- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv (VRT) Is Up 6.1% After Announcing Data Center Alliance With Caterpillar – What’s Changed

Reviewed by Sasha Jovanovic

- Vertiv and Caterpillar announced in November 2025 a collaboration to integrate advanced energy optimization and cooling solutions for data centers, combining Vertiv’s modular portfolio with Caterpillar’s power generation and CCHP expertise.

- This alliance enables more efficient, on-site energy and cooling architectures designed to accelerate deployment and reduce grid dependence for customers amid rising AI and cloud infrastructure needs.

- We’ll explore how Vertiv’s joint focus on energy efficiency and faster data center deployment with Caterpillar may affect its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vertiv Holdings Co Investment Narrative Recap

For investors considering Vertiv Holdings Co, the central theme is confidence in the company’s ability to leverage critical demand for advanced, integrated data center power and cooling solutions, especially as AI and cloud deployments accelerate. The November 2025 collaboration with Caterpillar supports this narrative as it offers potential near-term momentum for Vertiv’s modular data center solutions, which may amplify the pace of deployments. However, key risks remain, particularly the possibility that major hyperscale and cloud customers could build their own power and cooling solutions, affecting Vertiv’s market share and revenue growth.

Among recent company announcements, the launch of gigawatt-scale reference architectures for generative AI with NVIDIA in October 2025 stands out as directly relevant. This development reinforces Vertiv’s focus on large-scale, rapidly deployable infrastructure for next-generation technologies, and complements the Caterpillar collaboration by extending Vertiv’s reach into the growing AI-driven data center segment, fueling one of the principal business catalysts.

In contrast, investors should closely watch for signs that major cloud players may shift toward in-house solutions, as this could materially impact Vertiv’s competitive position and future earnings…

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co’s narrative projects $13.9 billion in revenue and $2.3 billion in earnings by 2028. This requires a 15.2% yearly revenue growth and a $1.49 billion increase in earnings from $812.3 million today.

Uncover how Vertiv Holdings Co's forecasts yield a $194.63 fair value, a 9% upside to its current price.

Exploring Other Perspectives

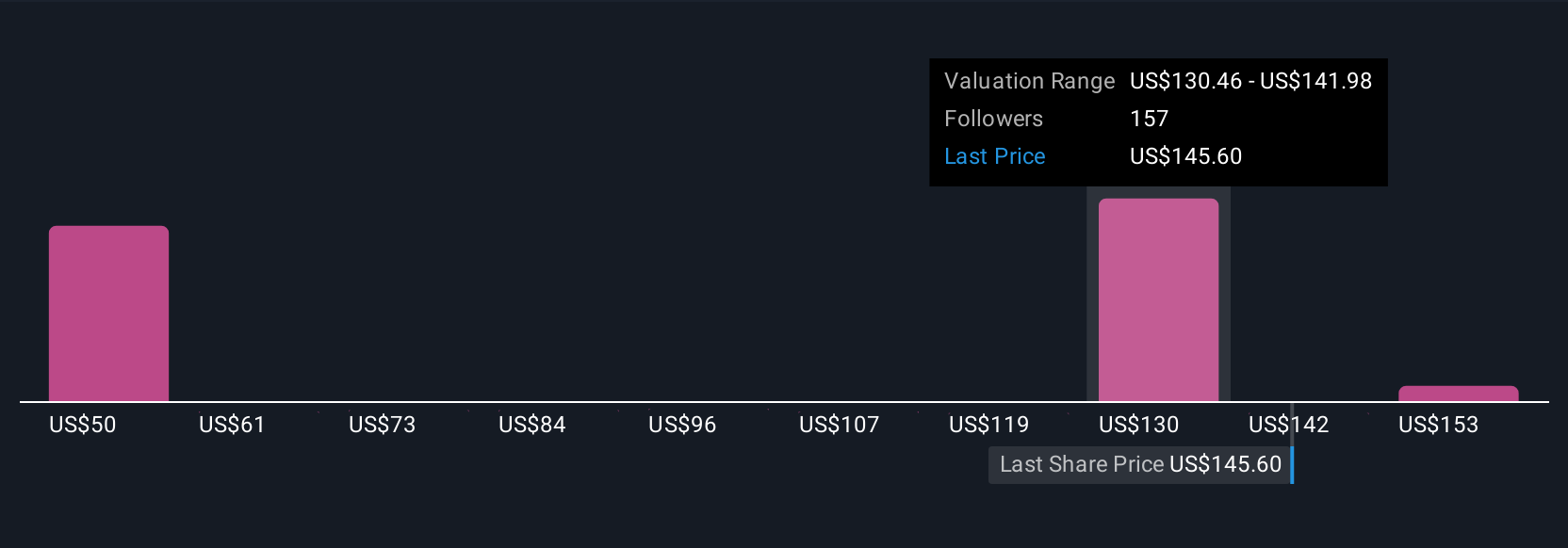

Nineteen fair value estimates from the Simply Wall St Community range from US$123.78 to US$216.58, capturing a broad spectrum of outlooks. With rapid growth in AI data center demand seen as a catalyst, these perspectives underscore the need to consider several viewpoints on Vertiv’s earnings potential.

Explore 19 other fair value estimates on Vertiv Holdings Co - why the stock might be worth 31% less than the current price!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026