- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

How NYC’s US$963 Million Enforcement Expansion Will Impact Verra Mobility (VRRM) Investors

Reviewed by Sasha Jovanovic

- Verra Mobility recently secured a five-year, approximately US$963 million contract with New York City to expand automated traffic enforcement across 600 intersections and add 300 new bus-lane cameras, materially increasing its recurring service revenue base.

- This contract further entrenches Verra Mobility’s dominant share in U.S. government traffic enforcement, underscoring how legislative and infrastructure commitments can convert into long-duration, service-based cash flows.

- We’ll now explore how this major New York City contract expansion could reshape Verra Mobility’s investment narrative and outlook for recurring Government Solutions revenue.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Verra Mobility Investment Narrative Recap

To own Verra Mobility, you need to believe that automated enforcement and smart mobility will keep converting into sticky, recurring contracts with governments and fleets. The new five-year, roughly US$963 million New York City award directly addresses the prior contract-renewal overhang and strengthens the near term catalyst in Government Solutions, while amplifying the existing concentration risk around this single customer.

The most relevant recent announcement alongside the NYC deal is Verra Mobility’s 2025 revenue guidance of US$925 million to US$935 million, which anchors expectations as this contract ramps. Together with new programs in places like Colorado, Nevada, and San Francisco, the expanded New York City footprint could deepen the company’s recurring service mix and reinforce the importance of legislative momentum for future growth.

Yet investors should also weigh how heavily results now hinge on one municipality and what happens if...

Read the full narrative on Verra Mobility (it's free!)

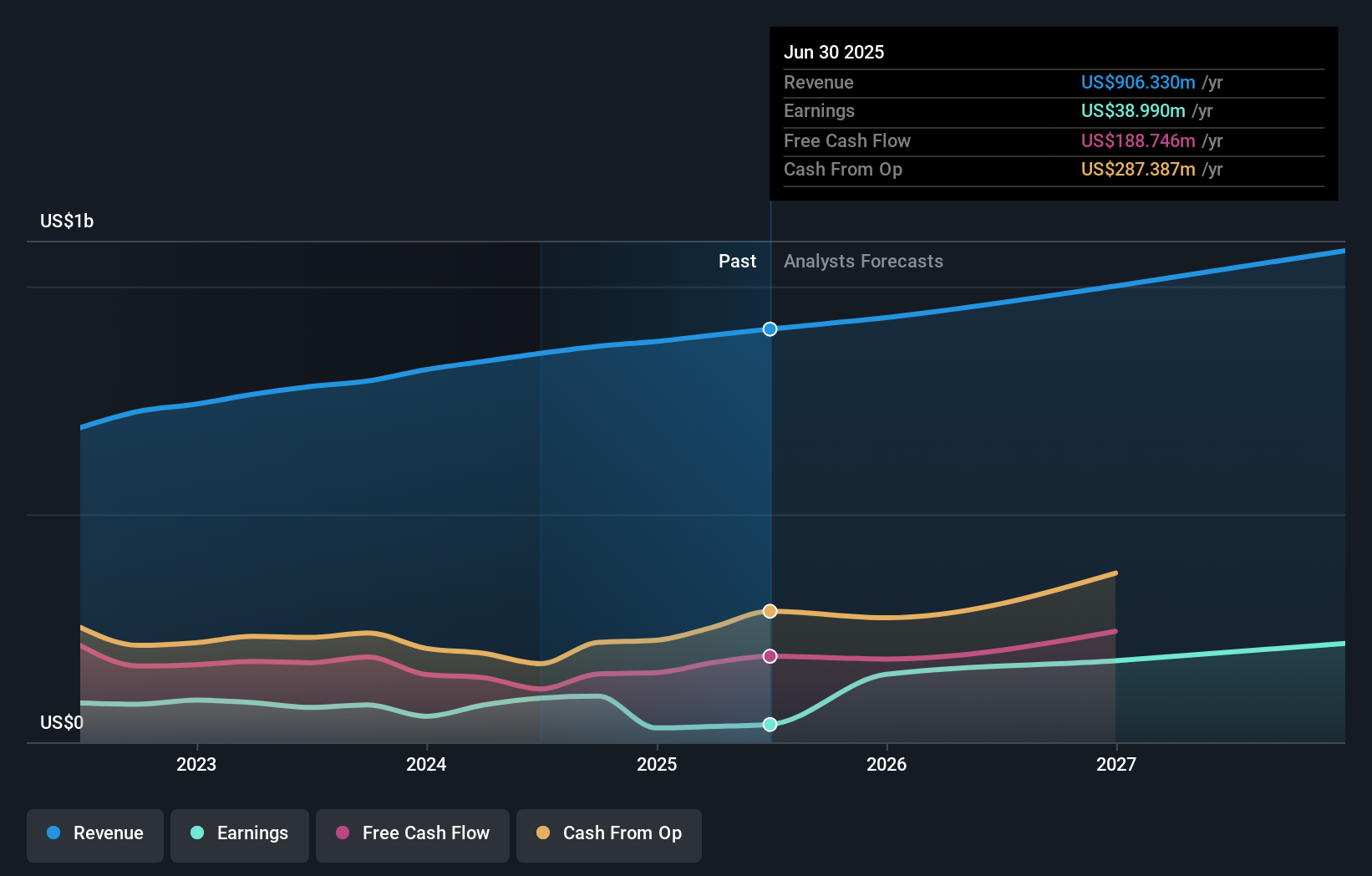

Verra Mobility's narrative projects $1.1 billion revenue and $289.5 million earnings by 2028. This requires 7.0% yearly revenue growth and about a $250 million earnings increase from $39.0 million today.

Uncover how Verra Mobility's forecasts yield a $29.83 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently converge on a single fair value estimate of about US$29.83 per share, showing one concentrated viewpoint. You may want to compare that with the growing dependence on New York City for Government Solutions revenue and consider how contract terms, renewals, or political shifts could influence your own expectations for Verra Mobility’s performance.

Explore another fair value estimate on Verra Mobility - why the stock might be worth just $29.83!

Build Your Own Verra Mobility Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Verra Mobility research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verra Mobility's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026