- United States

- /

- Professional Services

- /

- NYSE:CLVT

Clarivate (CLVT): Deep Value Narrative Tested by Prolonged Losses and Slow 0.2% Revenue Growth

Reviewed by Simply Wall St

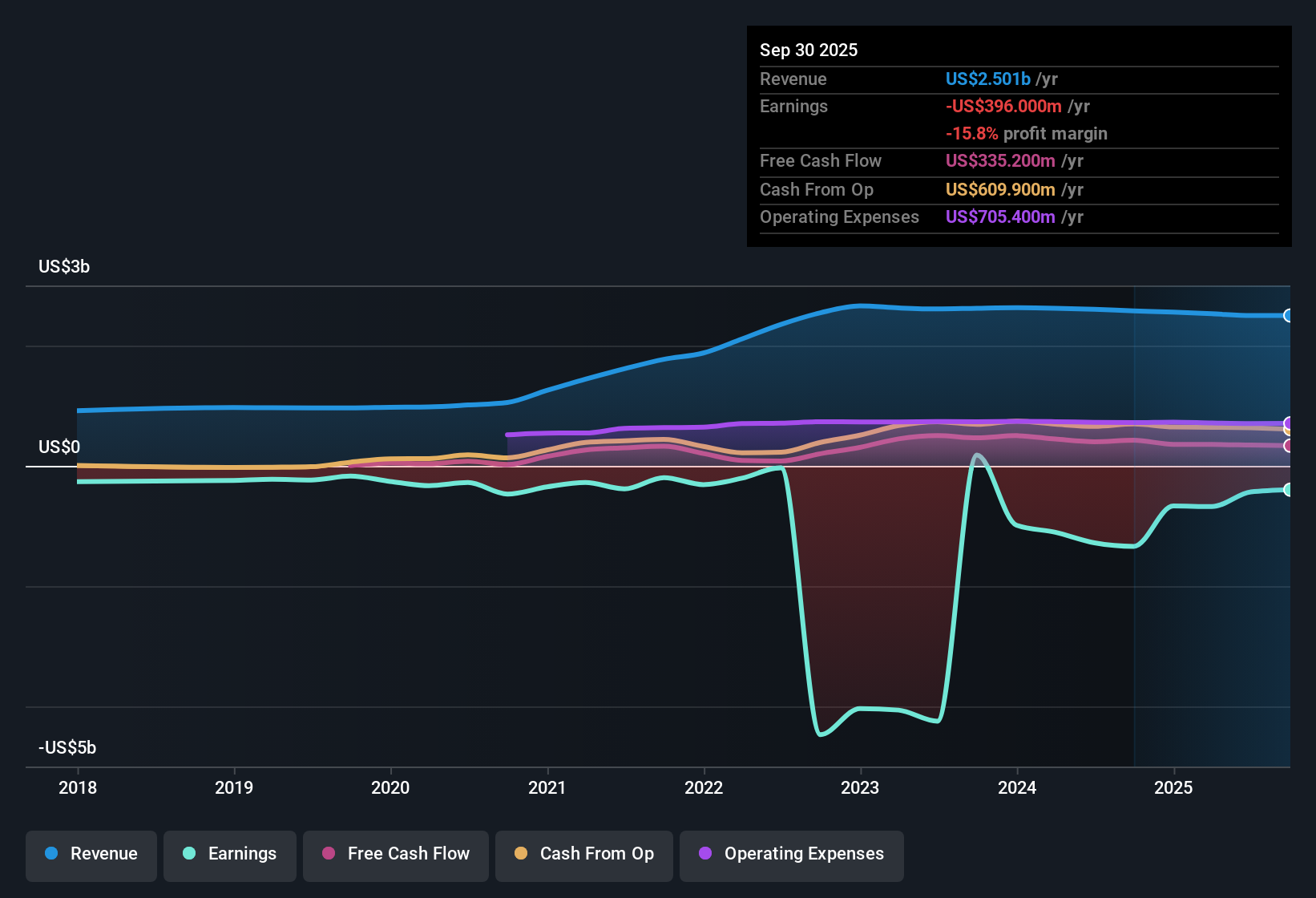

Clarivate (CLVT) remains unprofitable, with its losses increasing at a 6% annual rate over the last five years and no improvement in net profit margin over the past twelve months. Despite slow projected revenue growth of just 0.2% per year, earnings are forecast to surge by 71.65% annually. The current share price of $3.24 sits well below the estimated fair value of $6.33. Given this mix of historical challenges and strong growth expectations, investors are likely to focus on Clarivate's timeline to profitability and the potential for value as key drivers from the latest results.

See our full analysis for Clarivate.With the headline numbers clear, we are comparing them with the most widely held market narratives for Clarivate to see which stories the evidence supports and which ones might be reconsidered.

See what the community is saying about Clarivate

Margins Could Swing to Positive by 2028

- Analysts project profit margins will rise sharply from -17.3% now to 0.1% within three years, meaning Clarivate could make its first profit since listing.

- According to the analysts' consensus view, this path to break-even is underpinned by ongoing portfolio shifts, such as shedding noncore assets and focusing on recurring SaaS revenue:

- The transition toward a subscription-focused revenue mix and operational cost efficiencies could combine to support margin expansion and improve free cash flow.

- However, if these improvements take longer than expected or cost savings fail to materialize, the anticipated margin gains could be at risk.

- Results highlight that even with modest revenue growth, margin improvement is a major factor shaping Clarivate’s profitability outlook and valuation.

Price-to-Sales at 0.9x Signals Deep Discount

- Clarivate is trading at a price-to-sales ratio of just 0.9x, which is cheaper than both the US Professional Services average (1.3x) and the peer average (3.3x).

- Analysts' consensus narrative argues this sizeable discount is partly due to its slower revenue growth of 0.2%, yet creates significant upside if the company delivers on margin improvements:

- Achieving a positive profit margin could prompt the market to re-rate Clarivate closer to sector norms, closing today’s gap between its share price of $3.24 and the DCF fair value of $6.33.

- Rising sector-wide R&D investment and a strong push toward higher margin, subscription revenue streams provide catalysts for valuation catch-up.

- This deep value story rests on Clarivate proving it can convert discounted revenue into real profit, a result that remains to be seen.

- If Clarivate matches analysts’ improved margin expectations, the next few years could see its valuation rapidly converge with industry peers.

Eye-Catching Forward PE: 1167.9x on Estimated 2028 Earnings

- To align with analysts’ 2028 outlook, investors would need to accept a forward price/earnings ratio of 1167.9x, which is far above the US industry standard of 26.1x.

- Analysts' consensus narrative highlights how this expensive multiple is only justifiable if Clarivate delivers breakneck earnings growth after years of losses:

- The unusually high multiple reflects how even slight improvements in profit, after such a long unprofitable stretch, could have an outsized impact on valuation models.

- Yet the magnitude of this PE ratio also underlines the risk that if projected profits stall or miss expectations, the share price may continue reflecting a cautionary discount.

If you're weighing the balance of margin guidance, deep value signals, and sky-high earnings multiples, see how the market’s overall view stacks up in the full consensus narrative: 📊 Read the full Clarivate Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Clarivate on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your perspective and shape a fresh narrative for Clarivate in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Clarivate.

See What Else Is Out There

Clarivate’s slow revenue growth, volatile profitability, and discounted valuation highlight its struggle to deliver consistent performance compared to industry peers.

If you want companies that deliver steadier results regardless of market swings, use stable growth stocks screener (2112 results) to focus on businesses with reliably stable growth profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLVT

Clarivate

Operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives