- United States

- /

- Building

- /

- NYSE:TT

A Fresh Look at Trane Technologies (TT) Valuation Following Latest Bank of America Upgrade and Earnings Growth

Reviewed by Simply Wall St

Trane Technologies (TT) captured investor attention this week after Bank of America Securities upgraded the stock to Buy. This reflects a shift in analyst sentiment following the company’s recently reported earnings growth amid industry challenges.

See our latest analysis for Trane Technologies.

Riding a wave of renewed analyst optimism and its steady results, Trane Technologies’ shares have built up notable momentum this year, with a strong year-to-date share price return of nearly 12%. While the 1-year total shareholder return is a more modest 3.6%, long-term holders are sitting on outstanding gains, including a 146% three-year return and a staggering 210% over five years. This suggests sustained outperformance for patient investors.

If you’re curious to see what else is performing in the world of industrials, now is a perfect moment to broaden your search and discover See the full list for free.

With Trane Technologies’ shares hovering near record highs and analysts revising their ratings upward, the real question is whether the stock remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 12.5% Undervalued

With Trane Technologies’ fair value estimate sitting at $477.69, analysts currently see meaningful upside from its last close price of $418.16. This highlights continued confidence in the company’s growth trajectory.

The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long-term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement.

What kind of growth plan earns this premium projection? The narrative leans on ambitious momentum, hidden behind bold profit margin goals and revenue expansion that few expect. There is a future PE target that hints at rare optimism in this sector. If you are curious about the numbers driving this call, you will want to dig deeper into the narrative’s full calculations.

Result: Fair Value of $477.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in key sectors like data centers or unexpected inflationary pressures could challenge Trane Technologies' ambitious growth and margin outlook.

Find out about the key risks to this Trane Technologies narrative.

Another View: Comparing Key Ratios

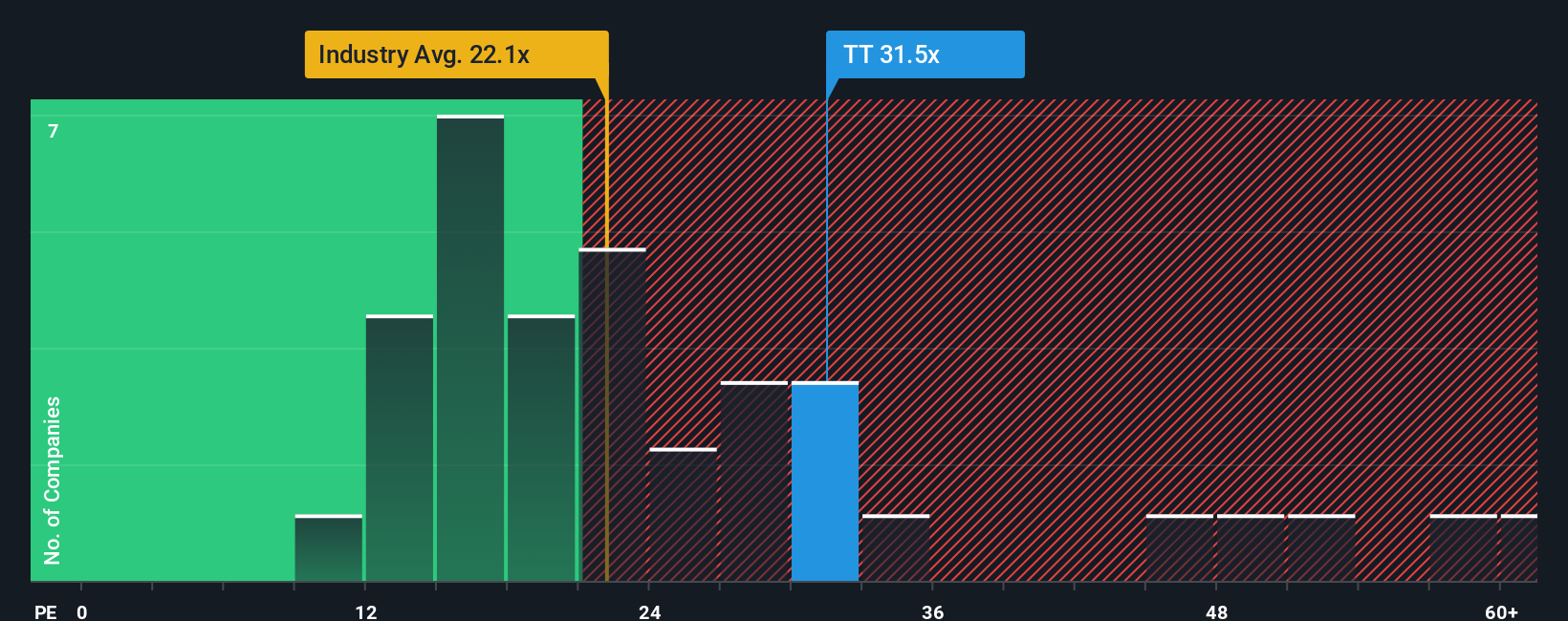

Looking through another lens, Trane Technologies trades at a price-to-earnings ratio of 31.4x, which is higher than both the industry average of 17.5x and its peer group at 29.1x. It is also slightly above its estimated fair ratio of 30.2x. This difference means the market is putting a premium on the stock, raising the stakes for continued growth. Is this pricing justified, or could it signal an opportunity or a risk if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trane Technologies Narrative

If you see things differently or want to dive into the numbers on your own, you can easily craft your own perspective in just a few minutes. Start fresh with Do it your way.

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always on the hunt for the next big opportunity. Don’t miss your chance to spot breakthrough themes and strong stocks using the Simply Wall Street Screener.

- Maximize yield potential and step up your income game by reviewing these 16 dividend stocks with yields > 3% with robust payouts and solid fundamentals.

- Uncover high-growth potential in healthcare by targeting these 32 healthcare AI stocks leading medical innovation with advanced AI-driven solutions.

- Tap into the future of computing and see which companies are set to disrupt industries through these 26 quantum computing stocks and advanced quantum breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives