The Bull Case For Genpact (G) Could Change Following Raised Full-Year Guidance and Strong Q3 Results

Reviewed by Sasha Jovanovic

- Genpact recently reported third quarter results for 2025, showing an increase in net revenues and earnings, and announced raised full-year earnings and revenue guidance, with updated expectations for segment growth and EPS.

- This shift in guidance highlighted acceleration in both Data-Tech-AI and Digital Operations segments, reflecting stronger demand for Genpact's advanced technology solutions versus earlier projections.

- We'll now assess how the upgraded full-year outlook, particularly the higher revenue guidance, impacts Genpact's overall investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Genpact Investment Narrative Recap

Owning Genpact stock means believing in the company’s ability to accelerate growth by shifting from legacy business process outsourcing toward advanced data, technology, and AI-driven solutions. The recent guidance upgrade may reinforce the near-term catalyst of stronger adoption in these segments, but it does not eliminate ongoing execution risk if clients remain cautious or delay spending, especially in more volatile end-markets.

Genpact’s raised full-year guidance, boosting expected revenue growth to up to 6.4% and Data-Tech-AI growth above 9%, closely ties to this catalyst by spotlighting outperformance in advanced solutions, but also raises the stakes for continued contract wins and seamless delivery.

By contrast, investors should be aware that if client adoption or deal conversions disappoint, this improved outlook could quickly be challenged by...

Read the full narrative on Genpact (it's free!)

Genpact's narrative projects $5.9 billion revenue and $669.6 million earnings by 2028. This requires 6.2% yearly revenue growth and a $131.3 million earnings increase from $538.3 million.

Uncover how Genpact's forecasts yield a $50.30 fair value, a 31% upside to its current price.

Exploring Other Perspectives

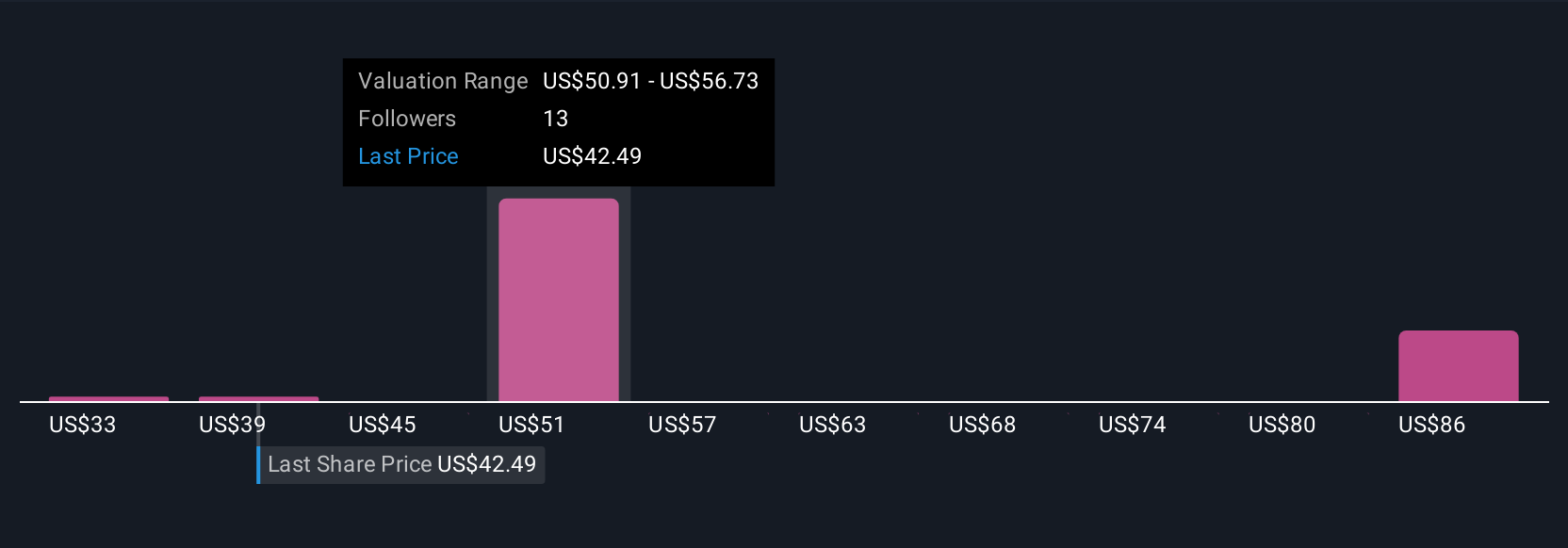

Retail investors in the Simply Wall St Community estimate Genpact’s fair value between US$33.47 and US$78.99, with three distinct perspectives. While this spread highlights differing growth expectations, the upgraded revenue guidance underscores how growth in advanced technology will remain critical for the company's progress going forward.

Explore 3 other fair value estimates on Genpact - why the stock might be worth 13% less than the current price!

Build Your Own Genpact Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genpact research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Genpact research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genpact's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives