- United States

- /

- Professional Services

- /

- NasdaqGS:PCTY

Paylocity (PCTY): Reassessing Valuation After Momentum Cools and Growth Expectations Reset

Reviewed by Simply Wall St

Paylocity Holding (PCTY) has quietly been grinding through a tough stretch, even as its payroll and HR software remain in steady demand. With shares still well below their past year highs, investors are re-checking the growth story.

See our latest analysis for Paylocity Holding.

The recent pullback, including a double digit 90 day share price return decline and a weaker one year total shareholder return, suggests momentum has cooled as investors reassess how much to pay for Paylocity’s slower but still positive growth.

While Paylocity works through this softer patch, it can be useful to compare it with other business software names and explore high growth tech and AI stocks as potential opportunities on your radar.

With shares down sharply over the past year despite ongoing revenue and profit growth, Paylocity now trades at a hefty discount to analyst targets. This raises the question: is this a mispriced growth story, or is the slowdown fully reflected?

Most Popular Narrative Narrative: 24.5% Undervalued

Compared to Paylocity Holding's last close of $146.52, the most followed narrative points to a materially higher fair value anchored in sustained growth and rising margins.

Strong client retention (92%+) and accelerating cross-sell of new modules (including Paylocity for Finance) are yielding steady margin expansion and improved operating leverage, evidenced by rising adjusted EBITDA margins and free cash flow, which could lead to higher net margins in the future.

Want to see what powers that margin story? The narrative focuses on durable double digit growth, thickening profit margins, and a rich earnings multiple. Curious how those pieces combine into one bold valuation call?

Result: Fair Value of $194.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue growth and tougher competition from larger HCM and payroll players could pressure Paylocity’s margins and challenge that upbeat valuation story.

Find out about the key risks to this Paylocity Holding narrative.

Another Take on Valuation

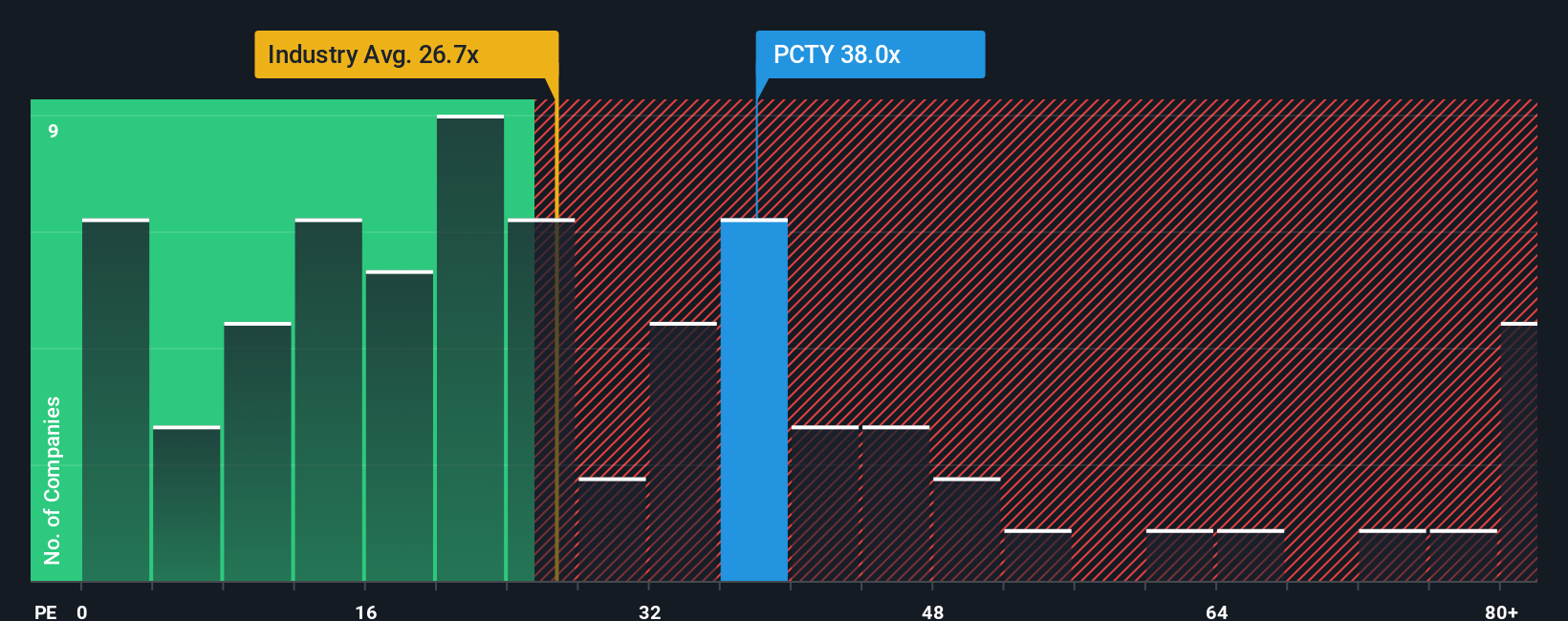

Those bullish fair value estimates clash with how the market is currently pricing Paylocity. At 35.3 times earnings, the stock trades far richer than both peers at 18.4 times and a fair ratio of 26.9 times, hinting at real downside risk if sentiment sours further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paylocity Holding Narrative

If you see the story differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own view: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paylocity Holding.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy and keep you a step ahead.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that the market may be overlooking today, but not for long.

- Capitalize on developments in intelligent automation by targeting these 26 AI penny stocks positioned to benefit from advances in machine learning.

- Strengthen your income stream with these 15 dividend stocks with yields > 3% that can help you compound cash flows over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCTY

Paylocity Holding

Provides cloud-based human capital management, payroll software, and spend management solutions for the workforce in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026