- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Is Upwork Fairly Priced After Shares Jumped 23% and New Enterprise Partnerships?

Reviewed by Bailey Pemberton

- If you’ve ever wondered whether Upwork is fairly priced, undervalued, or too expensive to buy right now, you’re not alone. It’s the question every savvy investor should ask before hitting “buy.”

- Upwork shares have gained 23.0% over the past year and are up 7.9% year-to-date, so there’s definitely momentum and changing sentiment to consider.

- After a wave of headlines spotlighting Upwork’s expanding partnerships with enterprise clients and increased interest in flexible remote work, the market’s attention seems firmly on its growth story. These developments have played a role in the recent price movements and renewed curiosity about how the business is valued.

- Right now, Upwork scores 5 out of 6 on our valuation checks, suggesting it passes most of our undervaluation filters. But let’s dig deeper into just how its value stacks up using different methods. Even better, we’ll share a fresh perspective for understanding what it’s really worth at the end of the article.

Approach 1: Upwork Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and then discounting them back to today's dollars. This approach aims to express what Upwork's future earnings might be worth in present terms, using analyst and extrapolated forecasts.

According to the DCF model, Upwork generated free cash flow of $204.7 million over the last twelve months. With projections suggesting steady annual increases, analysts estimate free cash flow will hit $212.9 million by the end of 2026. Beyond the next few years, further growth is extrapolated, with Simply Wall St calculations anticipating around $278.6 million annual free cash flow by 2035.

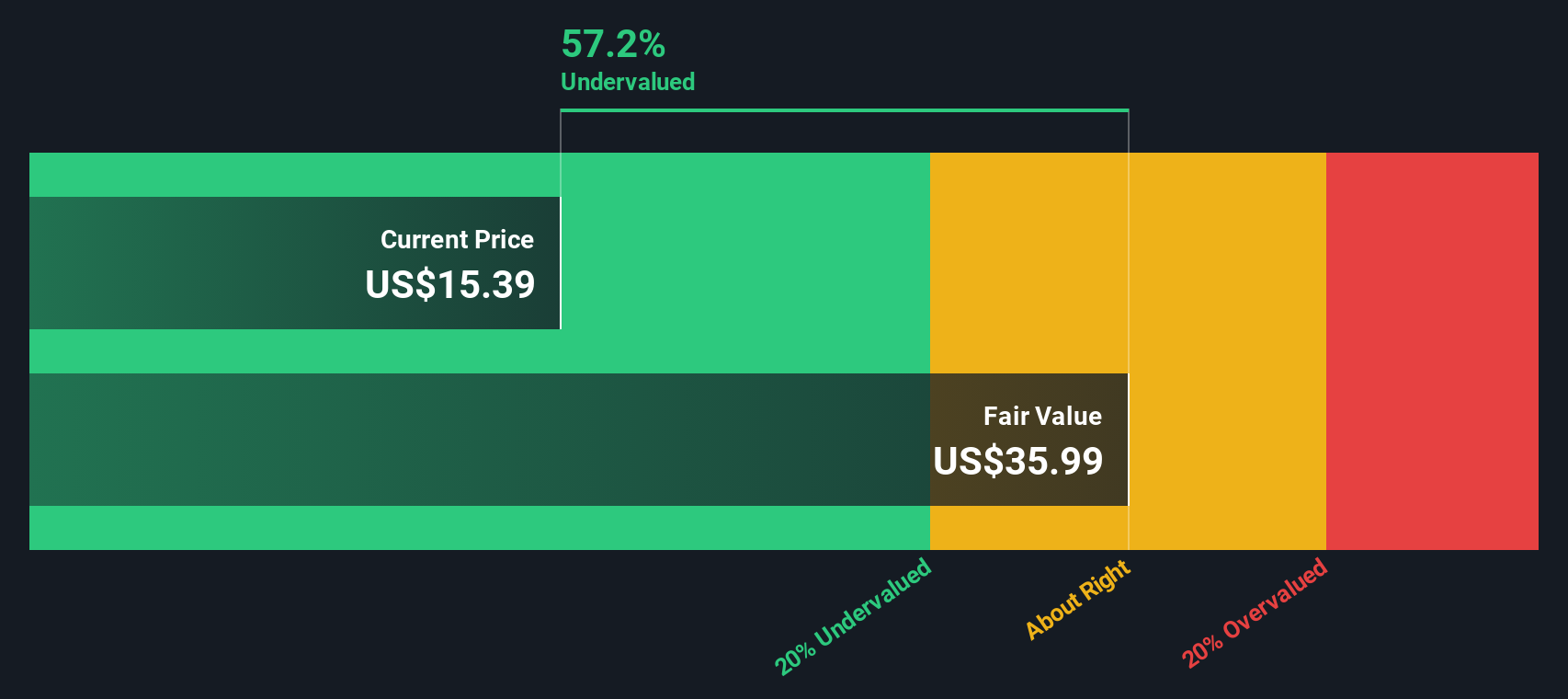

When all future cash flows are discounted to present value, the resulting estimated intrinsic value for Upwork is $38.08 per share. The model indicates that the stock is trading at a 53.5% discount to this intrinsic value. DCF analysis suggests Upwork is considerably undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Upwork is undervalued by 53.5%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Upwork Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies because it relates a company’s share price to its per-share earnings. For businesses like Upwork that are generating profits, the PE ratio offers a straightforward view of how much investors are willing to pay for each dollar of earnings.

Growth expectations and perceived risk are important here. Higher growth rates or greater reliability warrant higher PE ratios, while slower growth or higher risk tend to lower what’s considered “normal.” So, a fair PE depends on how fast the company’s earnings are expected to grow and how stable those earnings are compared to peers.

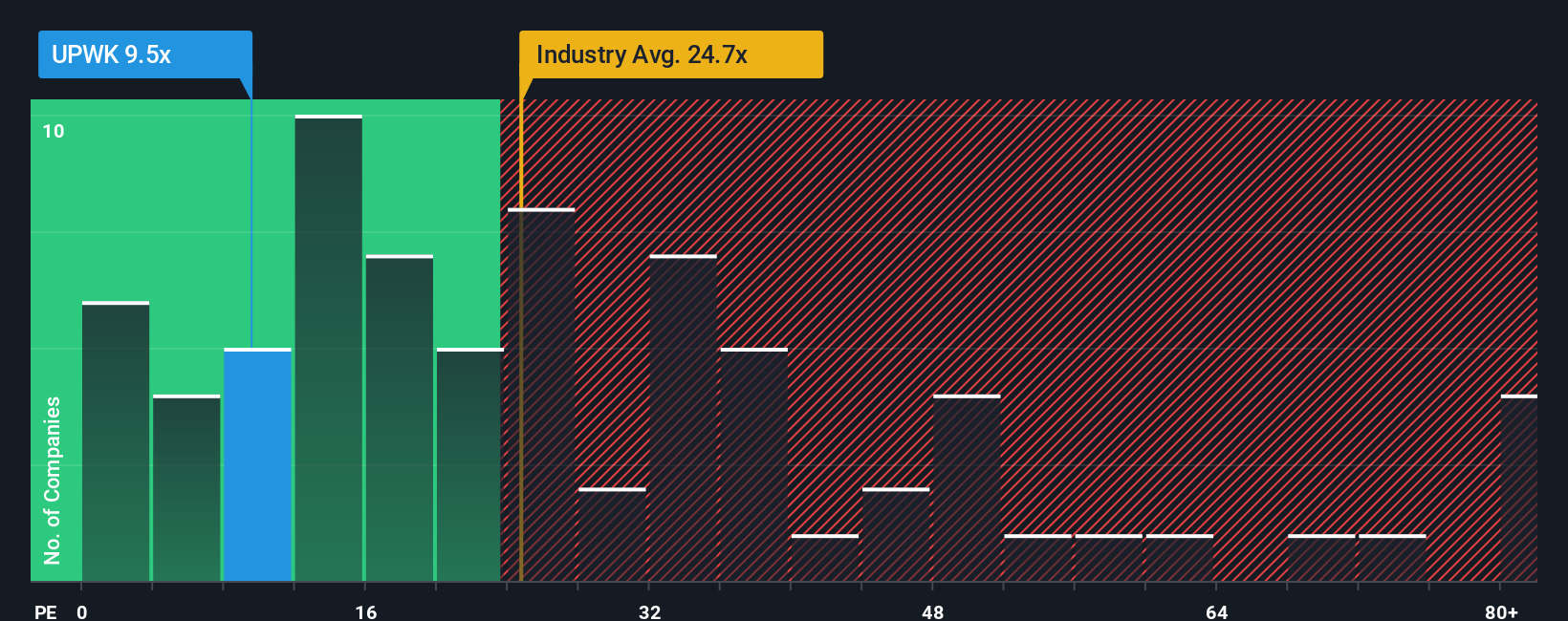

Upwork’s current PE ratio stands at 9.5x, which is much lower than both the Professional Services industry average of 25.0x and the average among peers at 33.3x. At first glance, this could suggest the stock is trading at a discount. However, Simply Wall St’s proprietary “Fair Ratio” for Upwork is 15.9x. The Fair Ratio goes a step further than standard peer or industry comparisons by factoring in elements such as Upwork’s market cap, earnings growth prospects, risk profile, profit margin, and sector trends. This produces a more precise view of where Upwork ought to sit on the valuation curve.

Because Upwork’s actual PE ratio of 9.5x is well below its Fair Ratio of 15.9x, this method suggests the stock may be undervalued right now.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Upwork Narrative

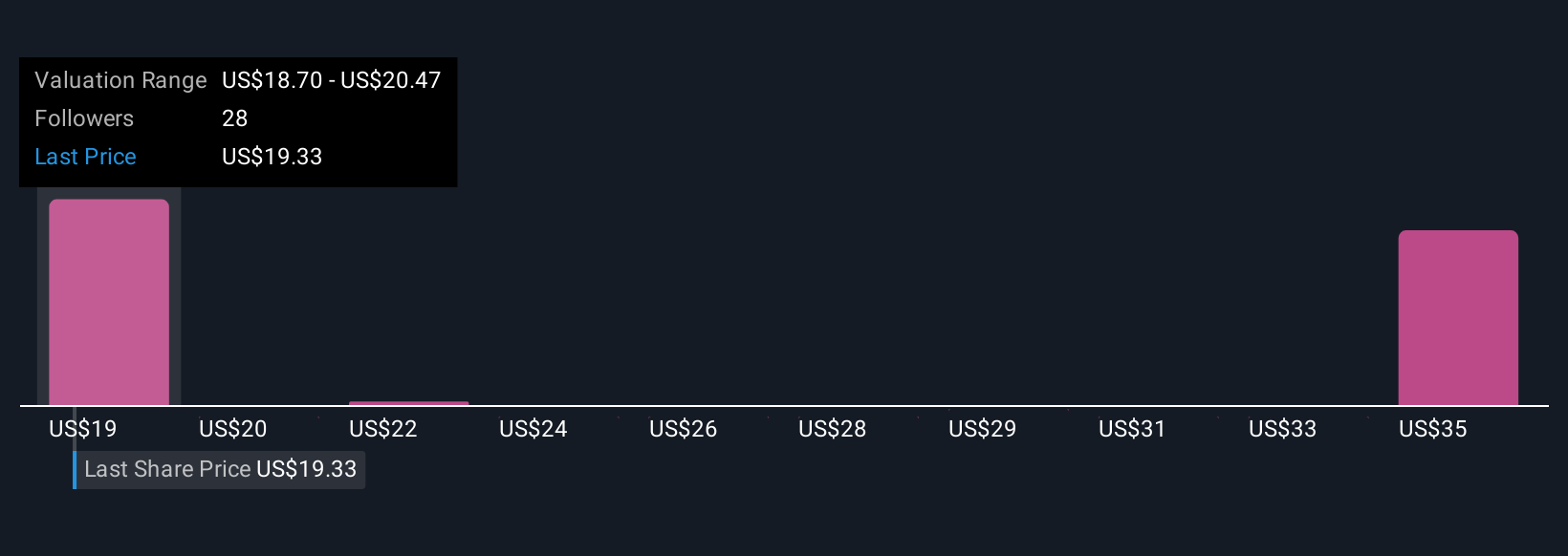

Earlier, we mentioned there is an even better way to understand value. Let’s introduce you to Narratives. A Narrative is your personalized investment story for a company, bringing together your expectations for fair value, future revenue, earnings, and margins into a cohesive, easy-to-understand picture. Rather than just following the numbers, a Narrative helps you connect Upwork’s business story to a specific financial forecast and, from there, to a fair value based on your unique view of how things might play out.

Narratives are accessible to everyone on Simply Wall St’s Community page, making powerful valuation tools available to millions of investors. By comparing your view of Upwork’s fair value to its latest share price, Narratives give you practical, immediate context for deciding whether it is time to buy, hold, or sell. The best part is that your Narrative adapts automatically. Every time new earnings numbers, industry news, or updated forecasts are released, it updates your assumptions instantly.

For example, right now some investors are optimistic about Upwork’s potential, with the highest community price target at $24.00, while others see more risk and set their lowest target at $15.00. This helps you see at a glance how different stories and expectations lead to different fair values.

Do you think there's more to the story for Upwork? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives