- United States

- /

- Commercial Services

- /

- NYSE:ROL

How Investors Are Reacting To Rollins (ROL) Record Margins And AI-Resistant Marketing Strategy

Reviewed by Sasha Jovanovic

- Rollins recently reported a strong third quarter, delivering record revenue and improved margins as the company emphasized consistent execution and efficiency.

- Barclays’ rating upgrade highlighted how Rollins’ diversified marketing and multi-brand approach may help it manage emerging risks around AI-driven SEO disruption.

- We’ll now explore how this combination of margin progress and marketing resilience could influence Rollins’ investment narrative for long-term investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Rollins Investment Narrative Recap

To own Rollins, you need to believe its recurring pest control model, disciplined marketing and multi brand strategy can keep revenue and margins resilient, even when consumer demand or costs wobble. The latest quarter’s record revenue and margin improvement support that view, while Barclays’ upgrade suggests the key near term catalyst remains execution on marketing and efficiency. The biggest current risk, in my view, is still pressure on costs and demand rather than the AI related SEO disruption highlighted.

Among recent announcements, the 11% year on year increase in the quarterly dividend to US$0.1825 per share stands out in this context. Paired with consistent earnings growth and the recent buyback, it reinforces how Rollins is using its cash flows while it works on margin improvement and marketing resilience as potential drivers of the next leg of the investment story.

Yet investors should also know more about how higher fleet expenses and other cost pressures could still affect...

Read the full narrative on Rollins (it's free!)

Rollins’ narrative projects $4.6 billion revenue and $686.0 million earnings by 2028.

Uncover how Rollins' forecasts yield a $61.61 fair value, in line with its current price.

Exploring Other Perspectives

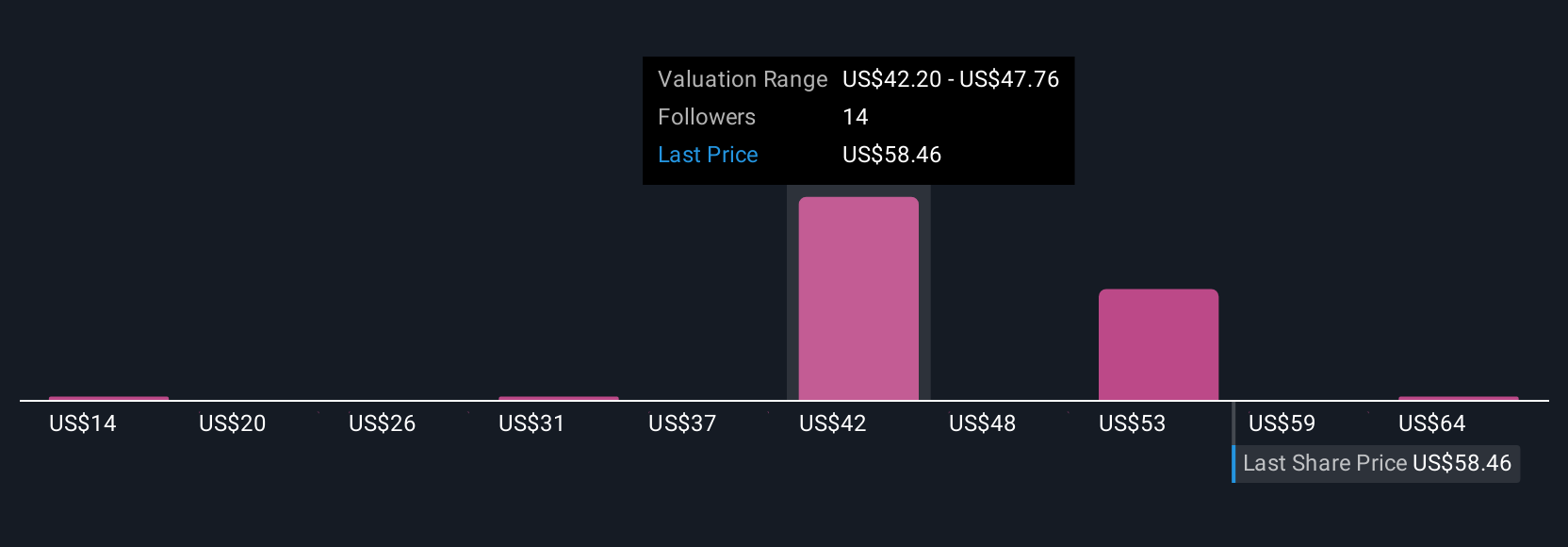

Five members of the Simply Wall St Community currently see fair value for Rollins anywhere between US$14.40 and US$72.00, underlining how far apart individual views can be. Set against this, the recent margin progress and marketing focused upgrade highlight how differently people weigh execution strengths versus cost and demand risks, so it is worth comparing several of these perspectives side by side.

Explore 5 other fair value estimates on Rollins - why the stock might be worth less than half the current price!

Build Your Own Rollins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rollins research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rollins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rollins' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026