- United States

- /

- Professional Services

- /

- NYSE:EFX

Equifax (EFX): Evaluating Valuation as New AI-Driven AML Platform Targets Regulatory Efficiency for Financial Firms

Reviewed by Simply Wall St

Equifax (EFX) has rolled out a new set of AI-powered anti-money laundering compliance solutions tailored for financial institutions. The platform combines machine learning with comprehensive global list screening to help firms manage growing regulatory requirements more effectively and efficiently.

See our latest analysis for Equifax.

The launch of Equifax’s new AI-driven compliance platform comes at a time when its stock has seen some pressure, with a recent 1-year total shareholder return of -20.5%. Despite posting long-term growth and recently affirming its dividend, the market’s risk appetite for EFX seems to be cooling compared to past years.

If those moves have you curious about where momentum is building elsewhere, now is a great chance to discover fast growing stocks with high insider ownership

With Equifax shares trading at nearly a 26 percent discount to analysts’ price targets and recent fundamentals showing resilience, investors may be wondering whether this is a rare buying opportunity or if the market is already anticipating future growth.

Most Popular Narrative: 22.8% Undervalued

At $207 a share, Equifax trades well below the consensus fair value pegged at $268.30 by the most-followed narrative. This suggests a substantial disconnect between market pricing and future earnings expectations.

“Analysts are assuming Equifax's revenue will grow by 9.9% annually over the next 3 years. Analysts assume that profit margins will increase from 11.0% today to 16.8% in 3 years time.”

What’s the formula behind that high price target? It combines solid high single-digit sales growth with an ambitious forecast for profit margin improvement. Find out which financial levers are set to drive that valuation and see what analysts are anticipating for Equifax’s next chapter.

Result: Fair Value of $268.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent litigation costs and shifting industry dynamics could put pressure on Equifax’s margins and dampen its growth expectations going forward.

Find out about the key risks to this Equifax narrative.

Another View: Multiples Analysis Sends a Different Signal

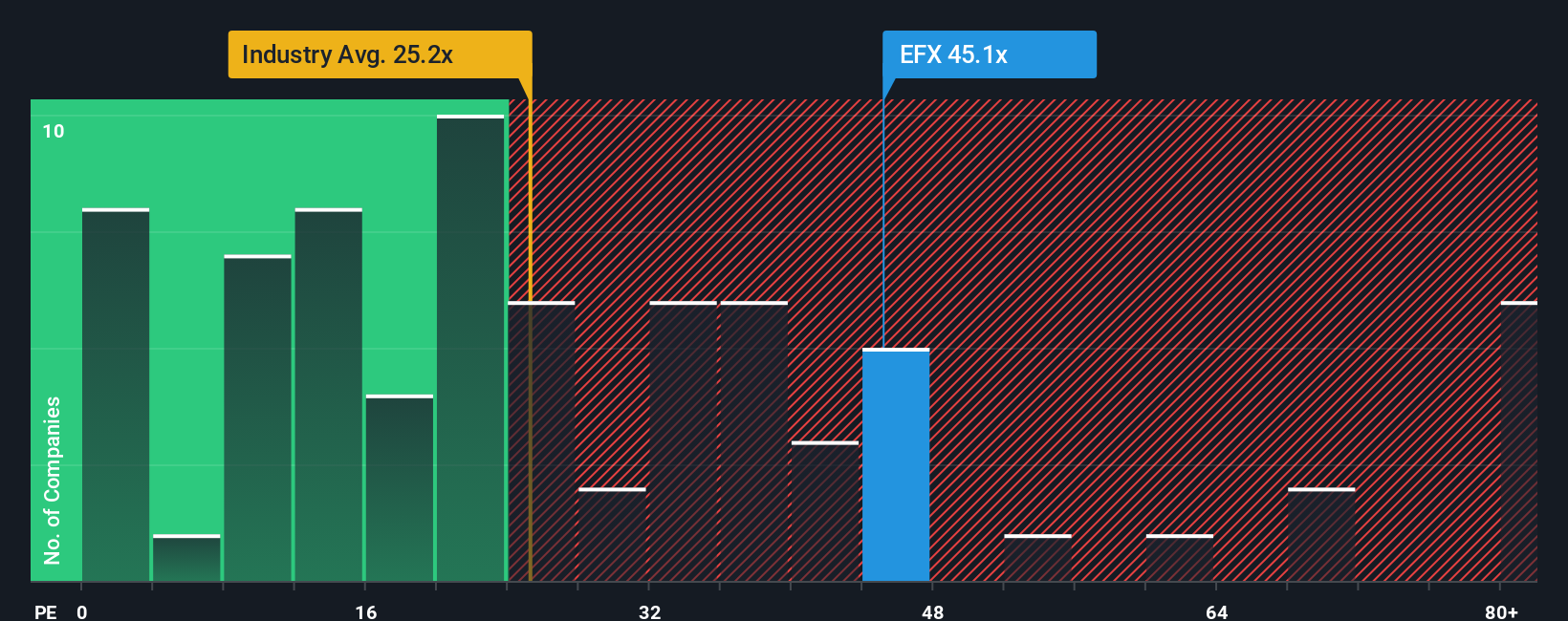

While fair value estimates suggest Equifax is underpriced, the company’s price-to-earnings ratio is notably higher than both its peers and the broader industry. Trading at 38.5x earnings compared to a peer average of 34.7x and an industry average of 24.4x raises questions about how much future growth is already reflected in the price. Can Equifax grow rapidly enough to close that valuation gap with fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you see things differently or want to test your own ideas, you can use the same data and shape your own story in just a few minutes. Do it your way

A great starting point for your Equifax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take bold steps toward your goals by checking out these hand-selected lists packed with potential. Don’t sit on the sidelines while opportunities slip by.

- Boost your search for stocks poised to surge by starting with these 870 undervalued stocks based on cash flows. This list generates value based on real cash flows and forward-looking market signals.

- Zero in on tomorrow’s breakthroughs by reviewing these 27 AI penny stocks, which targets innovation in artificial intelligence and machine learning.

- Capture reliable income streams when you select these 15 dividend stocks with yields > 3%. This list features attractive yields above 3% to help grow your portfolio steadily.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives