- United States

- /

- Professional Services

- /

- NasdaqGS:PCTY

Paylocity (PCTY): Evaluating the Valuation Disconnect After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Paylocity Holding.

Paylocity Holding’s share price has seen some dramatic swings. While there was a 2.5% pop in the past day, the year-to-date share price return sits at -27.3%. With a one-year total shareholder return of -32.8%, recent momentum has been lackluster and suggests cautious sentiment persists despite fundamental growth.

If you’re looking to broaden your investing horizons beyond payroll tech, now’s a great opportunity to discover fast growing stocks with high insider ownership.

With Paylocity trading well below analyst targets despite steady revenue and income gains, investors are left wondering whether this disconnect presents a compelling entry point or if the market is accurately pricing in its prospects.

Most Popular Narrative: 33.9% Undervalued

With Paylocity shares last closing at $141.88, the most widely followed narrative points to a fair value considerably higher. This suggests the market may be missing key long-term growth drivers.

Ongoing integration of third-party solutions (like Airbase) and continued investment in open API capabilities is reinforcing Paylocity's value proposition for distributed and remote workforces. These actions aid client acquisition and retention, which supports stable or improved revenue retention and long-term earnings visibility.

Think this is just another tech stock story? The logic behind this valuation leans on future revenue per client, recurring growth, and the hidden leverage of cross-selling new products. Only the full narrative breaks down exactly how these financial levers could drive massive upside over today's price.

Result: Fair Value of $214.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue growth or stumbling adoption of new products, such as Paylocity for Finance, could present challenges to the optimistic earnings outlook.

Find out about the key risks to this Paylocity Holding narrative.

Another View: Market Multiples Raise Questions

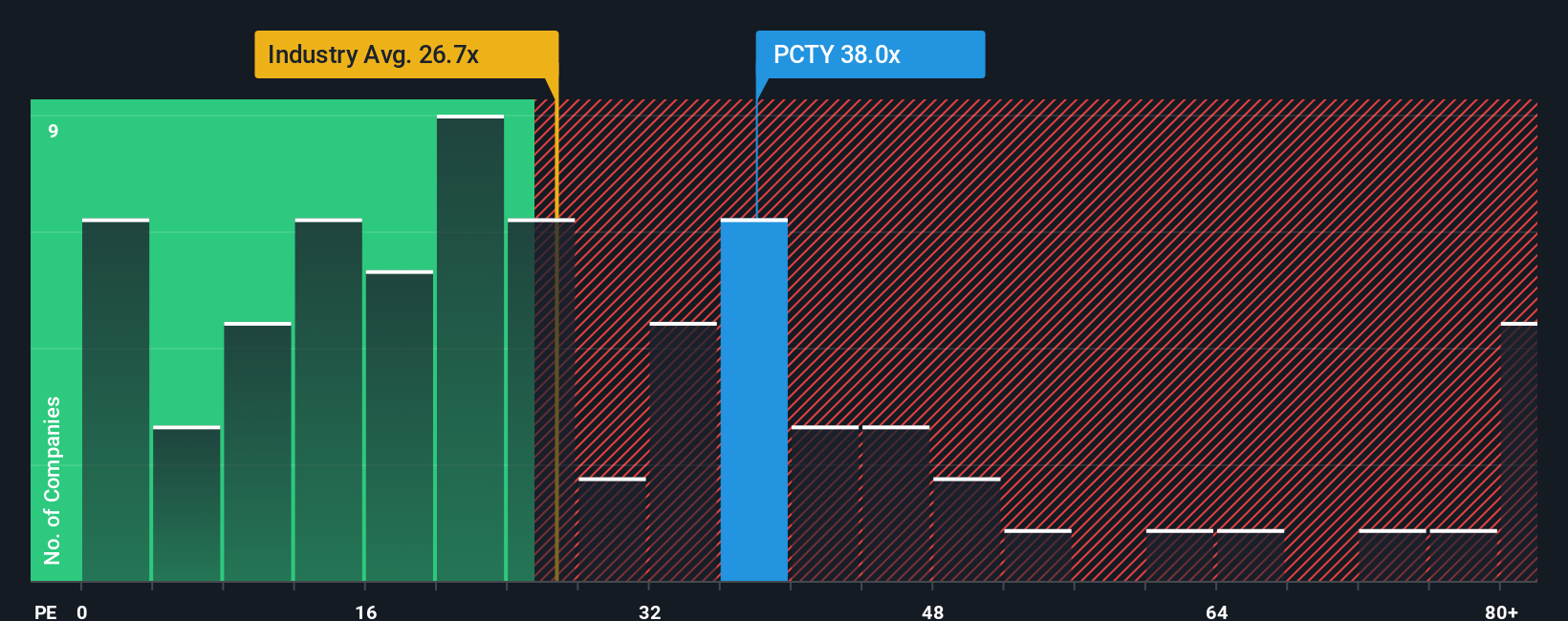

Looking from another angle, Paylocity’s price-to-earnings ratio stands at 34.2x, which is not only above the US Professional Services industry average of 24.5x but also outpaces its peer average of 21.5x and the fair ratio of 26.3x. This premium suggests investors expect outperformance, but it also increases valuation risk if growth slows. Is the market pricing in too much optimism, or do the company’s strengths justify the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paylocity Holding Narrative

If you see things differently or want to follow your own reasoning, you can put together a custom perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Paylocity Holding.

Looking for more investment ideas?

Seize your chance to get ahead. Don’t limit your search to just one company. The smartest investors always keep fresh opportunities on their radar.

- Catch rising trends and see which companies are powering growth in artificial intelligence when you tap into these 25 AI penny stocks today.

- Secure steady income streams by targeting high-yield potential. Start by checking out these 16 dividend stocks with yields > 3% yielding over 3%.

- Spot undervalued gems based on future cash flows and unlock smart bargains using these 876 undervalued stocks based on cash flows before others do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCTY

Paylocity Holding

Provides cloud-based human capital management, payroll software, and spend management solutions for the workforce in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives