- United States

- /

- Professional Services

- /

- NYSE:CBZ

CBIZ (CBZ): Examining Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for CBIZ.

CBIZ’s share price has been notably volatile, with a 1.28% bump in the past day but still down 19.41% over the last three months, reflecting shifting investor sentiment. While short-term share price momentum has faded, longer-term performance stands out as the company boasts a 105.61% total shareholder return over five years.

If recent moves in CBIZ have you thinking bigger, now’s a great moment to discover fast growing stocks with high insider ownership.

With shares now well below highs, yet strong long-term gains and robust earnings growth on the books, the question looms: Does CBIZ offer an undervalued entry point, or are markets already pricing in all future potential?

Most Popular Narrative: 42.7% Undervalued

With the most closely watched narrative estimating CBIZ’s fair value at $91.50, the gap to the last close of $52.41 is striking. The story behind this premium outlook hinges on major business transformations and bold assumptions.

The Marcum acquisition has significantly expanded CBIZ's client base, increased scale, and strengthened capabilities in core tax, accounting, and advisory services. This enables the firm to leverage cross-selling, deepen client relationships, and improve its competitive position in target middle-market segments. These factors are expected to fuel higher future revenue growth and structural margin expansion as integration synergies are realized.

Wondering what’s fueling such a sky-high target? One key assumption stands out: this valuation is driven by projected step-changes in growth and profitability. Intrigued about the ambitious numbers and financial levers behind that bold calculation? Dive in to discover which forecasts justify this market-beating fair value.

Result: Fair Value of $91.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures and CBIZ's heavy reliance on acquisitions could pose real challenges to sustaining the optimistic growth story in the future.

Find out about the key risks to this CBIZ narrative.

Another View: What Do Market Ratios Tell Us?

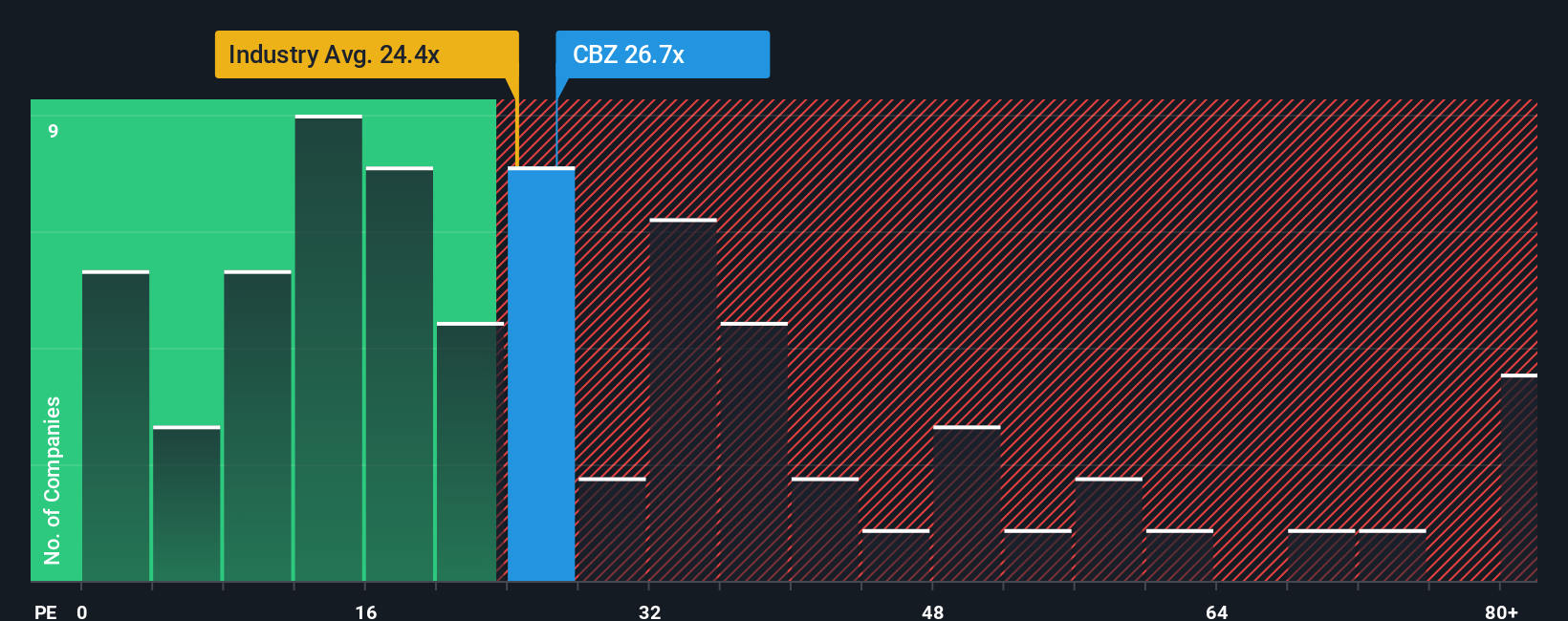

Looking through the lens of price-to-earnings, CBIZ trades at 26.9 times earnings. This puts it above the US Professional Services industry average of 24.5x, but well below its peer average of 61.6x. Notably, it is still discounted compared to a fair ratio of 32.1x, which could suggest a possible valuation gap or, just as likely, market caution about future risks. Will investors be rewarded if the market shifts closer to that fair ratio, or is caution still warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBIZ Narrative

If these perspectives don't quite match your own, why not dig into the numbers yourself and see if you uncover a different outlook? After all, crafting your own assessment can take just a few minutes, so trust your research instincts and Do it your way.

A great starting point for your CBIZ research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always looking ahead, so why limit yourself to just one opportunity? Use these powerful screeners to unlock your next bold move.

- Maximize potential returns by targeting undervalued companies with cash flow strength in these 856 undervalued stocks based on cash flows that the market may have overlooked.

- Amplify your portfolio with these 25 AI penny stocks, which are pushing the boundaries in artificial intelligence and redefining tomorrow’s technology landscape.

- Tap into future-ready income by focusing on these 15 dividend stocks with yields > 3%, offering reliable yields above 3 percent and proven financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBZ

CBIZ

Provides financial, insurance, and advisory services in the United States and Canada.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives