- United States

- /

- Commercial Services

- /

- NasdaqGS:CMPR

Does Management’s Reaffirmed Guidance Reveal a Shift in Cimpress’ (CMPR) Long-Term Earnings Quality?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Cimpress plc reaffirmed its financial guidance for fiscal year 2026, projecting 5% to 6% revenue growth (2% to 3% organic constant currency), a minimum net income of US$72 million, and at least US$450 million in adjusted EBITDA.

- This guidance update provides investors with increased transparency into Cimpress’ anticipated earnings trajectory and operational progress over the next fiscal year.

- To assess how this renewed earnings outlook shapes the investment narrative, we'll examine the potential impact of management's confidence in both revenue and profit targets.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Cimpress Investment Narrative Recap

To be a Cimpress shareholder today, you need to believe that management can successfully shift the business away from shrinking legacy print products while turning high capital expenditures into meaningful, profitable growth. The reaffirmed fiscal 2026 guidance sends a confident message around revenue and earnings potential, but it does not fundamentally alter the biggest short-term catalyst, progress on cost efficiency, or the key risk surrounding the pace and profitability of newer business segments. The latest update increases visibility, yet the core challenge remains execution against prior promises.

Among recent developments, Cimpress’ Q1 2026 earnings release offers the most relevant context. The positive swing to net income and improved revenue suggest early traction in reaching the updated full-year targets, indicating that recent operational changes are beginning to have a visible effect. This ongoing transition is crucial in sustaining momentum as Cimpress repositions for a future less reliant on traditional print.

On the other hand, investors should be aware that if elevated capital expenditures fail to deliver anticipated cost savings fast enough, free cash flow could remain suppressed and profitability under pressure...

Read the full narrative on Cimpress (it's free!)

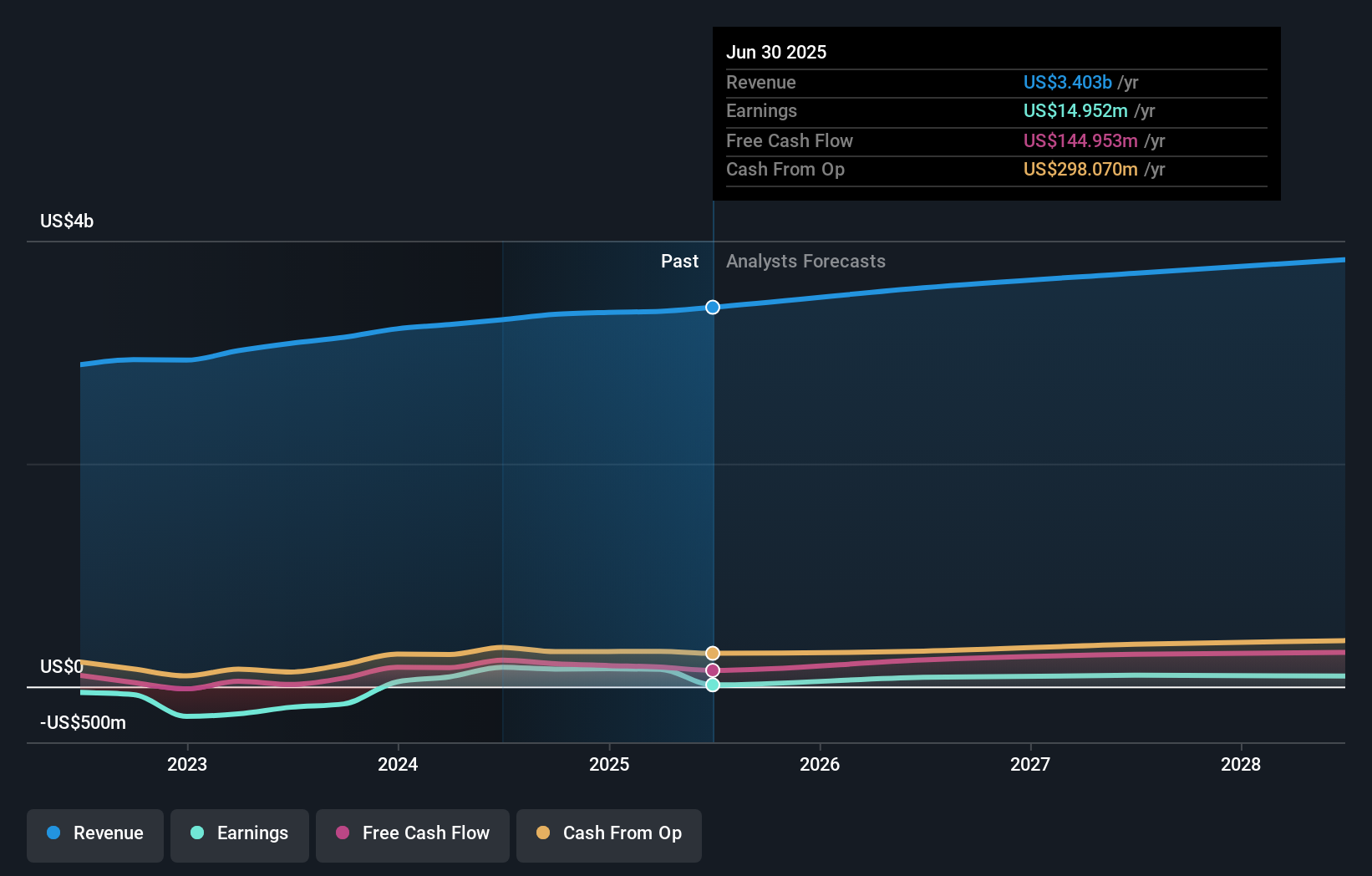

Cimpress' outlook anticipates $3.8 billion in revenue and $94.7 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.0%, and represents an increase in earnings of about $79.7 million from the current $15.0 million figure.

Uncover how Cimpress' forecasts yield a $83.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Cimpress ranging from US$83.50 to US$3,107.51. While some expect substantial earnings growth ahead, others point to the risk that newer product lines may not offset declines in legacy print, reminding you that market views are rarely unanimous.

Explore 3 other fair value estimates on Cimpress - why the stock might be a potential multi-bagger!

Build Your Own Cimpress Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cimpress research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cimpress' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMPR

Cimpress

Provides various mass customization of printing and related products in North America, Europe, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives