- United States

- /

- Commercial Services

- /

- NYSE:MEG

Montrose Environmental Group (MEG): Assessing Valuation Following This Year’s Strong Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Montrose Environmental Group.

Montrose Environmental Group has shown real momentum lately, with a robust 53.66% year-to-date share price return and 41.43% total shareholder return over the past twelve months. This signals investor optimism about its growth prospects. The stock’s current rally reflects renewed confidence following recent company milestones.

If MEG’s surge has sparked your curiosity, this could be the perfect moment to broaden your search and uncover fast growing stocks with high insider ownership.

With shares up strongly this year and the stock approaching analyst price targets, the question remains: Is Montrose Environmental Group now trading at fair value, or could there still be a genuine buying opportunity for investors?

Most Popular Narrative: 6.6% Undervalued

Montrose Environmental Group’s most followed narrative assigns a fair value higher than the latest closing price of $28.78, suggesting further room for appreciation. The story now pivots to how industry shifts and company strategy may set the stage for this upside.

“Ongoing global investment in climate change mitigation and adaptation, coupled with increased regulatory requirements at state, local, and international levels regardless of US federal shifts, is sustaining robust demand for Montrose's measurement, monitoring, and remediation services. This is driving recurring revenue growth and supporting the company's guidance for organic revenue expansion in the 7 to 9%+ range.”

Want to peek under the hood of this bullish view? Discover the core growth assumptions, including margins and revenue moves that could rewrite Montrose’s profit story. Only the full narrative reveals what financial momentum justifies this price target. Tempted to learn which trends underpin these projections?

Result: Fair Value of $30.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering reliance on episodic emergency projects and uncertainty in future acquisitions could create challenges for Montrose Environmental Group’s steady growth outlook.

Find out about the key risks to this Montrose Environmental Group narrative.

Another View: Comparing Price Multiples

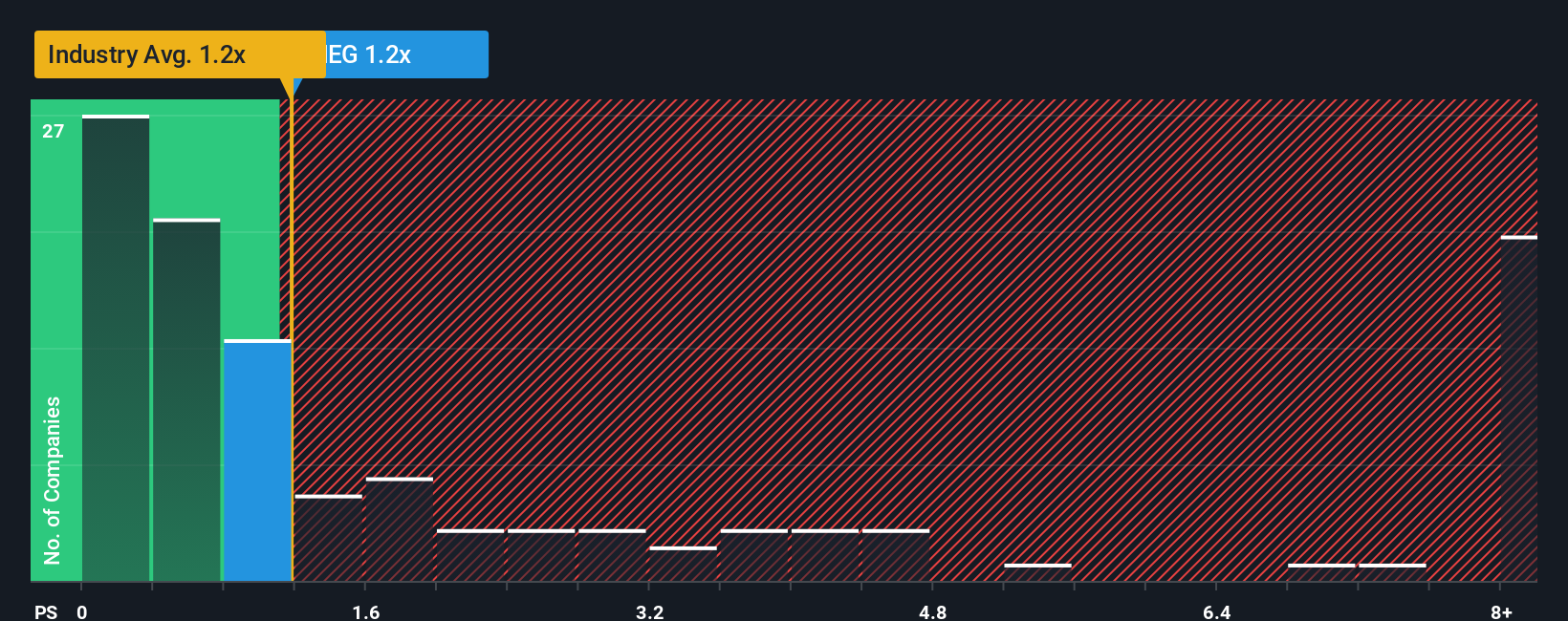

Taking a look through the lens of price-to-sales, Montrose Environmental Group trades at 1.3 times sales. That is higher than the peer average of 1 times sales, but still below the broader US Commercial Services industry average of 1.6. Interestingly, the fair ratio is slightly lower at 1.1, which suggests there may be limited upside and some risk if the market moves closer to that fair value.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Montrose Environmental Group Narrative

If you have a unique perspective or enjoy digging into the details yourself, there’s nothing stopping you from shaping your own conclusion in just a few minutes. Do it your way.

A great starting point for your Montrose Environmental Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You don’t have to stop here. Explore fresh investing opportunities using these tailored lists and consider your next move before others catch on.

- Capture early-stage growth by targeting innovation and agility among these 3574 penny stocks with strong financials.

- Pinpoint future health sector leaders with artificial intelligence applications when you review these 32 healthcare AI stocks.

- Boost your portfolio’s income potential by selecting from these 19 dividend stocks with yields > 3% yielding higher than 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MEG

Montrose Environmental Group

Operates as an environmental services company in the United States, Canada, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives