- United States

- /

- Professional Services

- /

- NasdaqGS:FA

A Look at First Advantage (FA) Valuation Following Analyst Upgrades and Raised Earnings Projections

Reviewed by Simply Wall St

First Advantage has recently seen its stock price climb as analysts across the board have revised earnings projections higher. This trend points to growing confidence in the firm's near-term outlook and performance.

See our latest analysis for First Advantage.

The recent momentum in First Advantage’s share price stands out, with a 1-month share price return of nearly 10% and analyst upgrades sparking renewed interest. While the stock has faced pressure over the past year, as reflected in its -28% total shareholder return, the market’s tone has shifted more positive in recent weeks as confidence grows around future prospects.

If you're looking for other compelling growth stories that may not be on your radar, now is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares rebounding and analyst targets suggesting notable upside, investors are left to wonder if First Advantage represents an undervalued opportunity right now, or if the market has already accounted for its next phase of growth.

Most Popular Narrative: 20.4% Undervalued

Based on the popular narrative, First Advantage's fair value is set well above the latest closing price, which suggests notable upside if projections are realized. The narrative outlines key catalysts behind this perceived opportunity and sets a high bar for future performance.

Ongoing investments in proprietary AI-enabled technology, automation, and integrated platforms (particularly following the Sterling acquisition) are unlocking operational efficiencies and enabling more high-margin value-added services. This creates potential for margin expansion and higher net earnings.

Want to know what future milestones justify this bullish outlook? The narrative’s case hinges on sharp increases in revenue, profit margins, and a valuation multiple that is rare in this segment of the market. Uncover the projections shaping this verdict—there is more drama in the forecasts than meets the eye.

Result: Fair Value of $17.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic headwinds and uncertainty in hiring demand could threaten growth expectations and potentially challenge the current positive narrative for First Advantage.

Find out about the key risks to this First Advantage narrative.

Another View: Multiples Paint a Cautious Picture

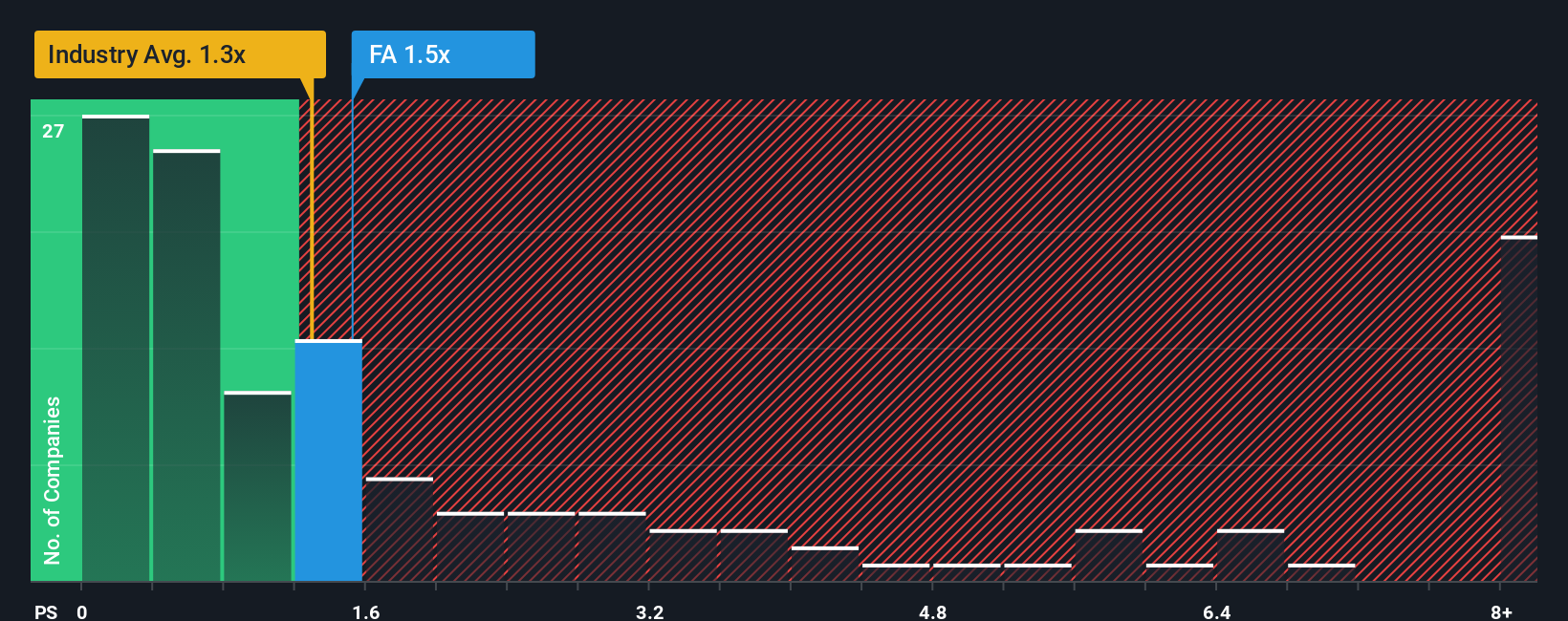

Looking at valuation through the lens of the price-to-sales ratio, First Advantage appears more expensive than industry norms. The company’s ratio of 1.7x sits above both the US Professional Services industry average of 1.3x and the peer average of 1.4x, as well as the fair ratio of 1.6x. This gap could mean investors should weigh whether the rapid rebound is already priced in, or if the market might eventually bring the valuation back in line with its peers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Advantage Narrative

If you want to take a hands-on approach or see things from a different angle, you can put together your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Advantage.

Looking for more investment ideas?

Smart investors do not settle for just one opportunity. Use these targeted stock screeners to unearth investments others are missing and stay ahead of the market shift.

- Uncover steady income potential with these 15 dividend stocks with yields > 3%, which offers compelling yields and robust financial health for your portfolio.

- Capitalize on cutting-edge breakthroughs by checking out the latest opportunities in artificial intelligence with these 25 AI penny stocks.

- Explore deep value opportunities by reviewing these 919 undervalued stocks based on cash flows, where hidden gems may reward your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FA

First Advantage

Provides employment background screening, identity, and verification solutions worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026