- United States

- /

- Professional Services

- /

- NYSE:FVRR

Taking Stock of Fiverr International (FVRR) Valuation After Analysts Lift Earnings Estimates

Reviewed by Simply Wall St

Recent upward revisions to earnings estimates have pushed Fiverr International (FVRR) into the spotlight, as a stronger earnings outlook and favorable ranking are drawing fresh attention from investors watching the freelancing platform.

See our latest analysis for Fiverr International.

Those upgraded earnings expectations have helped the stock stabilize recently, with a 30 day share price return of 4.8% following a weak year to date share price return of negative 32.8%. This signals improving but still fragile momentum against a much tougher long term total shareholder return record.

If Fiverr’s rebound has you rethinking where growth could come from next, this is a good moment to explore other high growth tech and AI names through high growth tech and AI stocks.

But with earnings estimates rising and the stock still well below analysts’ targets, are investors looking at an undervalued turnaround story, or has the market already begun to price in Fiverr’s next leg of growth?

Most Popular Narrative: 41.5% Undervalued

With Fiverr International last closing at $21.54 against a narrative fair value near the mid 30s, the storyline leans toward a substantial upside case.

In 3 years, Fiverr is likely to consolidate its position as a leader in AI powered freelance services, benefiting from an expanding enterprise client base. By 5 years, the company is projected to achieve sustained revenue growth, underpinned by higher spend per buyer and broader adoption of value added services.

Want to see how this bold AI push translates into future profits and premium multiples? The narrative hides surprisingly aggressive revenue, margin and growth assumptions.

Result: Fair Value of $36.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected adoption of Fiverr’s AI tools or prolonged weakness in small business sentiment could easily derail this upbeat growth narrative.

Find out about the key risks to this Fiverr International narrative.

Another View: Multiples Tell a Tougher Story

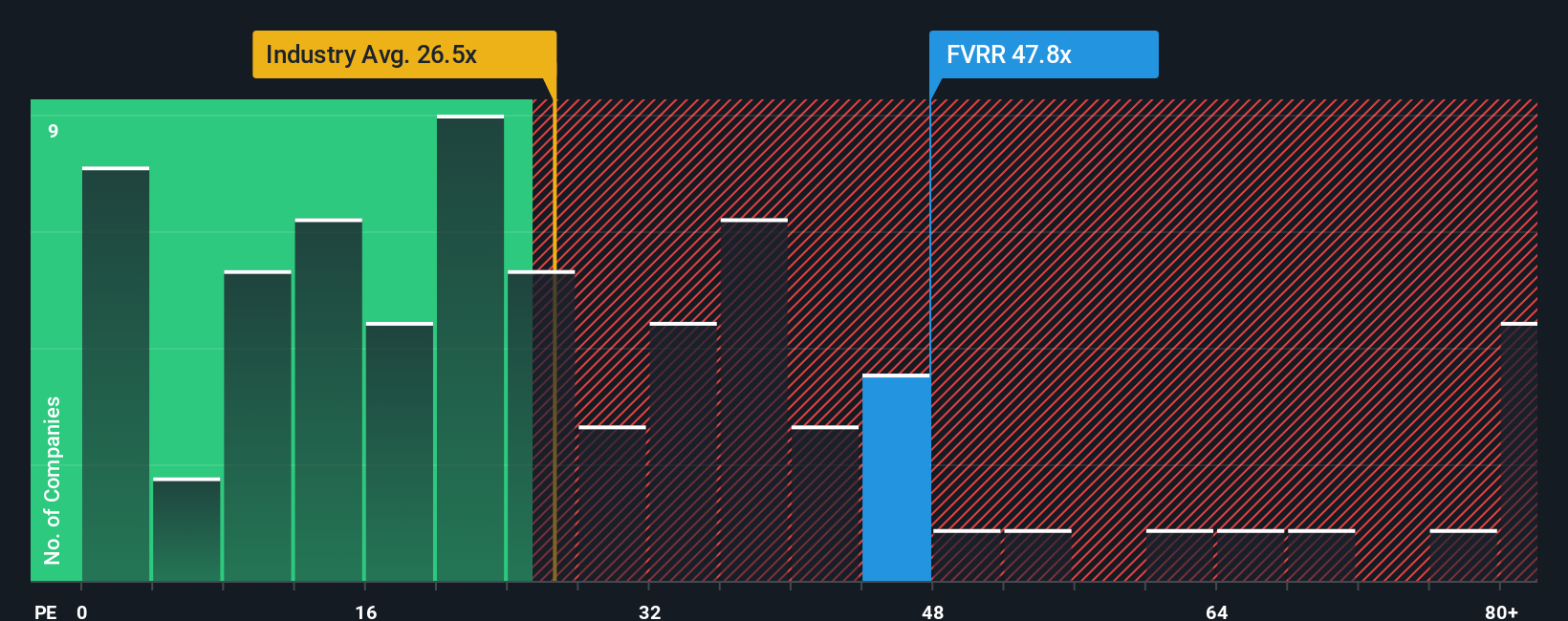

Zooming out from that 41.5% upside narrative, Fiverr’s current 35.6x price to earnings looks stretched. It sits above the Professional Services industry at 25x and even the 31.8x fair ratio. This suggests the market is already paying up and leaving less room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fiverr International Narrative

If this perspective does not match your own, or you prefer to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Fiverr International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning curated stock ideas that match your style, instead of waiting for the market to surprise you.

- Capitalize on market mispricing by targeting companies that look cheap on cash flow grounds through these 906 undervalued stocks based on cash flows.

- Ride powerful technological shifts by focusing on innovators supercharging their businesses with smart algorithms using these 26 AI penny stocks.

- Strengthen your income stream by prioritizing reliable payers with robust yields via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FVRR

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026