- United States

- /

- Professional Services

- /

- NYSE:CACI

A Fresh Look at CACI International (CACI) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

CACI International (CACI) stock has been on the move recently, with shares climbing over 9% in the past month and nearly 28% across the past three months. Investors are taking a closer look at the company's strong performance and what might be driving these gains.

See our latest analysis for CACI International.

Momentum around CACI International has been accelerating, with the stock’s 1-day share price return of 0.28% adding to an already impressive uptrend. This latest spike complements a year-to-date share price return of more than 50% and a 1-year total shareholder return of 34%. These developments indicate that investors are showing increased optimism regarding the company’s ongoing growth prospects and recent performance shifts.

If you’re watching these strong gains and want to see what else is out there, now’s the perfect time to discover fast growing stocks with high insider ownership.

With CACI International’s share price repeatedly hitting new highs this year, some investors may wonder if the company’s strong fundamentals have been fully accounted for, or if there is still an overlooked buying opportunity in play.

Most Popular Narrative: 6% Undervalued

With CACI International’s fair value in the most popular narrative coming in higher than its last close, there is a notable gap that points to potential upside. The fair value estimate rests at $658.91, compared to the recent $617.10 closing price, catching the attention of investors curious about the drivers behind this narrative’s valuation.

Accelerated adoption of advanced technologies, such as software-defined platforms, cyber solutions, and enterprise software modernization, is driving a shift in federal procurement toward higher-value, tech-enabled contracts where CACI's existing leadership, strong track record, and investments ahead of customer need enable higher win rates, contract stickiness, and margin expansion.

Want to know what is fueling these elevated expectations? There is a compelling financial projection and a reimagined industry approach at the core of this narrative. Think revenue acceleration, profit margin expansion, and a future outlook shaped as much by innovation as by contracts. Find out what sets these assumptions apart. Are you ready to see why this narrative targets a value well above today’s market price?

Result: Fair Value of $658.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty tied to U.S. government budget decisions and intensifying competition could still disrupt CACI International's growth momentum and long-term outlook.

Find out about the key risks to this CACI International narrative.

Another View: Is CACI Actually Expensive Compared to Its Peers?

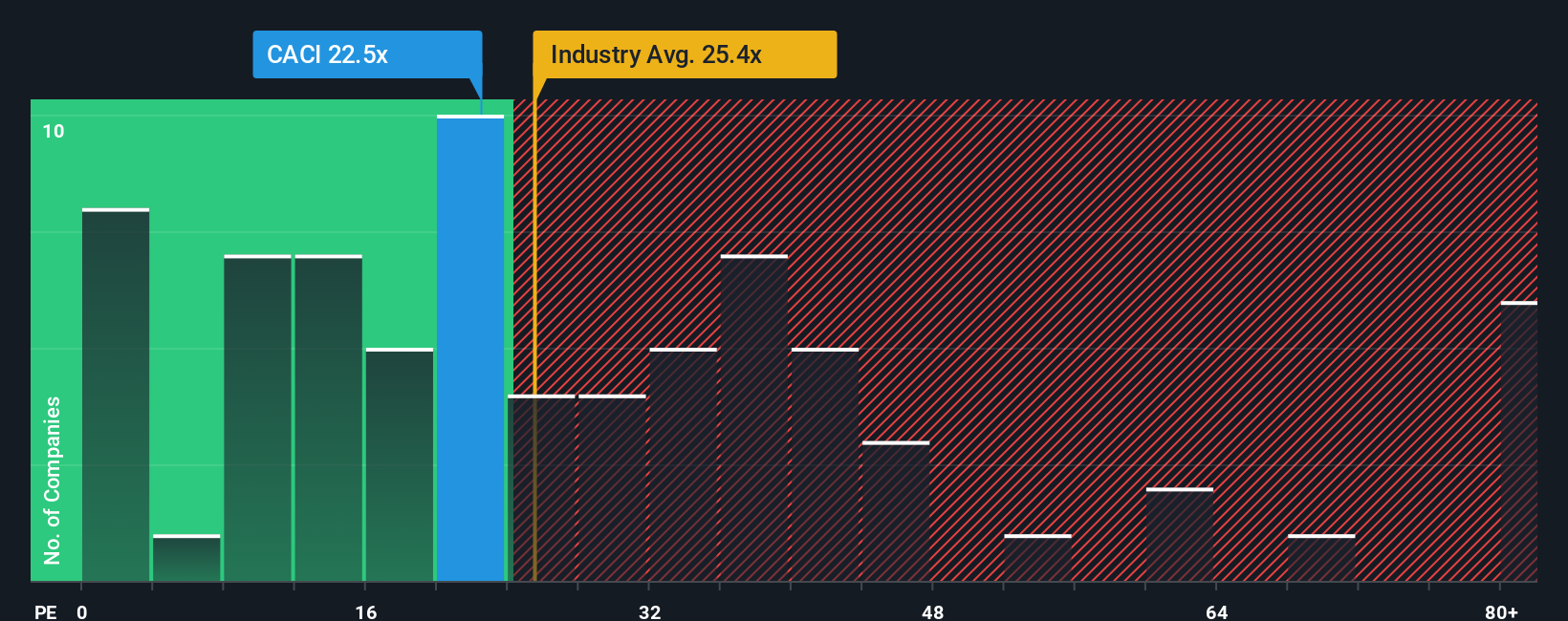

Looking at CACI International using the standard price-to-earnings ratio, the stock appears a bit pricey. Its ratio is currently 27 times earnings, higher than both the US Professional Services industry average of 24.3x and the fair ratio of 26.4x. This gap could signal limited upside unless earnings outpace expectations. Does this raise caution for those chasing further gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CACI International Narrative

If you’d like a fresh perspective or want to dig into the details on your own terms, you can craft a personalized story in just minutes. Do it your way.

A great starting point for your CACI International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Hot Investment Ideas?

Don’t just follow the crowd. Be among the first to uncover smart opportunities across new themes and trends, specially matched for ambitious investors like you.

- Unlock higher returns by targeting these 916 undervalued stocks based on cash flows positioned for a rebound based on real cash flow fundamentals and attractive entry points.

- Boost your long-term income potential when you tap into these 15 dividend stocks with yields > 3% delivering reliable yields greater than 3% for steady portfolio growth.

- Ride the wave of disruption. Get ahead with these 25 AI penny stocks at the forefront of machine learning, automation, and game-changing business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CACI

CACI International

Through its subsidiaries, provides expertise and technology solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026