- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

How Earnix Integration Has Shifted the Investment Narrative at Verisk Analytics (VRSK)

Reviewed by Sasha Jovanovic

- On November 12, 2025, Earnix announced a new integration with Verisk Analytics, bringing together Earnix's Price-It platform and Verisk's ISO Electronic Rating Content to streamline insurance pricing and compliance processes.

- This development is intended to help insurance carriers quickly adopt regulatory changes, reduce manual workloads, and automate impact analyses, potentially making Verisk Analytics a more valuable data partner in the insurance industry.

- We'll explore how this new automation capability may strengthen Verisk's positioning within insurance data analytics and influence its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Verisk Analytics Investment Narrative Recap

Investors in Verisk Analytics generally need to believe in the persistent demand for advanced data analytics as insurance carriers seek to modernize, automate compliance, and manage regulatory complexity. While the Earnix integration strengthens Verisk’s value proposition and could support client retention, it is unlikely to have a material short-term impact on the company’s most pressing risk: cautious insurance industry spending amid economic uncertainty and shifting regulations.

Among recent announcements, Verisk’s Q3 earnings report stands out, with sales and net income both rising year-over-year even as full-year revenue guidance was lowered. This outlook tilt, combined with automation-focused partnerships like Earnix, sheds light on how Verisk is balancing growth initiatives against industry headwinds such as spending restraint and regulatory volatility. But in contrast to product innovation, the real question for shareholders centers on ...

Read the full narrative on Verisk Analytics (it's free!)

Verisk Analytics' narrative projects $3.9 billion revenue and $1.2 billion earnings by 2028. This requires 9.1% yearly revenue growth and a $290.7 million earnings increase from $909.3 million.

Uncover how Verisk Analytics' forecasts yield a $251.29 fair value, a 16% upside to its current price.

Exploring Other Perspectives

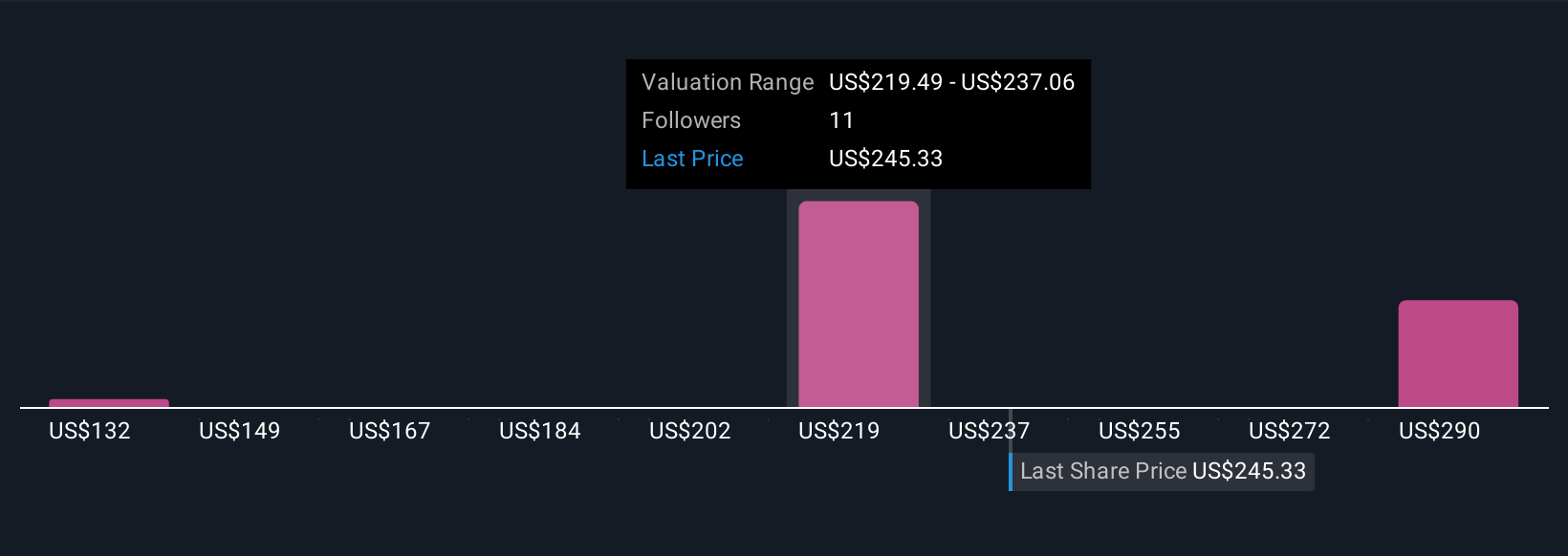

The Simply Wall St Community provided four fair value estimates ranging from US$131.67 to US$277.85 per share. While automation partnerships may drive efficiency, shifting insurance market budgets could weigh on performance, so consider how widely investor opinions differ on Verisk’s value.

Explore 4 other fair value estimates on Verisk Analytics - why the stock might be worth 39% less than the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verisk Analytics' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives