- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

Evaluating CRA International (CRAI) Stock: Is the Recent Pullback an Opportunity Based on Its Long-Term Valuation?

Reviewed by Simply Wall St

See our latest analysis for CRA International.

Even with this month’s modest pullback, CRA International’s 1-year total shareholder return of -7.3% reflects some cooling momentum after years of impressive gains. For comparison, its 3-year total shareholder return is nearly 59%, and over five years, it stands at a substantial 332%. Recent price moves suggest investors are weighing both the company’s strong track record and shifting market risk perceptions. Still, the long-term growth story remains notable.

If you’re curious what else is catching the market’s attention right now, this could be a great opportunity to discover fast growing stocks with high insider ownership

With CRA International now trading at a substantial discount to analyst price targets, investors may wonder if the recent dip signals that the stock is undervalued, or if the market is already factoring in the company’s future growth.

Most Popular Narrative: 26.6% Undervalued

At $183.13, CRA International trades far below the most widely followed fair value estimate of $249.50, heightening market debate about what the company’s future could look like. The disconnect invites a closer inspection into the factors fueling this high target.

Investments in talent, technology, and leadership position CRA to capture high-value opportunities in dynamic markets, driving long-term margin and revenue expansion.

Is CRA International’s premium price target based on a bold confidence in margin growth and industry leadership? Only a handful of key analyst assumptions underpin this gap. Want to see which projections turn a steady consultancy into a possible growth outlier? Unpack the logic before deciding whether the optimism stacks up.

Result: Fair Value of $249.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CRA International’s heavy exposure to antitrust and M&A cycles, along with challenges attracting top talent, could disrupt the positive growth narrative.

Find out about the key risks to this CRA International narrative.

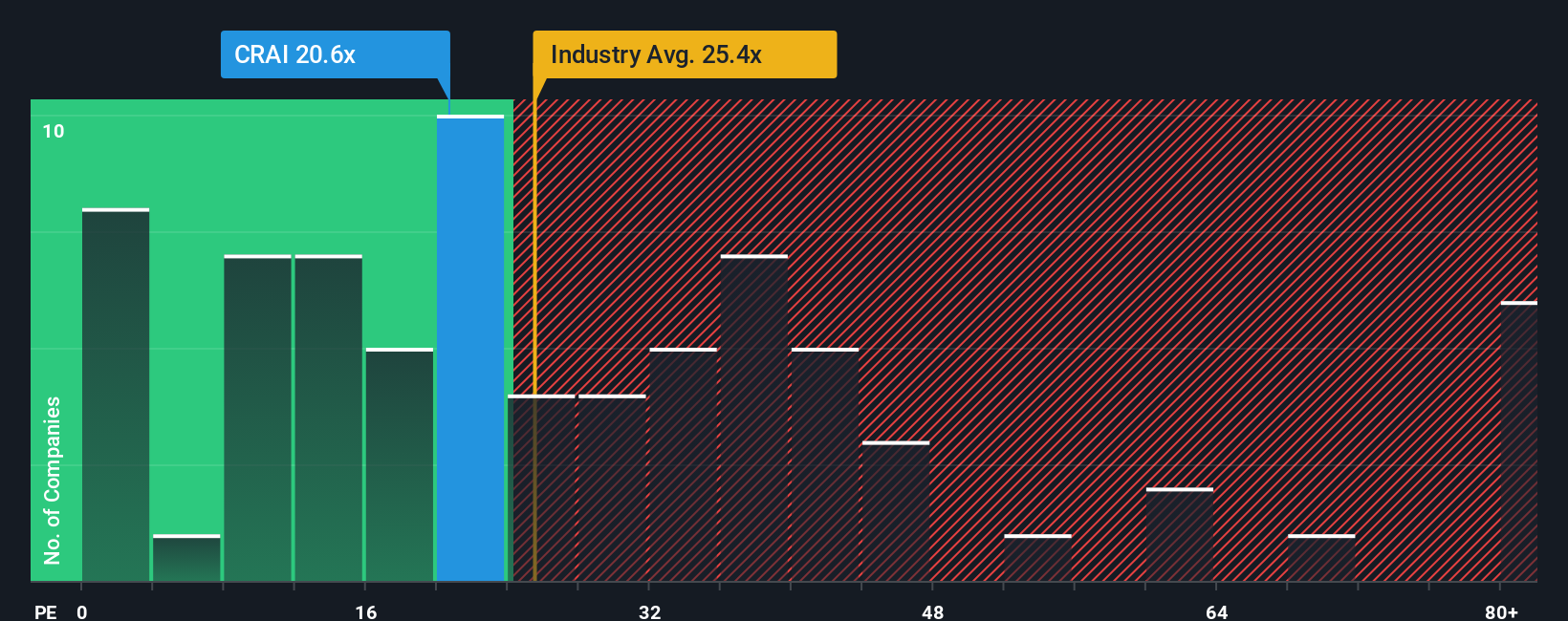

Another View: Market Ratios Paint a Cautious Picture

Looking from a market ratios perspective, CRA International’s price-to-earnings sits at 21.3x, which is lower than the US industry average of 25.1x and far below its peer group’s average of 45.8x. However, it remains above the fair ratio of 18.5x, hinting at potential valuation risk if the market normalizes. Does this leave the stock exposed if investor optimism fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRA International Narrative

If you have a different perspective or want to see what the underlying numbers reveal, you can easily build your personal take on CRA International’s outlook in just a few minutes. Do it your way

A great starting point for your CRA International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not wait. Give yourself a head start by checking investment themes others are missing. These could be your edge in the market.

- Capture incredible yield potential by targeting high-payout companies through these 17 dividend stocks with yields > 3%. This approach can deliver reliable cash flow straight to your portfolio.

- Ride the wave of tomorrow’s breakthroughs with these 25 AI penny stocks, which are powering disruption across industries through advanced machine learning and smart automation.

- Unlock remarkable bargains and maximize your upside by leveraging these 848 undervalued stocks based on cash flows to spot market mispricings before they hit the mainstream radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives