- United States

- /

- Commercial Services

- /

- NYSE:ABM

Could a Boardroom Shift at ABM Industries (ABM) Reveal New Priorities for Long-Term Strategy?

Reviewed by Sasha Jovanovic

- ABM Industries recently appointed Barry Hytinen, a seasoned finance executive and current CFO of Iron Mountain Incorporated, to its Board of Directors, and the company’s Chief Information Officer, Melanie Kirkwood Ruiz, spoke at the 18th Annual New York Global Innovation Summit held at The Yale Club in New York City.

- Hytinen’s extensive background in corporate finance and strategic transformation across multiple industries is expected to strengthen ABM’s leadership team as it pursues further growth and operational efficiency.

- We’ll examine how the addition of Barry Hytinen to the board could influence ABM’s long-term strategy and investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

ABM Industries Investment Narrative Recap

Investing in ABM Industries centers on the belief that demand for integrated facility services will persist through cycles, underpinned by stable, recurring contracts, technological advancements, and an experienced leadership team. While Barry Hytinen’s addition to the board enhances ABM’s financial expertise, it does not materially shift the most immediate catalyst, the company’s margin improvement initiatives, or reduce the company’s exposure to margin pressures in challenged commercial office markets, which remains the biggest risk to the business in the short term.

The company’s recent Q3 earnings announcement stands out, showing year-over-year sales and net income growth, signaling operational momentum even as segments face ongoing margin headwinds. This performance provides some reassurance for shareholders keeping a close eye on the effectiveness of restructuring and cost takeout measures, especially as ABM seeks to strengthen its profitability against a backdrop of pricing concessions.

On the flip side, investors should also be mindful of persistent margin pressures that continue to challenge the stability of future earnings and...

Read the full narrative on ABM Industries (it's free!)

ABM Industries' narrative projects $9.5 billion revenue and $370.4 million earnings by 2028. This requires 3.2% yearly revenue growth and a $254.5 million earnings increase from $115.9 million today.

Uncover how ABM Industries' forecasts yield a $58.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

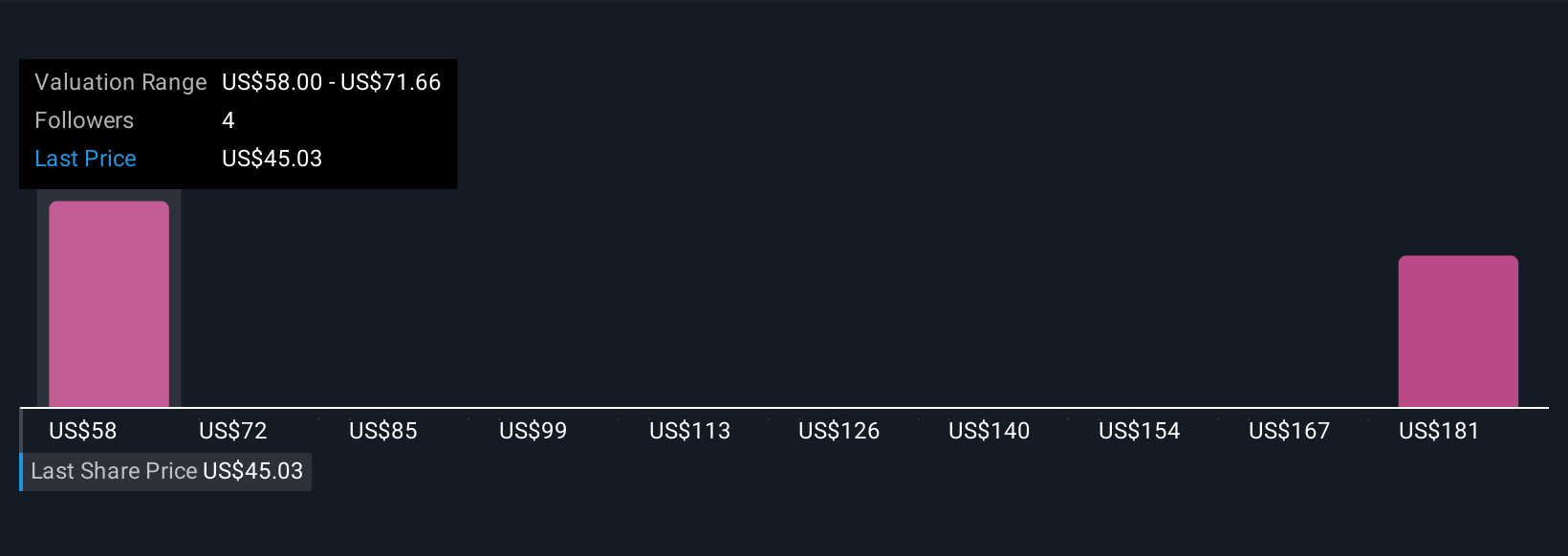

Two members of the Simply Wall St Community have published fair value estimates for ABM Industries ranging widely from US$58 to US$194.98 per share. These contrasting outlooks reflect varying beliefs about how quickly margin improvement initiatives might offset ongoing headwinds, underscoring the importance of considering different perspectives when evaluating ABM’s long-term potential.

Explore 2 other fair value estimates on ABM Industries - why the stock might be worth over 4x more than the current price!

Build Your Own ABM Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABM Industries research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ABM Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABM Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives