- United States

- /

- Building

- /

- NYSE:WMS

A Look at Advanced Drainage Systems’s Valuation Following Strong Q2 Results and Dividend Hike (WMS)

Reviewed by Simply Wall St

Advanced Drainage Systems (WMS) just shared its second quarter earnings, revealing jumps in both sales and net income. The company also announced its quarterly dividend will increase by 13%, providing another boost for investors.

See our latest analysis for Advanced Drainage Systems.

Momentum has picked up for Advanced Drainage Systems, with the stock climbing 9.23% over the last month and notching a year-to-date share price return of 29.3%. Over the longer run, total shareholder return has reached 11.7% for the past year and an impressive 133% over five years. This reflects sustained investor optimism as both financial results and dividend growth reinforce the outlook.

If strong results at WMS have you curious about other companies on a growth trajectory, now is the perfect chance to broaden your investing search and discover fast growing stocks with high insider ownership

With shares outperforming the market and analysts signaling further upside, the question now is whether Advanced Drainage Systems is still trading below its true worth or if the recent run-up already reflects all the potential ahead.

Most Popular Narrative: 8.3% Undervalued

Advanced Drainage Systems’ widely followed narrative points to a fair value above its current share price, highlighting expectations for sustained growth and improved profit margins based on upcoming catalysts.

Continuous expansion of the Allied Products and Infiltrator segments, both of which command higher margins and are growing faster than the core Pipe business, is shifting product mix toward higher profitability. This is resulting in improved EBITDA margins and long-term earnings power. Strategic investments in manufacturing automation, logistics, and operational efficiency (including new technology centers and line upgrades) have significantly increased production per line and lowered fixed costs. These actions position the company to achieve sustained margin expansion even in tepid end market demand environments.

Curious about the financial assumptions driving this promising outlook? Discover what ambitious revenue and profit margin projections are backing the high price target analysts have in mind. The underlying math and future expectations might surprise you. Get the full inside story before the market catches on.

Result: Fair Value of $161.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains if construction spending softens or if input costs unexpectedly rise. Either of these factors could constrain revenue growth and put pressure on margins ahead.

Find out about the key risks to this Advanced Drainage Systems narrative.

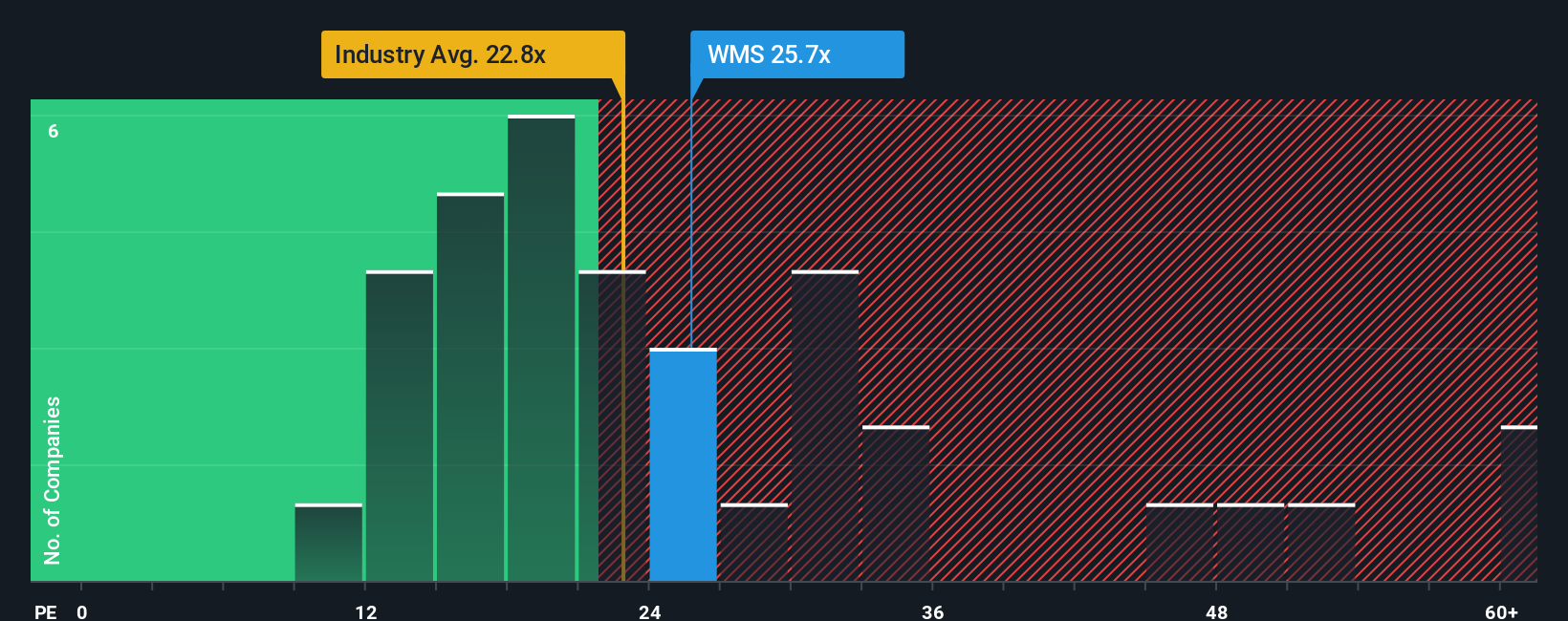

Another View: Comparing Market Multiples

Shifting focus from growth forecasts to how the market values the stock, Advanced Drainage Systems currently trades at a 25.1x ratio compared to a peer average of 17.5x and the US Building industry average of 19.1x. While our fair ratio estimate is 26.7x, this elevated valuation means expectations are already high and leaves limited room for disappointment. Is there still room for shares to climb, or does this price reflect most future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Drainage Systems Narrative

If you want to dig into the numbers yourself and arrive at your own conclusions, you can quickly build a personal take in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Advanced Drainage Systems.

Looking for More Smart Investment Ideas?

There’s a world of standout companies growing fast, rewarding investors, or taking on transformative technologies. Take charge of your financial future and see what’s truly possible by checking out these handpicked opportunities before everyone else does.

- Target regular income and financial resilience by adding these 15 dividend stocks with yields > 3% with yields over 3% to your watchlist now.

- Capture the upside of cutting-edge innovation by following these 26 AI penny stocks that are reshaping everything from automation to everyday life.

- Jump on undervalued gems early by reviewing these 872 undervalued stocks based on cash flows, powered by strong cash flow numbers and real potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives