a personalized valuation story in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Looking for more investment ideas?

Rollins may look compelling, but you will miss out on other powerful setups if you do not scan the broader market with targeted screeners today.

- Capture potential multi baggers early by reviewing these 3573 penny stocks with strong financials that pair tiny market caps with surprisingly robust balance sheets and fundamentals.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks where medical innovation and machine learning combine to reshape diagnostics, treatments, and long term demand.

- Evaluate these 15 dividend stocks with yields > 3% that aim to reward patient shareholders with above average yields and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026