- United States

- /

- Building

- /

- NYSE:ZWS

How Slowing Organic Growth at Zurn Elkay (ZWS) Is Shaping Its Investment Narrative

Reviewed by Sasha Jovanovic

- Zurn Elkay Water Solutions recently reported concerns over underwhelming organic revenue growth, declining earnings per share, and narrowing free cash flow margins as competition intensifies.

- This suggests the company may increasingly need to rely on acquisitions and higher investment to defend its market position in the face of ongoing challenges.

- We'll explore how persistent weakness in organic revenue growth could reshape Zurn Elkay's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Zurn Elkay Water Solutions Investment Narrative Recap

To be a Zurn Elkay shareholder, you must believe in the company's long-term ability to capitalize on regulatory tailwinds for water quality and sustain its position in nonresidential construction sectors, especially education and healthcare. The recent report of stalled organic revenue growth and shrinking free cash flow margins signals that intensified competition may impact near-term performance, making the upcoming Q3 2025 earnings release the chief short-term catalyst, while continued erosion of core growth forms the central risk. If the organic growth slowdown proves persistent, it could materially affect the company's narrative and investors' confidence.

The most relevant recent announcement is the scheduled Q3 2025 earnings release on October 28, where management will address financial trends and take investor questions. This update is especially important as investors assess whether the recent headwinds in organic revenues and competitive pressures are reflected in the company's updated guidance and financial outlook, directly influencing near-term sentiment and potential responses. Despite the strong long-term thesis, investors should be aware that if federal or state funding in Zurn Elkay’s core markets slows, then...

Read the full narrative on Zurn Elkay Water Solutions (it's free!)

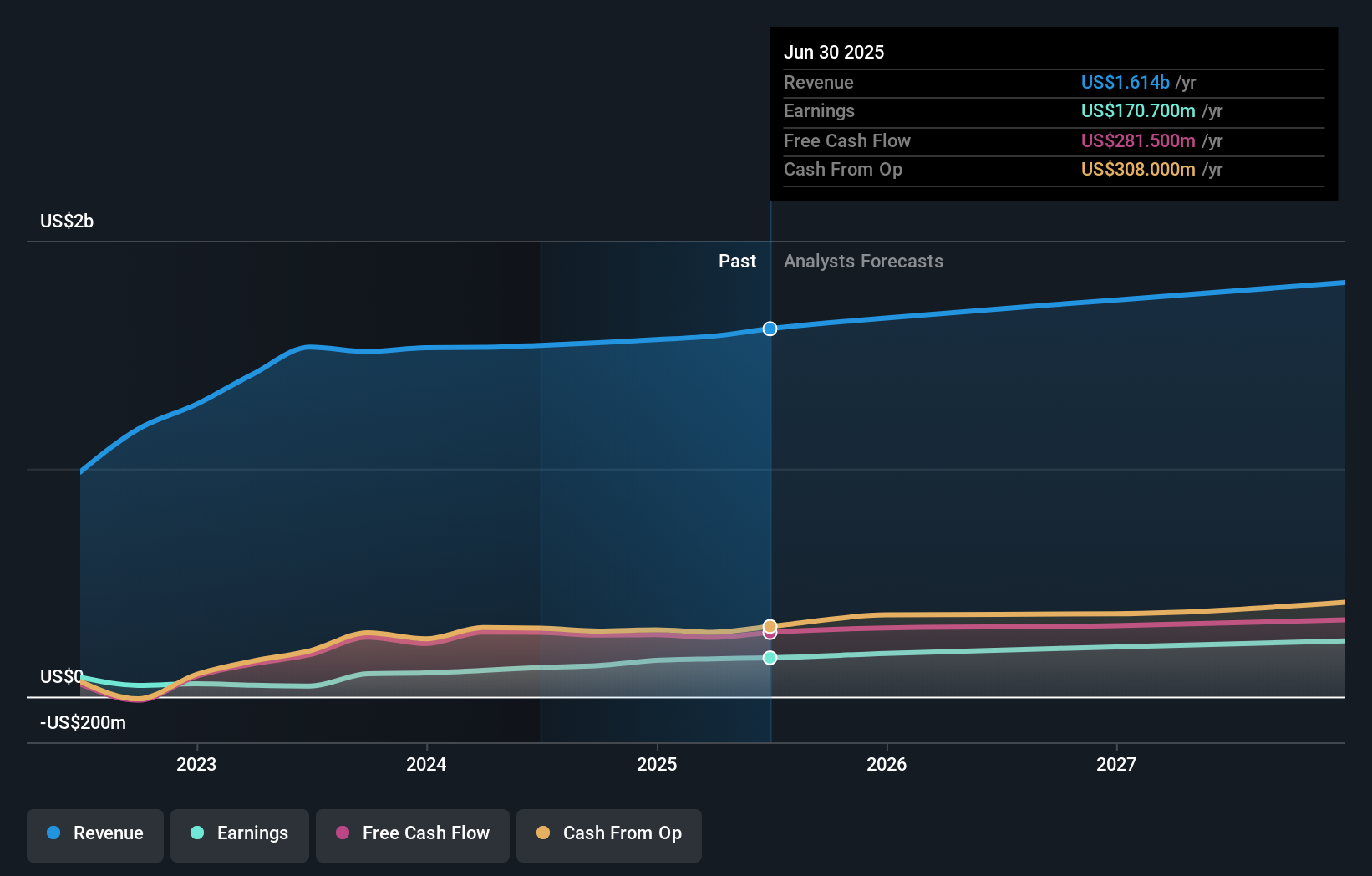

Zurn Elkay Water Solutions' outlook anticipates $1.9 billion in revenue and $266.9 million in earnings by 2028. This implies a 5.1% annual revenue growth rate and an earnings increase of $96.2 million from current earnings of $170.7 million.

Uncover how Zurn Elkay Water Solutions' forecasts yield a $47.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members provided fair value estimates for Zurn Elkay ranging from US$29.04 to US$45.30 per share. With core revenue growth concerns now in focus, you could see opinions shift further apart as more voices weigh risks to the company’s multi-year outlook.

Explore 2 other fair value estimates on Zurn Elkay Water Solutions - why the stock might be worth 37% less than the current price!

Build Your Own Zurn Elkay Water Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zurn Elkay Water Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zurn Elkay Water Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026