- United States

- /

- Electrical

- /

- NYSE:VRT

How Investors May Respond To Vertiv Holdings (VRT) 67% Dividend Hike and Management’s Cash Flow Confidence

Reviewed by Sasha Jovanovic

- Vertiv Holdings Co. has announced that its Board of Directors raised the regular annual cash dividend by 67%, from US$0.15 to US$0.25 per share, with the fourth-quarter dividend of US$0.0625 per share payable on December 18, 2025 to shareholders of record as of November 25, 2025.

- This substantial dividend increase reflects confidence in Vertiv’s financial strength and signals management’s conviction in sustainable cash generation for shareholders.

- With management highlighting strong cash flow as the reason for the dividend increase, we'll assess how this development may impact Vertiv's investment thesis.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Vertiv Holdings Co Investment Narrative Recap

To own Vertiv today, you must have conviction in the company's ability to capture surging demand for AI-driven and high-density data centers, while managing margin pressures from rapid global expansion. The recent 67% dividend hike underscores Vertiv’s confidence in its cash generation but does not significantly alter the immediate focus on continued margin improvement and resolution of supply chain headwinds, the primary short-term catalyst and risk.

One of the clearest signs of this momentum is Vertiv’s raised FY25 sales guidance, just announced alongside robust Q3 results. This guidance aligns with the major business catalyst of accelerating industry demand, even as the growing dividend payout reflects management’s confidence in sustaining profitable growth.

However, against this backdrop of growth and cash returns, investors should be particularly mindful of the risk that...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co's outlook points to $13.9 billion in revenue and $2.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 15.2% and an earnings increase of $1.49 billion from current earnings of $812.3 million.

Uncover how Vertiv Holdings Co's forecasts yield a $192.66 fair value, a 13% upside to its current price.

Exploring Other Perspectives

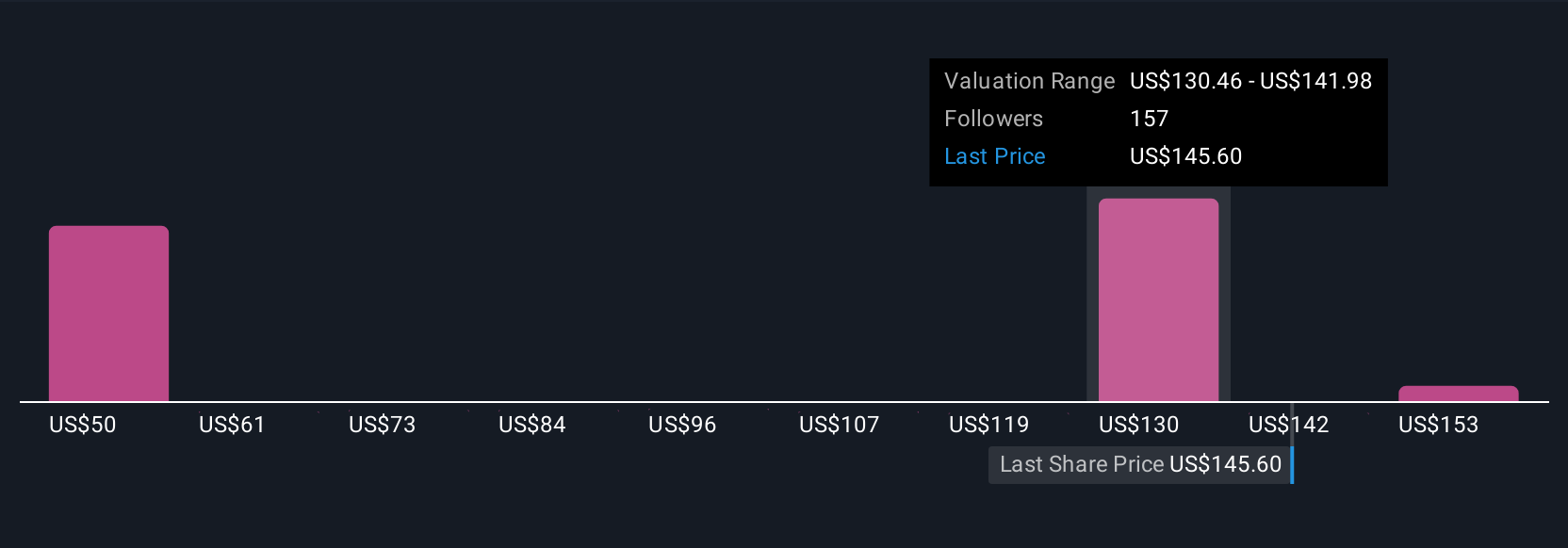

Nineteen individual valuations from the Simply Wall St Community span from US$123.78 to US$215.29, reflecting broad disagreement about Vertiv’s worth. While opinions differ widely, many remain focused on ongoing execution challenges as a critical factor influencing future profitability and market share.

Explore 19 other fair value estimates on Vertiv Holdings Co - why the stock might be worth as much as 26% more than the current price!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives