- United States

- /

- Professional Services

- /

- NYSE:KBR

How Investors Are Reacting To KBR (KBR) Winning Iraq Gas Project Engineering Contract

Reviewed by Sasha Jovanovic

- ENKA announced in early November 2025 that it selected KBR to provide detailed engineering design services for the Associated Gas Upstream Project Phase 2 in Iraq, building on KBR's earlier front-end engineering design work for the same project alongside TotalEnergies and QatarEnergy.

- This latest contract highlights KBR’s continued role in advancing Iraq’s energy transition goals, including boosting oil and gas production capability and eliminating routine flaring through large-scale infrastructure improvements.

- We'll examine how KBR's expanded role in Iraq's energy infrastructure could influence its outlook for technology-driven growth and international diversification.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

KBR Investment Narrative Recap

To own KBR stock, one largely needs to believe in the company’s ability to capture demand from global energy transition and infrastructure investment, while weathering risks tied to large government contracts and geopolitical uncertainty. The recent win in Iraq further demonstrates KBR’s international reach and supports its backlog, but it does not appear to materially change the key short-term catalyst: a rebound in government contract awards and backlog conversion after recent delays. At the same time, ongoing geopolitical risks in the Middle East remain a factor worth monitoring.

A recent announcement especially relevant here is KBR’s revised earnings guidance for 2025, which reflects lower short-term revenue expectations due to delayed government contracts. Even as international growth continues with major project wins like AGUP2, predictable timing and execution of new awards, primarily from U.S. government sources, remain essential to unlocking higher near-term earnings and supporting longer-term outlooks.

However, investors should also be aware that, despite steady international growth, ongoing uncertainty in government contracting can still...

Read the full narrative on KBR (it's free!)

KBR's narrative projects $9.4 billion in revenue and $664.3 million in earnings by 2028. This requires 5.4% yearly revenue growth and a $264.3 million earnings increase from the current $400.0 million.

Uncover how KBR's forecasts yield a $59.57 fair value, a 41% upside to its current price.

Exploring Other Perspectives

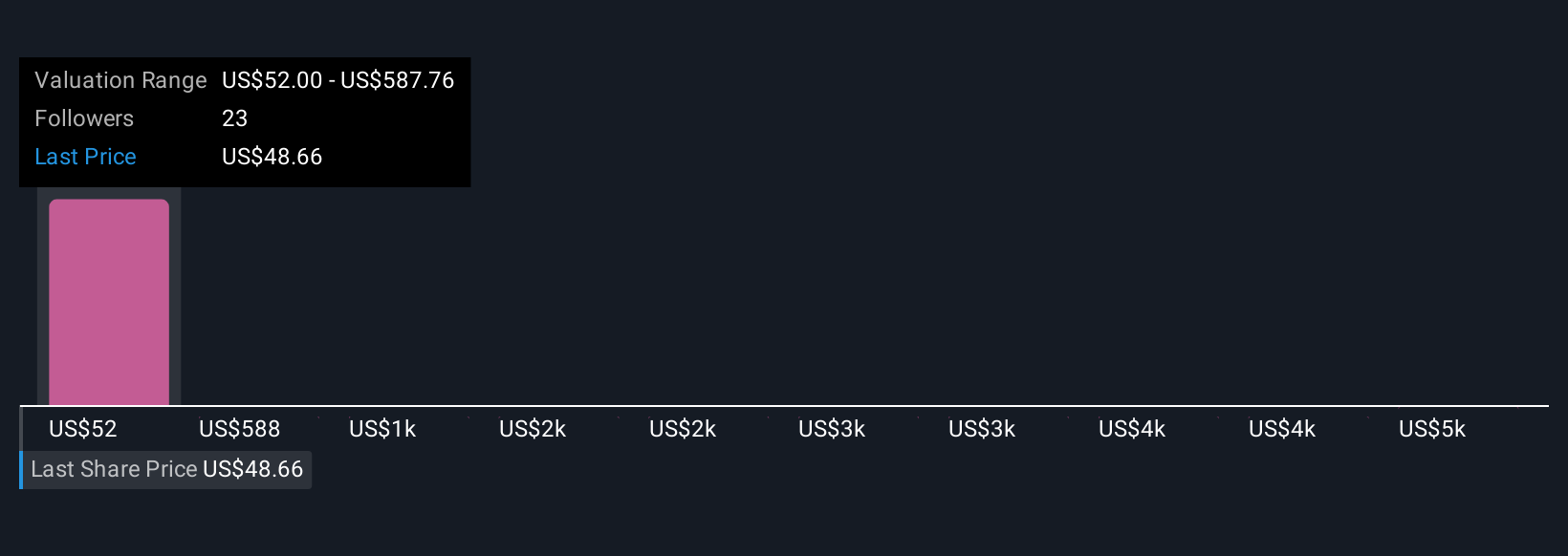

Simply Wall St Community members have published eight fair value estimates for KBR, ranging from US$40 to US$5,409.58 per share. Short-term revenue and backlog conversion delays still weigh on analyst outlooks, making it essential to compare several perspectives before forming your own view.

Explore 8 other fair value estimates on KBR - why the stock might be a potential multi-bagger!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives