- United States

- /

- Aerospace & Defense

- /

- NYSE:VOYG

Voyager Technologies (VOYG): Revenue Growth Forecast at 51.5% Tests High Valuation Narrative

Reviewed by Simply Wall St

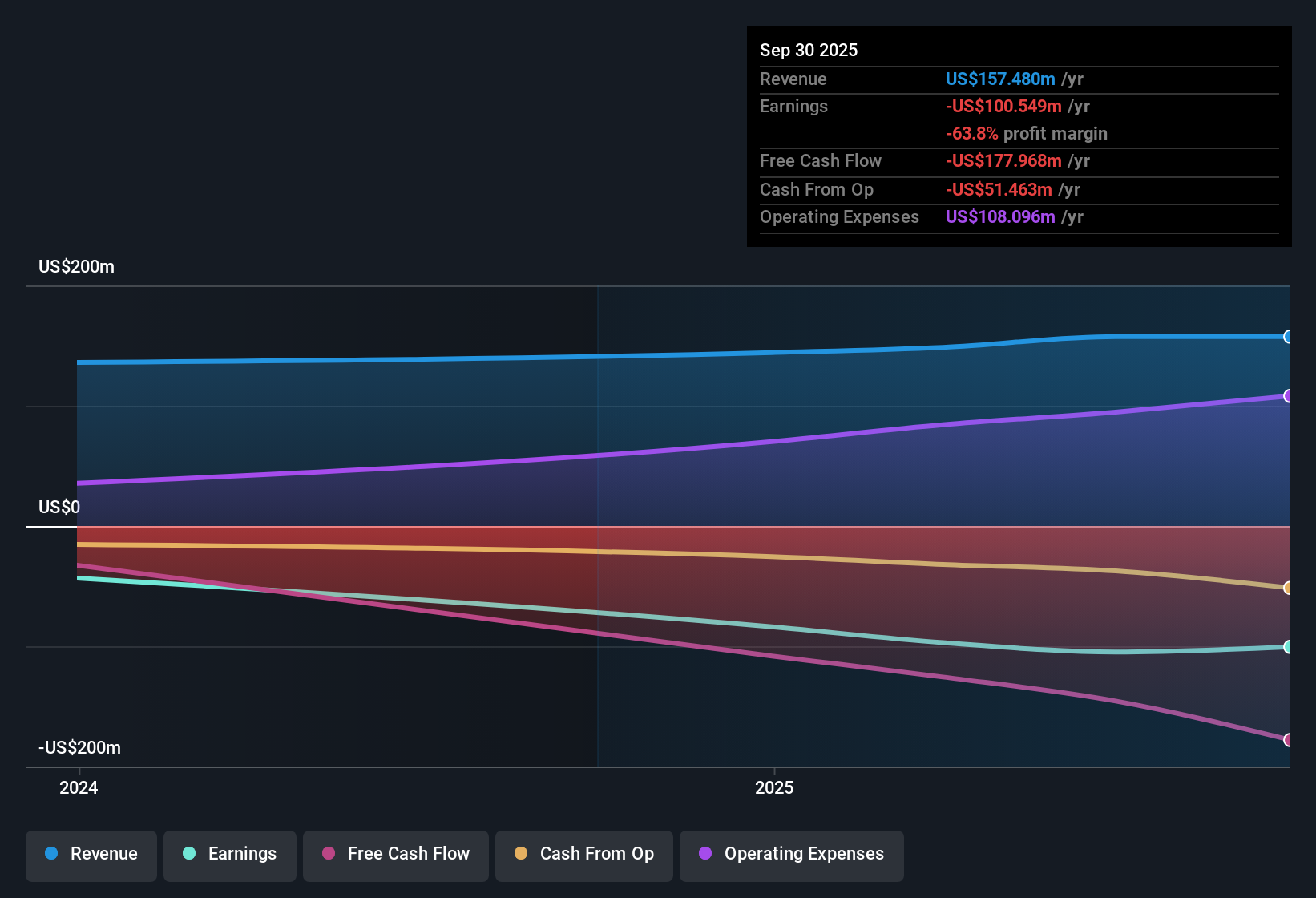

Voyager Technologies (VOYG) remains unprofitable, with no established year-on-year earnings trend so far, as the company has been publicly traded for less than three years. Revenue is forecast to surge 51.5% per year, far outpacing the US market average of 10.5%. However, net margins remain negative and the Price-To-Sales Ratio sits at a steep 10.3x, well above industry and peer benchmarks. With investors focused on whether overhead and costs are being effectively controlled, the company’s elevated valuation will demand clear signs of progress toward sustainable profitability.

See our full analysis for Voyager Technologies.The next step is to see how this earnings story fits with the broader narratives in the market. Some themes may be reinforced, while others face new challenges in light of these results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Remain in Negative Territory

- Even with standout revenue growth forecasts, Voyager Technologies continues to report negative net margins, highlighting that costs are still consuming more than the company brings in.

- The strong topline momentum supports optimism that, if the company can control overhead, margin improvement could follow.

- However, persistent unprofitability directly challenges hopes for near-term earnings inflection, as the company is expected to remain in the red for at least the next three years.

- Cost discipline will be under scrutiny, underscored by a lack of established year-on-year profit growth since going public.

Valuation Leaves Little Room for Error

- Voyager’s Price-To-Sales Ratio stands at 10.3x, far above the Aerospace & Defense industry average of 3.2x and the peer average of 2.9x, putting scrutiny on whether the shares fairly reflect the company’s actual progress and risks.

- Such a steep premium tests confidence that future growth will justify the multiple.

- The sharp valuation gap amplifies any disappointment if the company’s growth moderates or cost improvements take longer than hoped.

- Bulls may point to sector tailwinds and technology resonance, but bears are more likely to stress how these rich multiples magnify downside if milestones are missed.

Lack of Share Price Stability Among Near-Peers

- Unlike some sector peers, Voyager Technologies’ share price has not shown stability over the past three months, reflecting investor caution around unproven profitability and extended valuation.

- Broader market trends favor tech-focused disruptors.

- But absent consistent financial gains, the company’s stock remains at the mercy of swings in market sentiment and execution headlines.

- Recent figures reinforce that revenue momentum is a bright spot, yet fundamental progress—not hype—is what will determine whether the share price can break out of its current volatility.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Voyager Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust revenue growth, Voyager Technologies faces persistent losses, unsteady margins, and an expensive valuation that depends on future improvements which have not yet materialized.

Looking for stocks where the numbers better match expectations? Discover these 841 undervalued stocks based on cash flows with stronger value signals and better alignment between share price and business momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VOYG

Voyager Technologies

Operates as a defense technology and space solutions company in the United States, Europe, the Middle East, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives