- United States

- /

- Professional Services

- /

- NasdaqGS:FA

First Advantage (FA) Valuation Check After a 31% Share Price Slide Over the Past Year

Reviewed by Simply Wall St

First Advantage (FA) has quietly slipped about 31% over the past year even as revenue and net income have grown, a combination that can catch value focused investors’ attention.

See our latest analysis for First Advantage.

That slide in First Advantage’s 1 year share price return, down about 26% year to date and 31.7% on a 1 year total shareholder return basis, suggests sentiment has cooled even as fundamentals improve. This could set up a later rerating if growth holds.

If this kind of disconnect between performance and expectations interests you, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other potential mispriced stories.

With shares still trading at a steep discount to both analyst targets and some intrinsic value estimates despite solid top line growth, the key question now is whether this weakness is a buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative: 21.6% Undervalued

With First Advantage last closing at $13.66, the most widely followed narrative sees fair value nearer $17.43, implying meaningful upside if its roadmap plays out.

Successful execution of synergy capture, cost management, and accelerated deleveraging following the Sterling acquisition is freeing up capital for further investment, margin expansion, and potential future strategic M&A, directly supporting stronger free cash flow and net margin improvement.

Curious how modest revenue growth assumptions, a sharp swing to profitability and a premium future earnings multiple all combine into that outcome? The full narrative unpacks the playbook.

Result: Fair Value of $17.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn hiring headwinds and fiercer price competition could easily undercut those optimistic margin and growth assumptions, which could delay any meaningful rerating.

Find out about the key risks to this First Advantage narrative.

Another Angle on Valuation

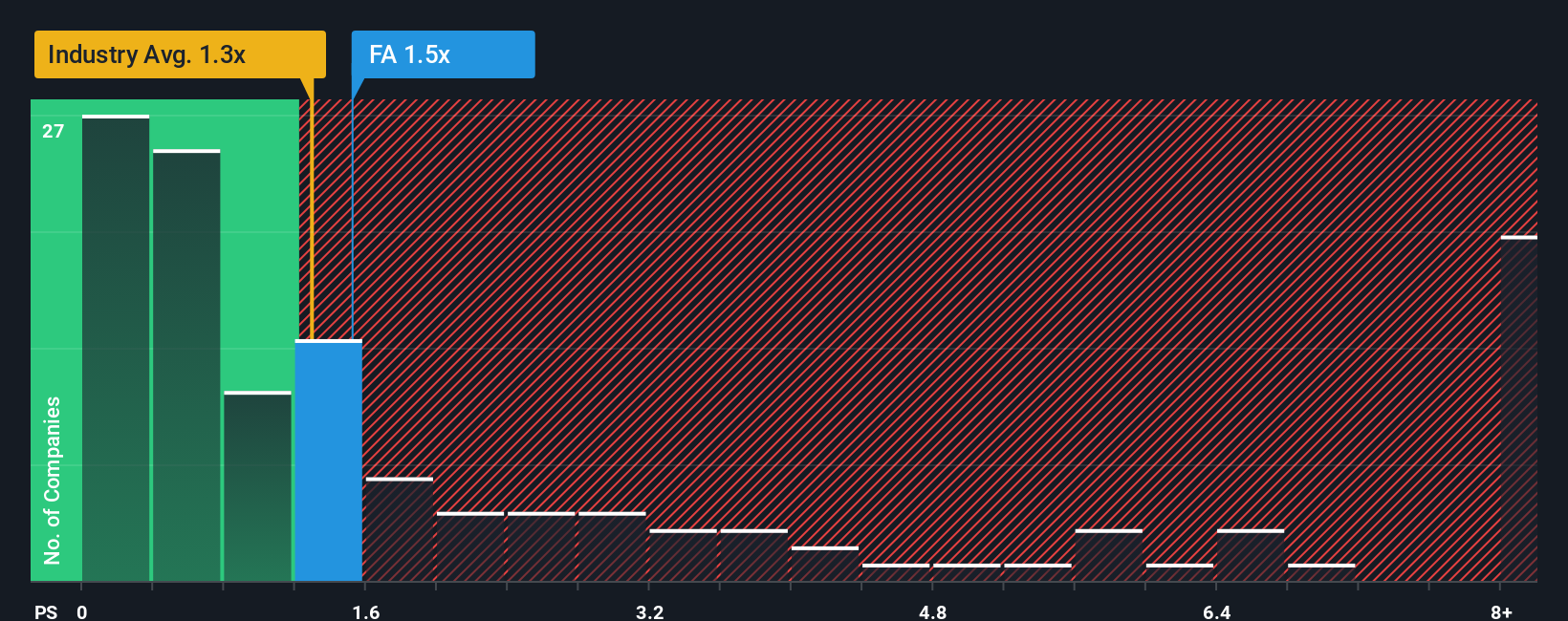

On simple sales based yardsticks, First Advantage does not look like a bargain. Its price to sales ratio of 1.6 times sits above both the US Professional Services average and its peer average of 1.4 times. This hints at less downside protection if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Advantage Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Advantage.

Looking for more investment ideas?

If you stop here, you may miss opportunities beyond First Advantage. Use the Simply Wall St Screener to uncover fresh, data driven ideas tailored to your strategy.

- Capture potential compounding benefits by targeting reliable income streams through these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Position yourself ahead of emerging tech themes by backing innovators driving breakthroughs across these 27 AI penny stocks.

- Turn market pessimism into potential upside by focusing on these 903 undervalued stocks based on cash flows that trade below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026