- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

What Do Innodata’s AI Partnerships and Recent 30% Drop Mean for Its 2025 Valuation?

Reviewed by Bailey Pemberton

- Wondering if Innodata’s stellar rally makes it a buy, or if it’s running too hot? Let’s take a close look at what’s really under the hood before talking price tags.

- The share price has soared 64.8% year-to-date and is up 52.2% over the last year, but it has cooled off lately with a -30.1% drop in the last month and -12.7% over the past week.

- Behind these recent swings, headlines have spotlighted Innodata’s growing foothold in AI data solutions, as partnerships with leading tech firms have drawn both investor optimism and scrutiny about future competition. This business buzz has fueled excitement, but also injected a touch of caution into the stock’s short-term outlook.

- According to our latest checks, Innodata scores 0 out of 6 on our valuation framework. This suggests it is not undervalued by traditional measures, but traditional methods never tell the whole story. A fresh approach to understanding value awaits at the end of this article.

Innodata scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Innodata Discounted Cash Flow (DCF) Analysis

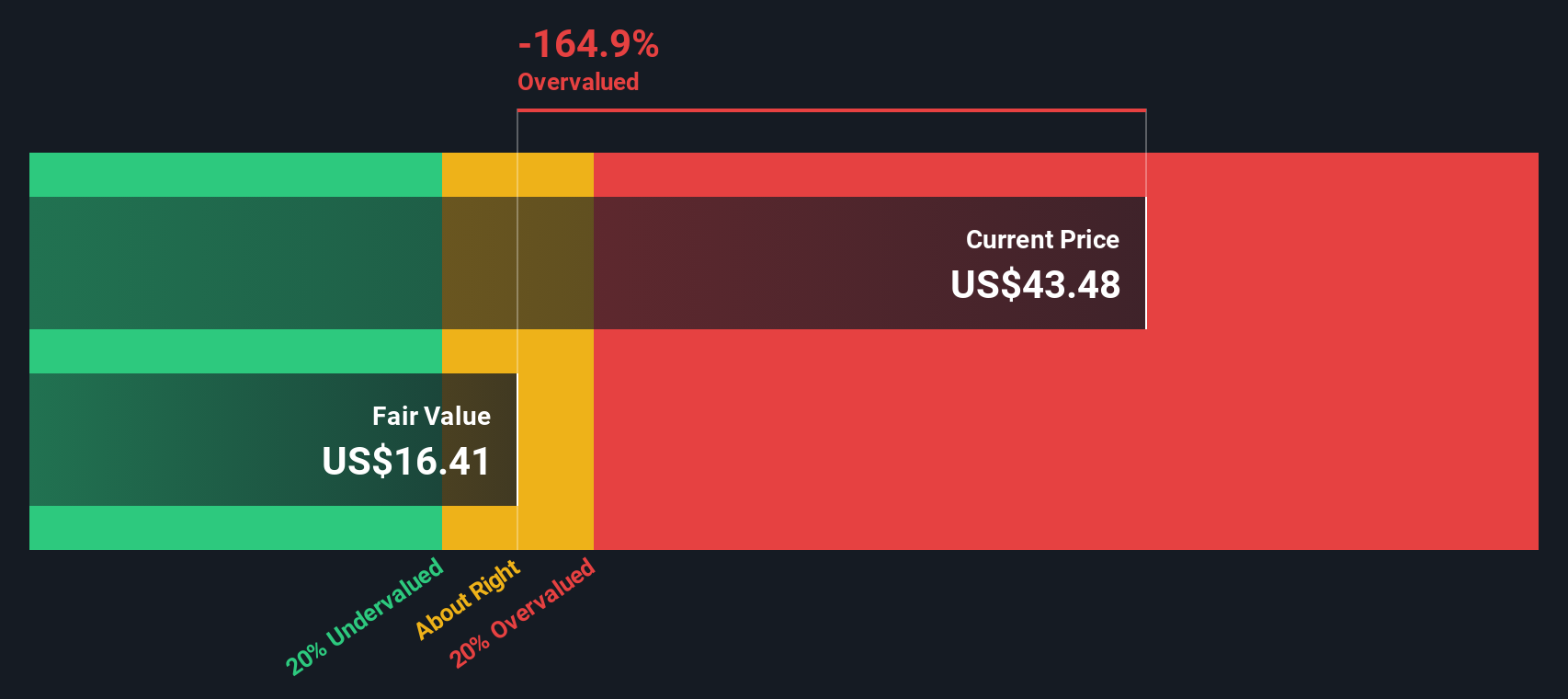

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach provides a forward-looking measure of value based on how much cash the business is expected to generate in the coming years.

For Innodata, the latest reported Free Cash Flow stands at $39.2 million. According to analyst forecasts, free cash flow is expected to decrease to $27.3 million by 2026, and over the next decade, projections show a gradual decline, reaching $18.4 million by 2035. While analysts typically provide estimates up to five years out, Simply Wall St extrapolates figures beyond this using its own methodology to paint a longer-term picture. All these estimates are given in US dollars.

Based on the 2 Stage Free Cash Flow to Equity DCF model, Innodata’s estimated intrinsic value is $12.12 per share. Compared to recent market prices, the DCF analysis implies the stock is trading at a hefty 437% premium to its fair value. This means Innodata appears significantly overvalued according to cash flow projections. Buyers may want to exercise caution before jumping in at these levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innodata may be overvalued by 437.0%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Innodata Price vs Earnings

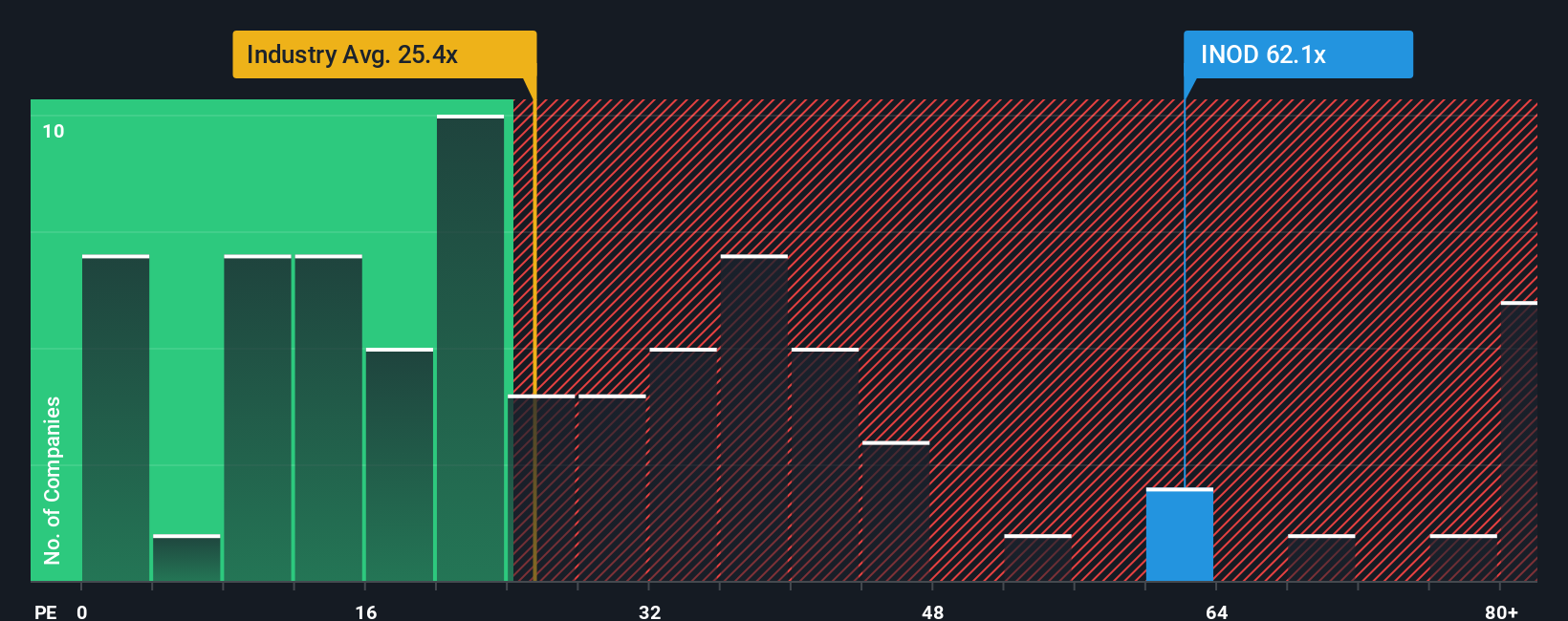

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies since it directly relates a company's stock price to its earnings power. Because earnings are a key driver of shareholder value, the PE ratio helps investors gauge whether a company’s shares are reasonably priced relative to the profit it generates.

What counts as a “normal” or “fair” PE ratio can vary depending on expectations for future growth and the amount of risk investors are willing to take. Companies growing faster than their peers or operating in less risky environments typically command higher PE ratios. Conversely, slower growth or added risks warrant lower multiples.

At the moment, Innodata is trading at a PE ratio of 61.6x. For context, the average PE ratio across the Professional Services industry stands at 24.6x, while Innodata’s peer group averages 41.4x. This positions Innodata well above both groups, indicating the market is pricing in high growth or unique advantages.

To provide a fairer benchmark, Simply Wall St developed a proprietary “Fair Ratio,” which, in Innodata’s case, is 26.3x. This reflects a balance of the company’s earnings growth outlook, profit margins, industry norms, risk profile, and market cap. Unlike blunt peer or industry averages, the Fair Ratio aims to capture the nuances specific to Innodata’s business and prospects.

Comparing the Fair Ratio (26.3x) to the current PE (61.6x), Innodata’s shares are trading at a significant premium to what would be considered reasonable based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

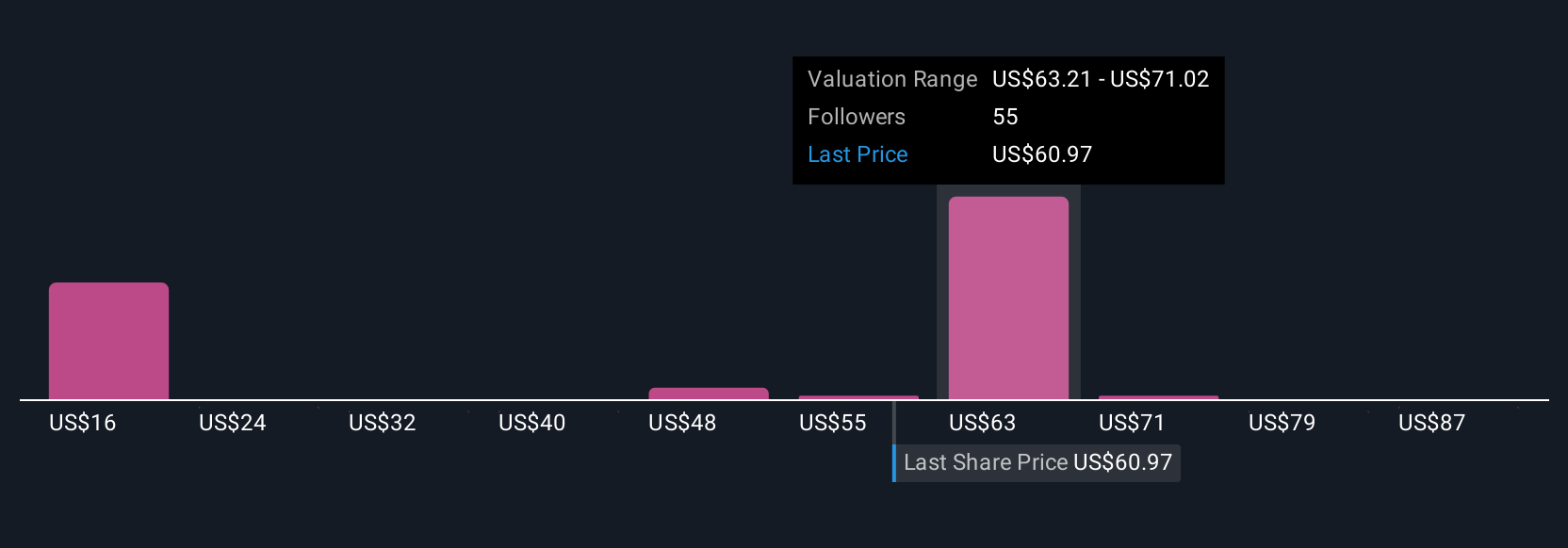

Upgrade Your Decision Making: Choose your Innodata Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative puts your perspective at the heart of investing. It's the story you build about a company, connecting what you believe about Innodata’s market, management, and future trends directly to your own financial estimates and fair value calculations.

Instead of relying only on static numbers or broad analyst opinions, Narratives make it easy to outline your reasons behind estimated revenue, profit margins, and risks, and instantly see what fair value that story implies. Narratives link the company’s unique story to a financial forecast, all within an accessible tool on Simply Wall St’s Community page, used by millions of investors worldwide.

This approach helps you quickly spot mismatches between your Fair Value and the current share price, so you can decide when to buy, sell, or wait. Plus, Narratives update automatically as soon as there’s fresh news or earnings, so your view is always informed and relevant. For Innodata, some users believe its premium AI partnerships and industry growth justify a bullish $75 price target, while more cautious investors cite client concentration risks and see fair value closer to $55. The right choice depends on the Narrative you build for yourself.

Do you think there's more to the story for Innodata? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives