- United States

- /

- Machinery

- /

- NYSE:TRN

Does Trinity Industries’ (TRN) Relentless Dividend Growth Reflect Strength or Strain in Its Balance Sheet?

Reviewed by Sasha Jovanovic

- Trinity Industries recently increased its quarterly dividend to US$0.31 per share, marking seven consecutive years of dividend growth and the 247th straight quarterly payout, with the latest payment set for January 30, 2026 to shareholders of record on January 15, 2026.

- This steady pattern of dividend increases, despite financial risks such as high leverage and low interest coverage, highlights management’s clear emphasis on returning cash to shareholders as a core part of the business model.

- With Trinity extending its dividend growth streak to seven years, we’ll examine how this payout discipline influences the existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Trinity Industries Investment Narrative Recap

To own Trinity Industries, you need to believe in a long term recovery in railcar demand and the value of its integrated rail platform. The latest dividend increase supports the income narrative but does not materially change the near term catalyst, which still hinges on an eventual pickup in customer ordering, nor the key risk around high leverage and weak interest coverage.

The upcoming presentation at the Goldman Sachs Industrials and Materials Conference places Trinity’s dividend move in a broader context for investors, as management updates the market on railcar demand, capital allocation, and balance sheet priorities. For anyone focused on how dividend growth sits alongside softer recent earnings and elevated financial risk, this event may help clarify how management is balancing income commitments with long term reinvestment needs.

Yet behind the reassuring dividend track record, investors should be aware of the company’s high leverage and relatively low interest coverage...

Read the full narrative on Trinity Industries (it's free!)

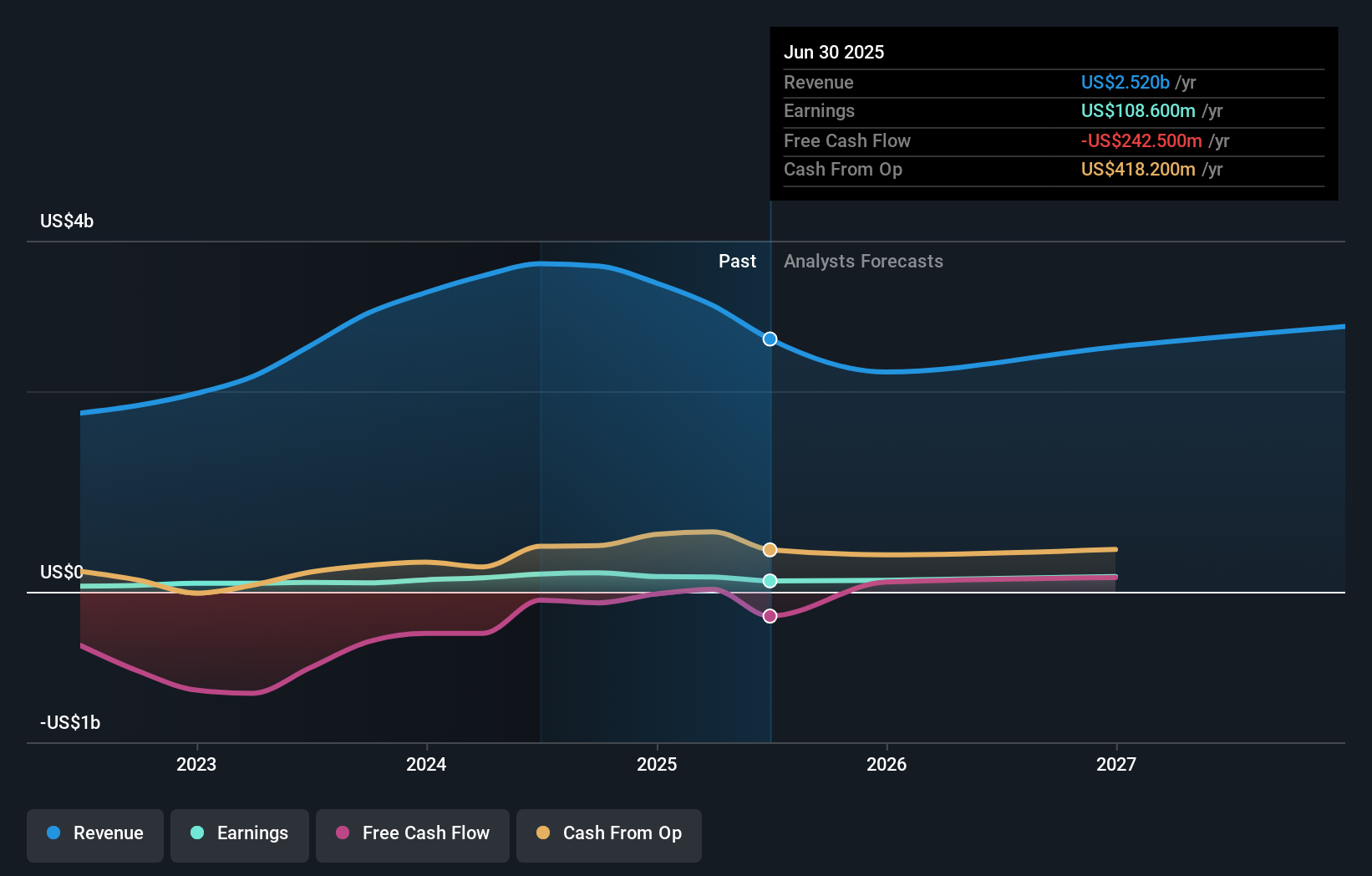

Trinity Industries' narrative projects $2.6 billion revenue and $207.4 million earnings by 2028. This requires 1.3% yearly revenue growth and about a $98.8 million earnings increase from $108.6 million today.

Uncover how Trinity Industries' forecasts yield a $25.50 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from about US$16.32 up to US$25.50 per share, underscoring how far apart individual views can be. When you set those against Trinity’s reliance on a cyclical railcar market and customer capex timing, it becomes clear why exploring several independent perspectives can be useful before forming your own view.

Explore 2 other fair value estimates on Trinity Industries - why the stock might be worth as much as $25.50!

Build Your Own Trinity Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Trinity Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Industries' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRN

Trinity Industries

Provides railcar products and services under the TrinityRail trade name in North America.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026