Major Infrastructure Contracts Could Be a Game Changer for Jacobs Solutions (J)

Reviewed by Sasha Jovanovic

- In recent announcements, Jacobs Solutions secured several major projects, including being selected in a joint venture by the Queensland Department of Transport and Main Roads for the Logan and Gold Coast Faster Rail Project, and by El Paso Water to deliver a US$200 million utility infrastructure improvement program near El Paso International Airport and Fort Bliss.

- An important insight is Jacobs' expanding footprint in advanced infrastructure sectors, such as quantum computing facilities with PsiQuantum, underlining the company's broad capabilities in delivering complex technology-driven projects worldwide.

- We'll examine how Jacobs’ major contract wins in critical infrastructure, such as the Southeast Queensland rail project, impact its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Jacobs Solutions Investment Narrative Recap

To be a shareholder in Jacobs Solutions, you need to believe in the company’s ability to capture growth from global infrastructure modernization, digital transformation, and long-term project backlogs. While recent contract wins like the Logan and Gold Coast Faster Rail Project reinforce Jacobs’ position in critical infrastructure, the most important short-term catalyst remains continued public sector investment momentum. The single biggest risk is potential volatility in government spending, which could unsettle revenue streams; the latest news does not materially change this risk profile.

The Logan and Gold Coast Faster Rail Project in Queensland is one of Jacobs’ largest recent announcements and showcases its role as a trusted partner in major public infrastructure upgrades. This is particularly relevant as it ties directly to the company’s backlog-driven catalysts and underscores ongoing reliance on multi-year government-funded projects for revenue consistency.

However, investors should also be aware that, in contrast to the recent project wins, fiscal policy shifts and public funding decisions could...

Read the full narrative on Jacobs Solutions (it's free!)

Jacobs Solutions is forecast to achieve $14.4 billion in revenue and $971.8 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 6.7% and nearly doubles earnings, representing an increase of $486.8 million from current earnings of $485.0 million.

Uncover how Jacobs Solutions' forecasts yield a $159.69 fair value, a 20% upside to its current price.

Exploring Other Perspectives

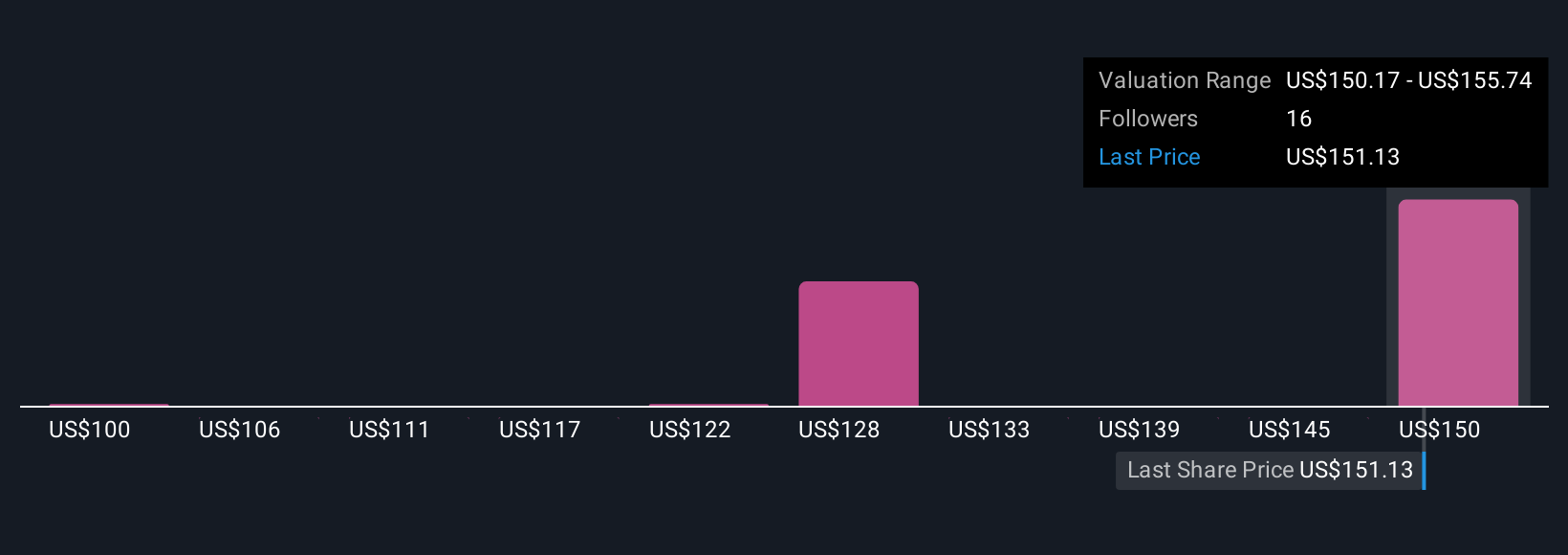

Five members of the Simply Wall St Community estimate Jacobs’ fair value between US$100 and US$232. Analysts continue to flag risks around government spending as central to the company’s performance, so explore several angles yourself.

Explore 5 other fair value estimates on Jacobs Solutions - why the stock might be worth as much as 75% more than the current price!

Build Your Own Jacobs Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jacobs Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jacobs Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jacobs Solutions' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026