- United States

- /

- Trade Distributors

- /

- NYSE:URI

The Bull Case For United Rentals (URI) Could Change Following Q3 Earnings Miss And Cost Pressures - Learn Why

Reviewed by Sasha Jovanovic

- In October 2025, United Rentals reported past-quarter revenue of US$4.23 billion, up 5.9% year on year and ahead of analyst forecasts, but significantly missed earnings per share estimates as inflation and higher operating costs pressured profitability.

- At the same time, the company reinforced its focus on expanding specialty rentals and enhancing financial flexibility, including a US$1.50 billion senior notes offering, underscoring management’s commitment to growth despite margin headwinds.

- We’ll now examine how this earnings miss, amid rising cost pressures, affects United Rentals’ existing investment narrative and forward-looking assumptions.

Find companies with promising cash flow potential yet trading below their fair value.

United Rentals Investment Narrative Recap

To own United Rentals, you need to believe in the long term demand for equipment rentals across construction and industrial projects, and in the company’s ability to convert that scale into consistent cash generation. The latest quarter’s revenue beat but EPS miss reinforces that the near term catalyst remains execution on margins, while the biggest current risk is that persistent inflation and higher operating costs could further compress profitability. So far, this earnings miss does not fundamentally change that thesis.

Among the recent announcements, the US$1.50 billion senior notes due 2033 stand out as most relevant. By boosting financial flexibility at a time of margin pressure, this debt raise sits at the intersection of the key catalyst of continued growth investment and the risk that high capital spending and leverage could limit room to maneuver if conditions worsen.

Yet behind the focus on revenue growth, investors should be aware that rising operating costs and higher CapEx commitments could...

Read the full narrative on United Rentals (it's free!)

United Rentals' narrative projects $18.8 billion revenue and $3.5 billion earnings by 2028. This requires 6.1% yearly revenue growth and a $1.0 billion earnings increase from $2.5 billion today.

Uncover how United Rentals' forecasts yield a $1025 fair value, a 29% upside to its current price.

Exploring Other Perspectives

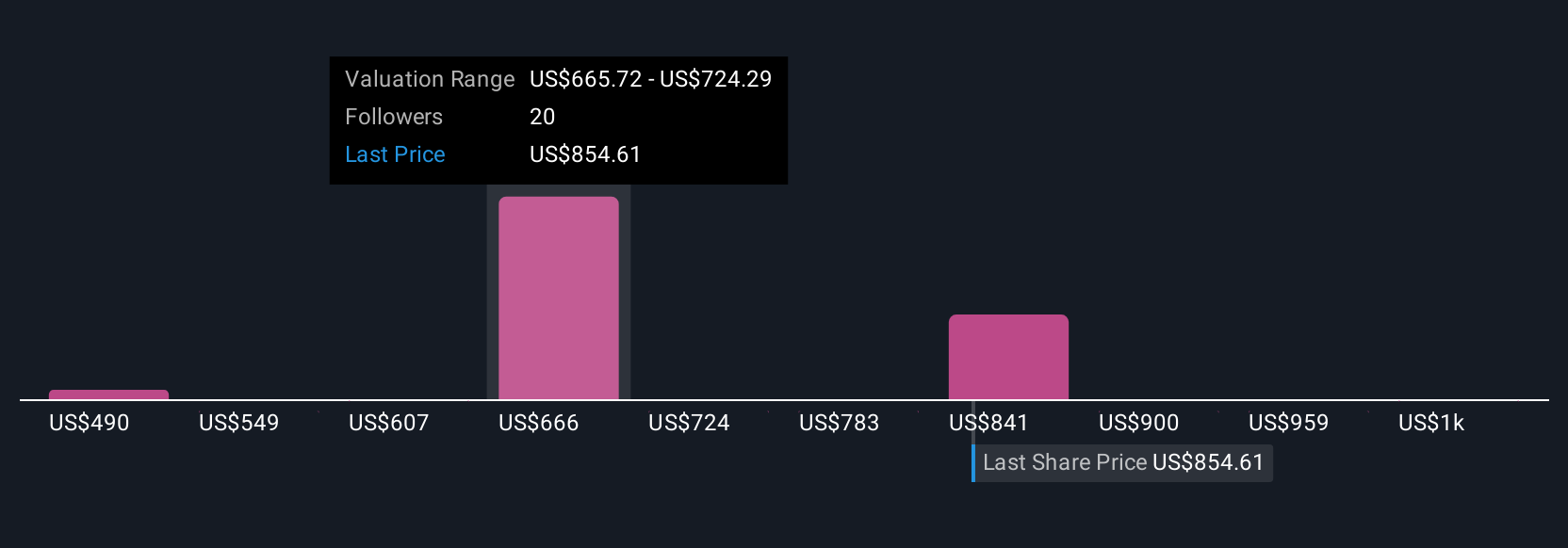

Five members of the Simply Wall St Community currently see United Rentals’ fair value anywhere between about US$533 and US$1,209 per share, highlighting how far apart individual views can be. As you weigh those perspectives, remember that recent margin pressure from inflation and operating costs could play a significant role in shaping how the company’s performance unfolds from here.

Explore 5 other fair value estimates on United Rentals - why the stock might be worth 33% less than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026