- United States

- /

- Professional Services

- /

- NYSE:PAYC

Does the Recent 31% Drop in Paycom Signal an Opportunity in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Paycom Software is trading at a bargain, or if the market has already caught onto its potential? If you are curious about what truly drives a great deal in tech stocks, you are in the right place.

- Despite some excitement last year, the stock has dropped 19.7% in the past month and is down over 31% in the past year. This raises significant questions about future growth and risk.

- Recent industry discussion includes heightened competition in cloud-based HR solutions and strategic leadership moves at Paycom, both of which have influenced investor sentiment and price fluctuations. Headlines about evolving digital payroll demand and analyst forecasts have kept Paycom in the spotlight for both skeptics and supporters.

- By our calculations, Paycom lands a valuation score of 6 out of 6, which means it is considered undervalued according to all our major checks. Next, we will break down the tools we rely on most when determining fair value. Be sure to read on to learn more about how to separate market narrative from the numbers.

Find out why Paycom Software's -31.1% return over the last year is lagging behind its peers.

Approach 1: Paycom Software Discounted Cash Flow (DCF) Analysis

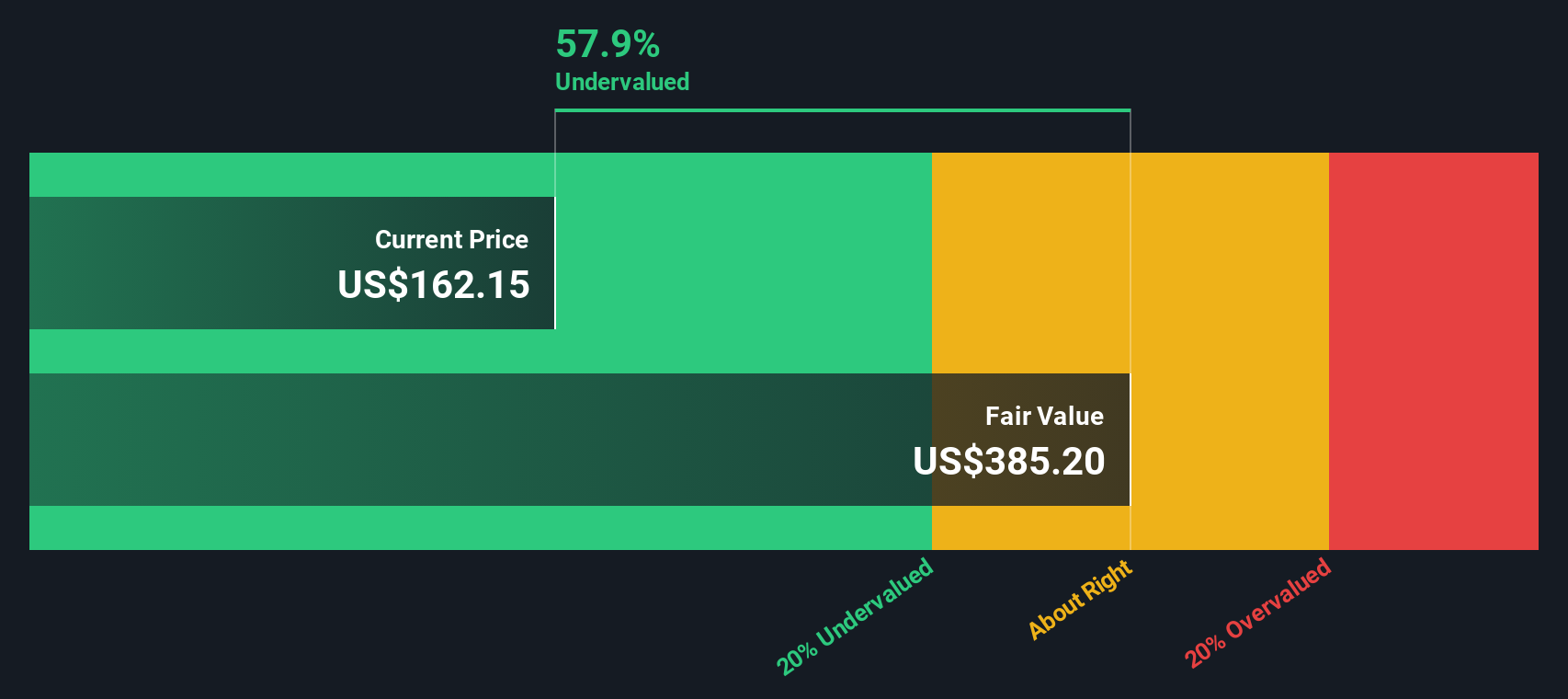

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's dollars. This approach is commonly used to assess whether a stock is undervalued or overvalued based on its expected ability to generate cash in the years ahead.

For Paycom Software, analysts estimate its current free cash flow at $409.8 Million. Over the next decade, projections show free cash flow growing steadily, with 2029 estimates reaching $783 Million. Further years are extrapolated, with future cash flows expected to rise even higher after that period, but the clearest analyst consensus extends to five years out. All figures are in US dollars.

Using the 2 Stage Free Cash Flow to Equity method, these cash flows are discounted back to reflect today's value. The resulting intrinsic valuation for Paycom stock is $374.49 per share. Based on the current share price, this implies a discount of 57.1 percent, suggesting Paycom shares are significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Paycom Software is undervalued by 57.1%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

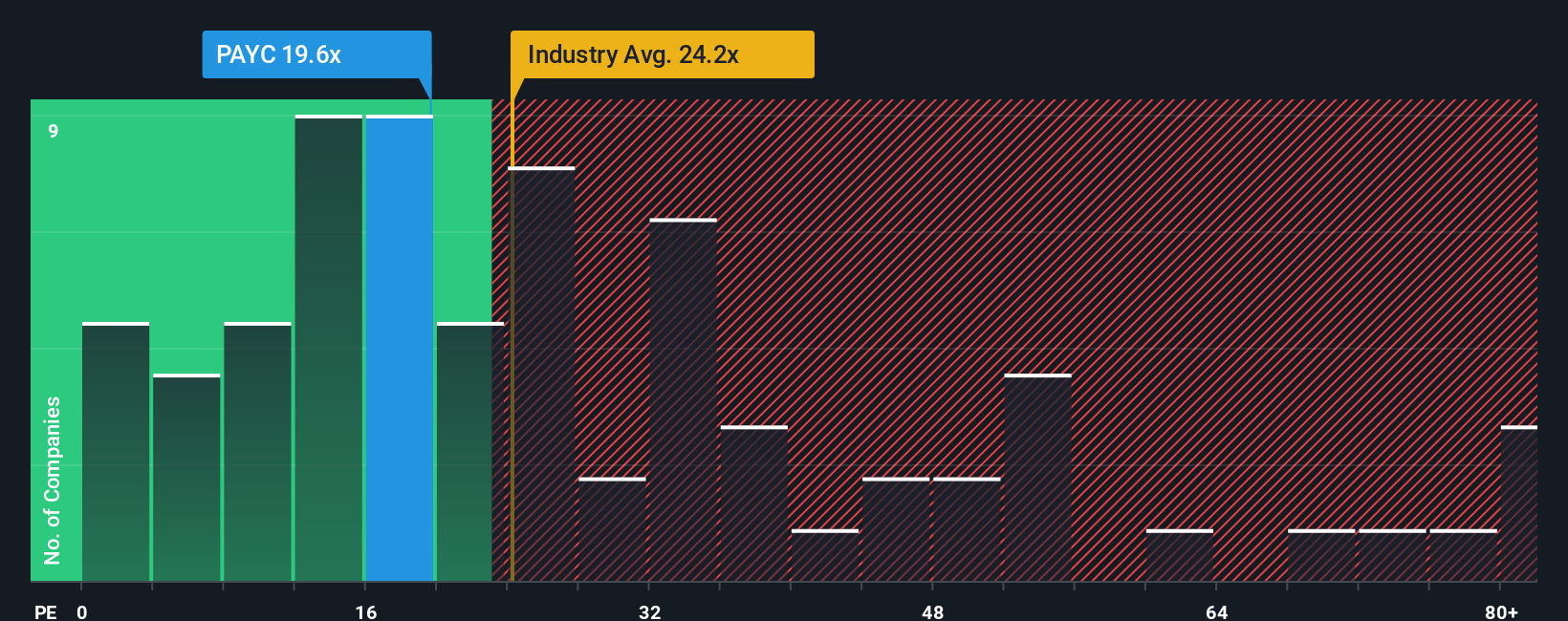

Approach 2: Paycom Software Price vs Earnings

The price-to-earnings (PE) ratio is a useful tool for valuing profitable companies like Paycom Software because it compares the company's share price to its earnings per share, offering an easy way to see how the market prices each dollar of earnings. Investors often use the PE ratio to gauge if a stock is attractively valued compared to its growth prospects and industry peers.

Growth expectations and risk play a significant role in shaping what is considered a "normal" or "fair" PE ratio. Companies with higher future earnings growth or lower risk profiles typically command a higher PE, while those with greater uncertainty or slower anticipated growth tend to trade for less.

Paycom Software's current PE ratio stands at 19.5x. This is lower than both the industry average of 24.3x and its key peer group, which averages 22.1x. While these benchmarks help provide context, they do not account for unique company characteristics, shifting growth outlooks, or business risks.

This is where Simply Wall St's "Fair Ratio" comes in. Unlike raw industry or peer comparisons, the Fair Ratio is calculated at 24.3x and blends Paycom's specific earnings growth, profit margins, industry dynamics, risk profile, and market cap to give a more tailored valuation benchmark. By considering these extra factors, the Fair Ratio offers a clearer view of whether Paycom is fairly priced for its own potential rather than by a broad category average.

Comparing Paycom's actual PE ratio to the Fair Ratio suggests the stock is currently trading below its tailored fair value multiple. With a PE of 19.5x versus a Fair Ratio of 24.3x, the numbers indicate Paycom shares are undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Paycom Software Narrative

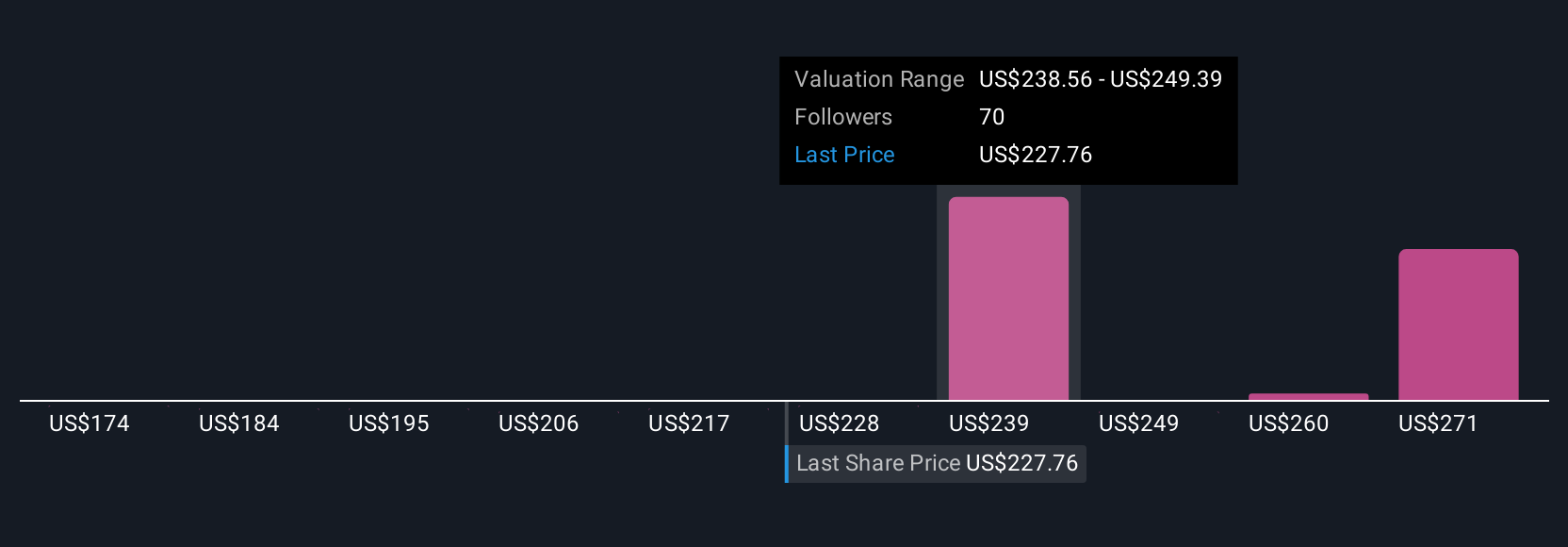

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your personal story about a company’s future, connecting your beliefs and expectations with forecasts for revenue, margins, and fair value. Instead of focusing solely on historical data or rigid metrics, Narratives allow you to frame Paycom Software’s numbers within a bigger picture by linking business drivers, risks, and trends to the valuation you assign the company.

Narratives make investing easier and more accessible by letting you create, share, and compare perspectives within the Community page on Simply Wall St, where millions of investors refine their thinking together. When you set your assumptions, the platform automatically creates a fair value based on your outlook, so you can see at a glance if Paycom’s current price matches your story and decide when to buy or sell. Narratives update dynamically as new information, news, or earnings become available, giving you a living, evolving estimate of what the stock is truly worth at any moment.

For example, recent analyst perspectives on Paycom range from bullish price targets of $310 (optimists expecting higher recurring growth and margin expansion) to more cautious estimates near $208 (those seeing risk from slowing subscription growth and market headwinds), showing how the power of Narratives helps every investor make smarter, more informed decisions.

Do you think there's more to the story for Paycom Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success