- United States

- /

- Professional Services

- /

- NYSE:ALIT

Alight (ALIT) Is Down 14.4% After $1.07 Billion Loss and Major Goodwill Impairment—What’s Changed

Reviewed by Sasha Jovanovic

- Alight, Inc. recently reported third quarter results showing sales of US$533 million and a net loss of US$1.07 billion, with a US$1.34 billion goodwill impairment and new earnings guidance for 2025 issued.

- The company also completed share buybacks totaling over 42.6 million shares since 2022, representing 8.04% of outstanding shares, amid ongoing governance changes and technology partnerships with IBM and MetLife.

- We'll examine how Alight's significant goodwill impairment and elevated losses impact the company's investment outlook and analyst expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Alight Investment Narrative Recap

Owning Alight requires faith in its ability to rebound from increasing losses and monetize its technology partnerships amid tough revenue and margin headwinds. The recent US$1.34 billion goodwill impairment compounds already elevated risks by amplifying questions around earnings visibility and the pace of margin improvement, even as cost and AI initiatives remain a critical short-term catalyst. Despite this, the confirmed 2025 guidance suggests the revenue outlook is intact, impact appears concentrated on near-term sentiment and perception, rather than fundamentally altering immediate catalysts or risks.

Among recent announcements, Alight’s expanded collaboration with IBM to deploy AI for benefits administration stands out, directly supporting the company’s ambitions to improve client experience and drive operational efficiency. This technology push is aligned with core growth catalysts and, if executed well, may help offset some financial volatility and address persistent execution challenges highlighted by analysts.

In contrast, persistent delays in new client signings due to complex sales cycles remain a risk investors should not overlook...

Read the full narrative on Alight (it's free!)

Alight's narrative projects $2.5 billion revenue and $142.2 million earnings by 2028. This requires 3.0% yearly revenue growth and a $1.24 billion increase in earnings from current earnings of -$1.1 billion.

Uncover how Alight's forecasts yield a $6.86 fair value, a 197% upside to its current price.

Exploring Other Perspectives

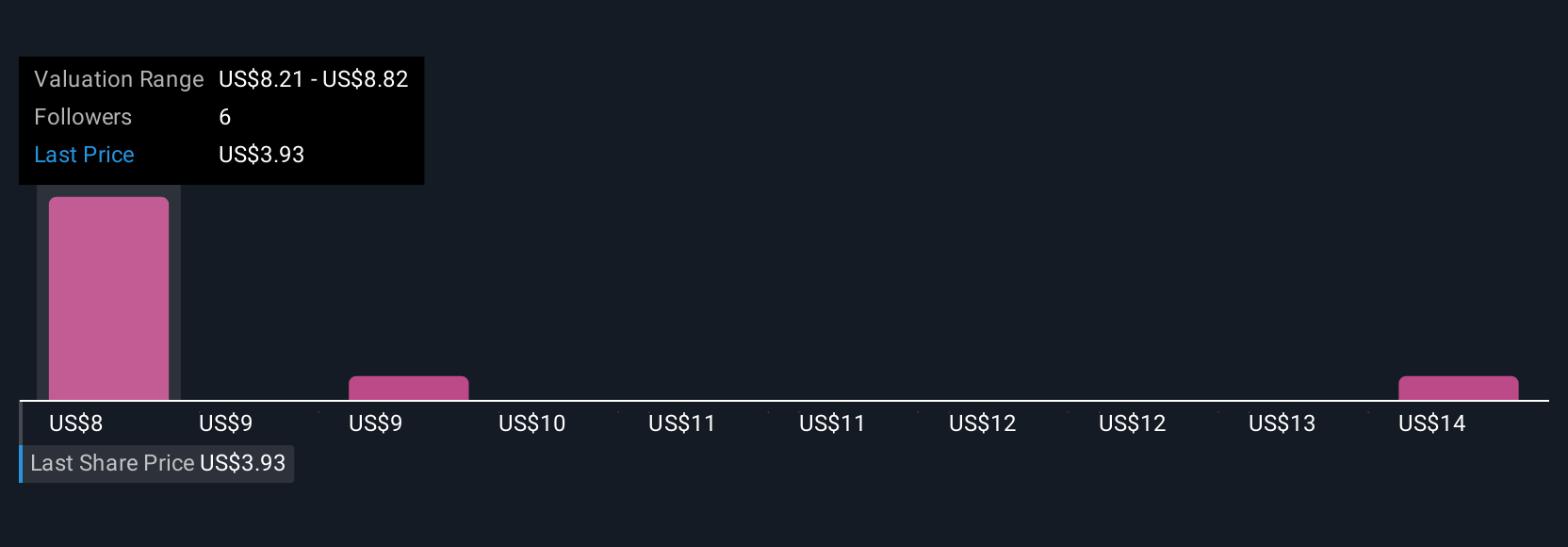

Four estimates from the Simply Wall St Community suggest fair value for Alight shares anywhere from US$6.86 to US$10.15. Against this spread in market opinion, the ongoing challenge of slow new client signings adds another layer for you to consider when evaluating Alight’s prospects.

Explore 4 other fair value estimates on Alight - why the stock might be worth over 4x more than the current price!

Build Your Own Alight Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alight research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alight's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALIT

Good value with adequate balance sheet.

Market Insights

Community Narratives