- United States

- /

- Professional Services

- /

- NYSE:PL

How Does Planet Labs Stack Up After Soaring 233.8% Amid New Satellite Partnerships?

Reviewed by Bailey Pemberton

- Wondering if Planet Labs PBC is really worth its soaring price tag? You are not alone, especially with all the buzz around this stock's potential.

- After a monster 233.8% gain year-to-date and an even bigger 436.4% return over the past year, this stock is definitely on investors' radars despite a recent 13.1% drop in the past month.

- Recent headlines have highlighted Planet's expanding customer partnerships and increased interest in satellite-driven data solutions. This attention has fueled speculation about both growth opportunities and risks tied to fast-moving innovation in the space sector.

- When it comes to our valuation checkup, Planet Labs PBC scores 0 out of 6 on our core metrics. This means it is not considered undervalued by any of our six core valuation measures. Next, we will dig into these valuation approaches one by one and provide a deeper perspective on what makes a business truly worth its price at the end of the article.

Planet Labs PBC scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

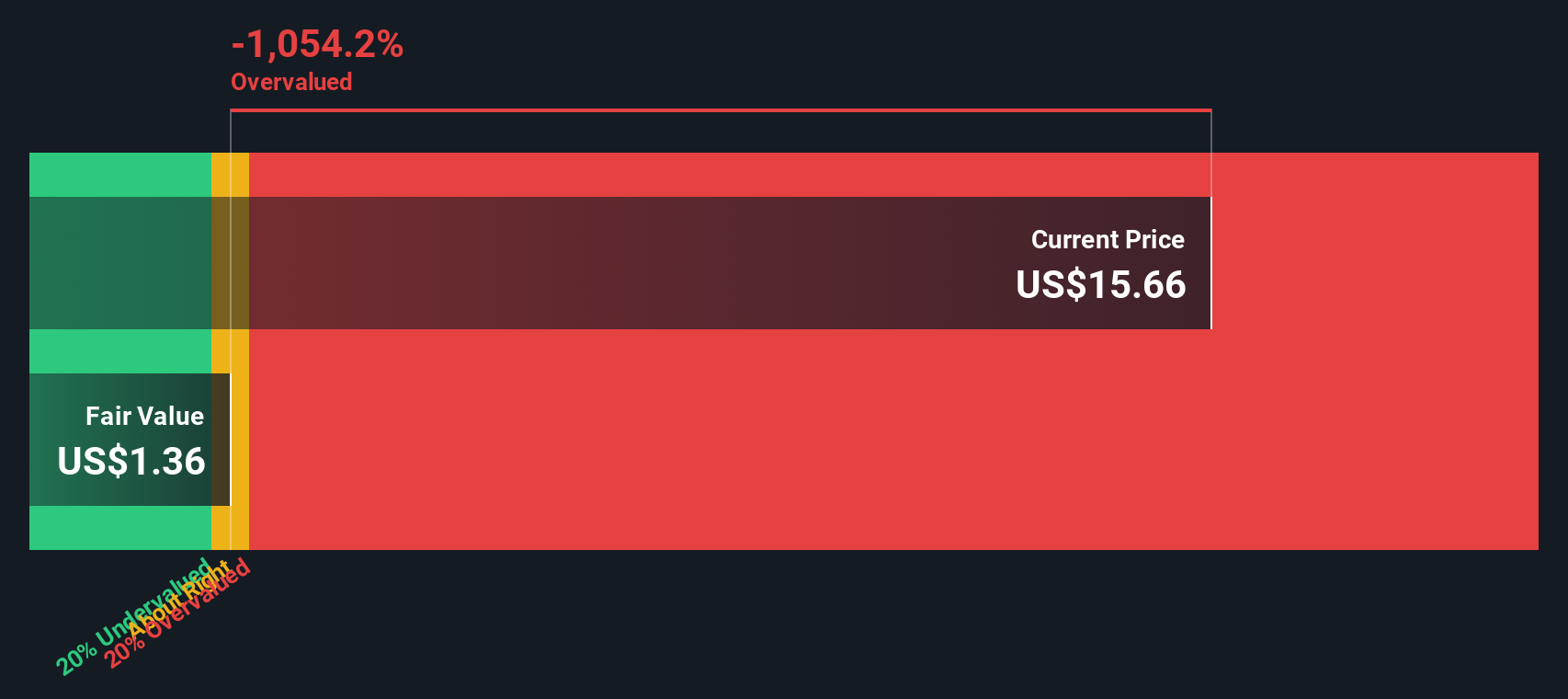

Approach 1: Planet Labs PBC Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those projections back to today's dollars. This method helps investors determine what a business is truly worth based on fundamentals rather than market sentiment.

For Planet Labs PBC, the current Free Cash Flow stands at $33.36 million. Analyst estimates cover the first five years, with projections suggesting Free Cash Flow will rise to $10.11 million by 2028. Beyond this, Simply Wall St extrapolates further and forecasts FCFs from $11.23 million in 2026 to $3.19 million in 2035. All cash flows are reported in US dollars.

Applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of just $0.27 per share. When compared to the current market price, this implies Planet Labs PBC is trading at a 4746.8% premium to its DCF fair value. In other words, the stock is significantly overvalued based purely on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Planet Labs PBC may be overvalued by 4746.8%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

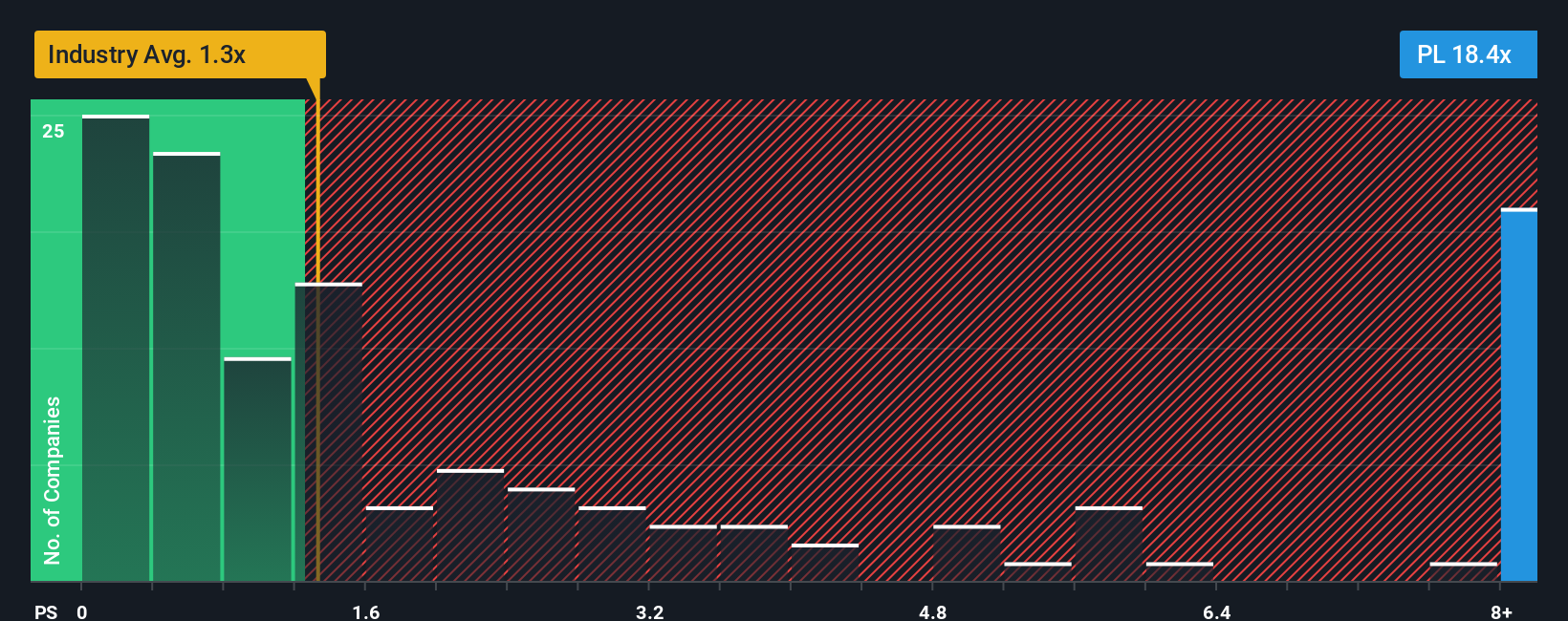

Approach 2: Planet Labs PBC Price vs Sales

For companies still working toward consistent profitability, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. This is because sales figures are less impacted by accounting quirks or one-off expenses and provide a clearer picture of the scale of the underlying business.

Growth expectations and business risk typically drive what counts as a fair P/S ratio in any industry. Rapidly growing or low-risk companies can justify higher multiples, while slow-growth or riskier firms tend to trade at lower ratios.

Planet Labs PBC currently trades at a P/S ratio of 15.54x, which is well above the Professional Services industry average of 1.37x. Its P/S ratio is also far higher than the average among its direct peers, which stands at 2.34x. However, simple peer or industry comparisons do not always tell the full story.

Simply Wall St’s proprietary “Fair Ratio” goes a step further by estimating the P/S multiple you should expect for this business, factoring in its growth prospects, industry dynamics, profit margins, size, and risk profile. For Planet Labs, the Fair Ratio is 4.18x. This more nuanced measure provides a meaningful anchor point for long-term investors, as it reflects both company and sector realities, not just raw averages.

Comparing Planet Labs PBC’s actual P/S ratio of 15.54x to its Fair Ratio of 4.18x suggests the stock is trading at a considerable premium to what would be justified by its fundamentals today.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Planet Labs PBC Narrative

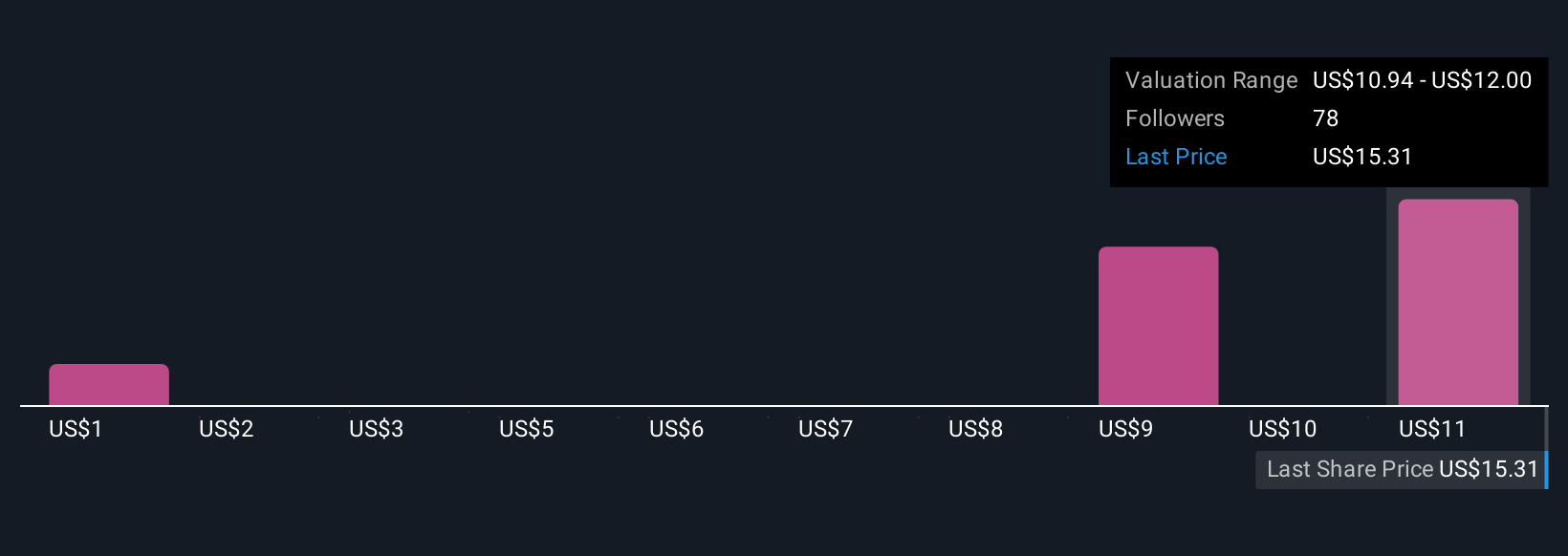

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story behind the numbers, your perspective on where a company is headed, how it will grow, and what that might mean for its future financials and value.

With Narratives, you explicitly connect your view on Planet Labs PBC’s prospects to a financial forecast, which then calculates a fair value. This makes your investment thesis transparent and actionable. Narratives simplify investing by allowing anyone, not just professionals, to build, edit, and compare different visions for a company via tools available on the Simply Wall St Community page, used by millions of investors worldwide.

By creating or following a Narrative, you see how shifts in forecasts or assumptions immediately update the company’s fair value. This enables you to quickly assess whether the current price is attractive or not. Narratives are dynamically refreshed as soon as new information arrives, such as earnings releases or major news, so your analysis stays current without manual updates.

For example, one Planet Labs PBC Narrative values the stock as high as $14.55, based on optimistic revenue growth and higher future margins, while another adopts a more conservative stance, valuing it at just $4.50. Narratives empower you to choose the story and valuation that matches your conviction.

For Planet Labs PBC, we will make it really easy for you with previews of two leading Planet Labs PBC Narratives:

- 🐂 Planet Labs PBC Bull Case

Fair Value: $14.55

Current price is 8.97% below this fair value

Revenue Growth Rate: 21.93%

- Strategic partnerships, a shift to high-value solutions, and new contract wins are projected to drive revenue expansion and margin improvement.

- Growth in satellite services, collaborations for AI-enhanced solutions, and increased focus on large accounts support long-term financial stability.

- Key risks include capital expenditures, reliance on major clients, and execution risk from new ventures. However, the consensus price target sees further upside.

- 🐻 Planet Labs PBC Bear Case

Fair Value: $11.31

Current price is 17.14% above this fair value

Revenue Growth Rate: 30.0%

- Planet Labs leads Earth Observation with the largest satellite constellation and is positioned to benefit from accelerating demand worldwide.

- Falling launch and AI costs plus new EO-based product ventures could fuel further growth and broader market opportunities.

- The main risks center on the stock currently trading above intrinsic value, placing heavy reliance on commercial adoption and government contracts to justify the high price.

Do you think there's more to the story for Planet Labs PBC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives