- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

LegalZoom (LZ): Valuation in Focus After Record Q3 Revenue Growth and Upgraded 2025 Outlook

Reviewed by Simply Wall St

LegalZoom.com (LZ) just delivered record third quarter revenue, with sales climbing 13% from last year and management boosting their full-year 2025 revenue outlook. Investors are watching both the strong results and shifting executive share activity.

See our latest analysis for LegalZoom.com.

After surging earlier in the year, LegalZoom.com’s recent momentum has cooled, with the share price down 9% over the past month but still up over 23% year-to-date. The strong third quarter, record revenue, and upbeat guidance have contributed to a solid 17% total shareholder return over the past 12 months. This suggests optimism remains even as short-term volatility persists.

If these performance shifts have you thinking about where else strong growth and investor interest might be found, it could be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading below analyst targets and recent results surpassing expectations, is the current dip a rare buying opportunity for LegalZoom.com, or are investors already factoring in all that future growth?

Most Popular Narrative: 24.7% Undervalued

LegalZoom.com’s most widely followed valuation narrative puts fair value at $12.36, well above the recent closing price of $9.31. This significant valuation gap is driven by aggressive growth assumptions and anticipated margin expansion over the coming years.

“Enhanced automation and AI deployment throughout the business is driving operating efficiency gains and enabling scalable delivery of higher-touch services. This underpins continued EBITDA margin expansion and a reduced cost structure.”

Curious what powers this bold valuation? The narrative’s entire case centers on explosive earnings growth, high-margin subscription expansion, and a future profit multiple that is much higher than today’s market norm. Which critical numbers are baked into this outlook? Discover where consensus expects LegalZoom.com to be in just a few years—the surprise might be in the details.

Result: Fair Value of $12.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising AI-driven competition and a dip in subscription retention rates could threaten LegalZoom.com’s growth and challenge today’s optimistic forecasts.

Find out about the key risks to this LegalZoom.com narrative.

Another View: Are the Market’s Multiples Telling a Different Story?

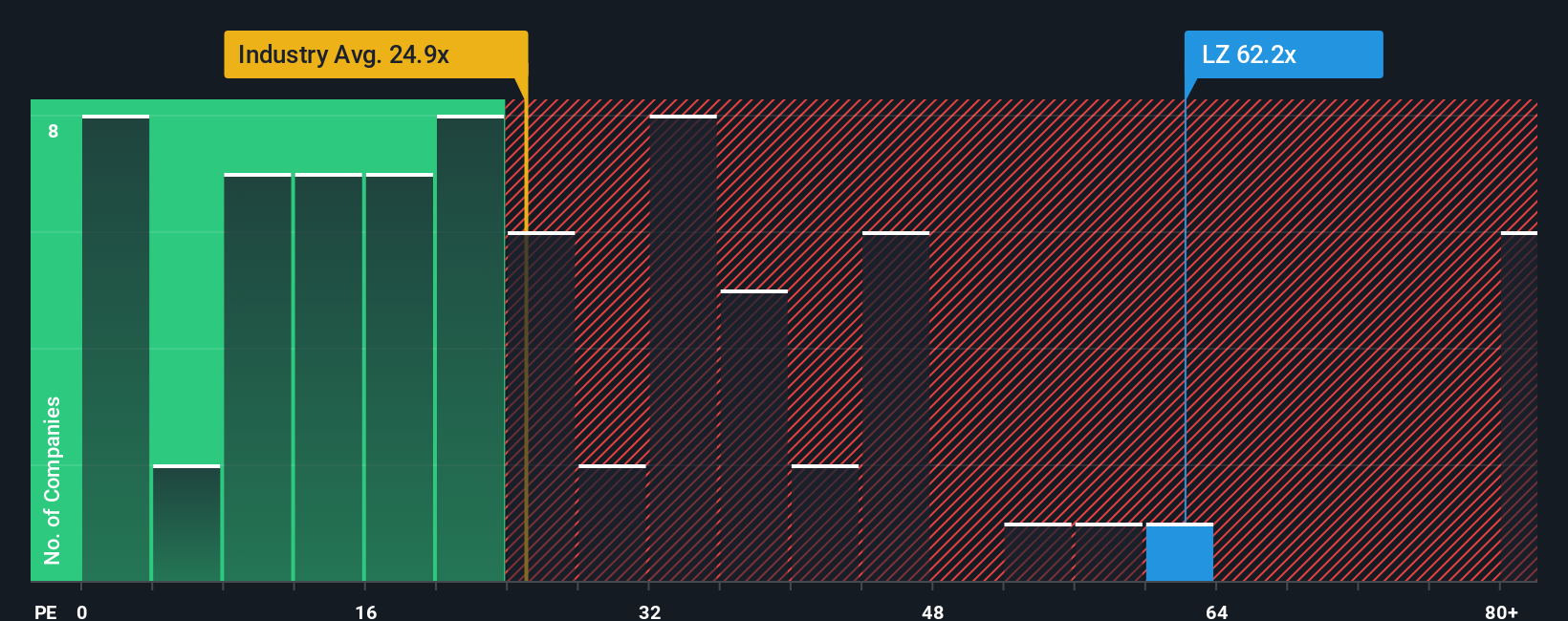

Looking at the price-to-earnings ratio gives a more cautious perspective. LegalZoom.com currently trades at 74.3x earnings, which is significantly higher than both peers (21.5x) and the US Professional Services industry average (24.3x). Even compared to its fair ratio of 46.7x, there is a sizable premium. Does this valuation gap reflect justified optimism, or should investors worry about downside if growth does not keep up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LegalZoom.com Narrative

If you have a different perspective or want to dive into the numbers yourself, you can easily craft your own story in just a few minutes. Do it your way

A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Make your next move count by tapping into unique opportunities you might not have considered. Your next winning stock could be just a click away.

- Uncover potential high-flyers with strong financials by starting with these 3578 penny stocks with strong financials before the crowd catches on.

- Capitalize on the AI trend and spot tomorrow’s tech leaders by looking through these 25 AI penny stocks now as momentum builds.

- Lock in attractive value by searching among these 927 undervalued stocks based on cash flows where the market may be overlooking hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success